Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q16. What is the prepayment risk faced by an investor? (A) the risk of loss if an issuer or counter-party does not fulfill contractual obligations

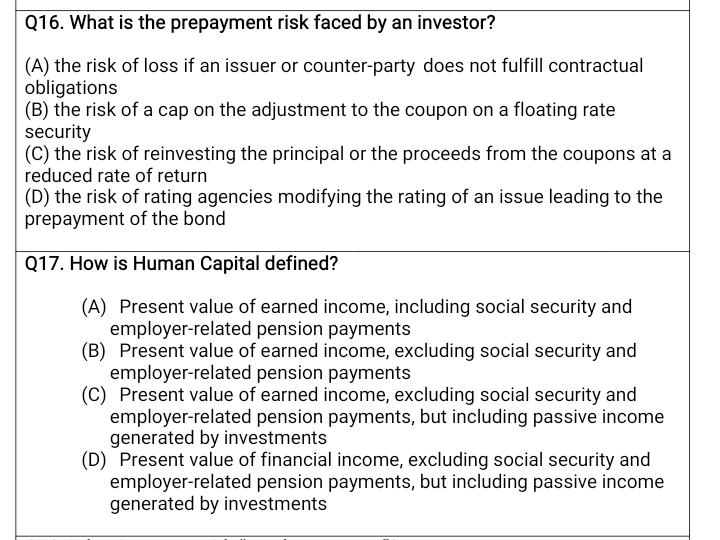

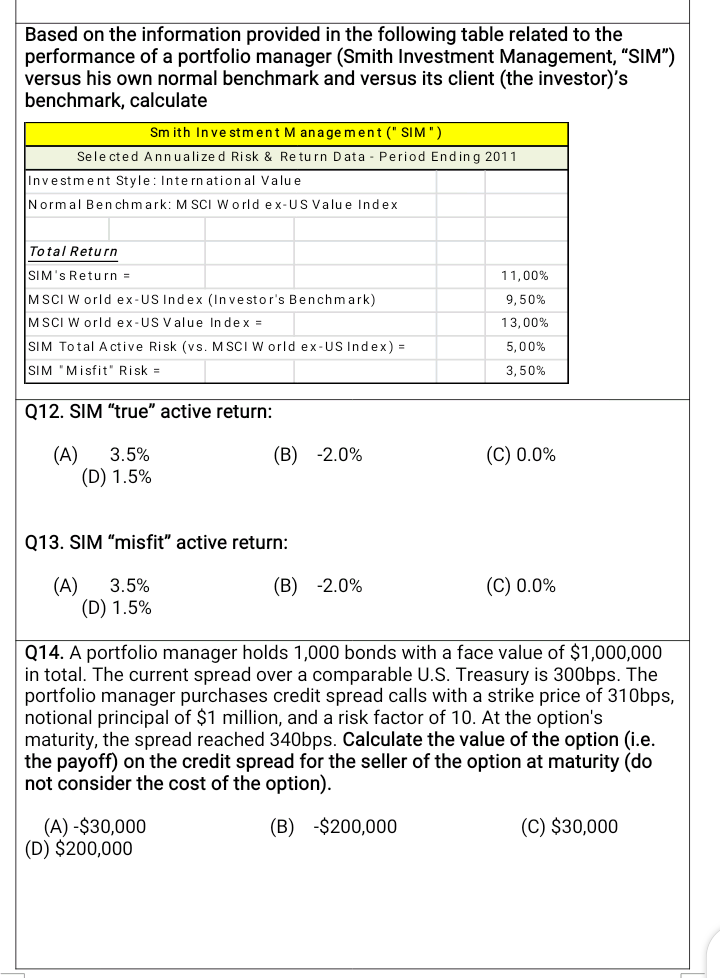

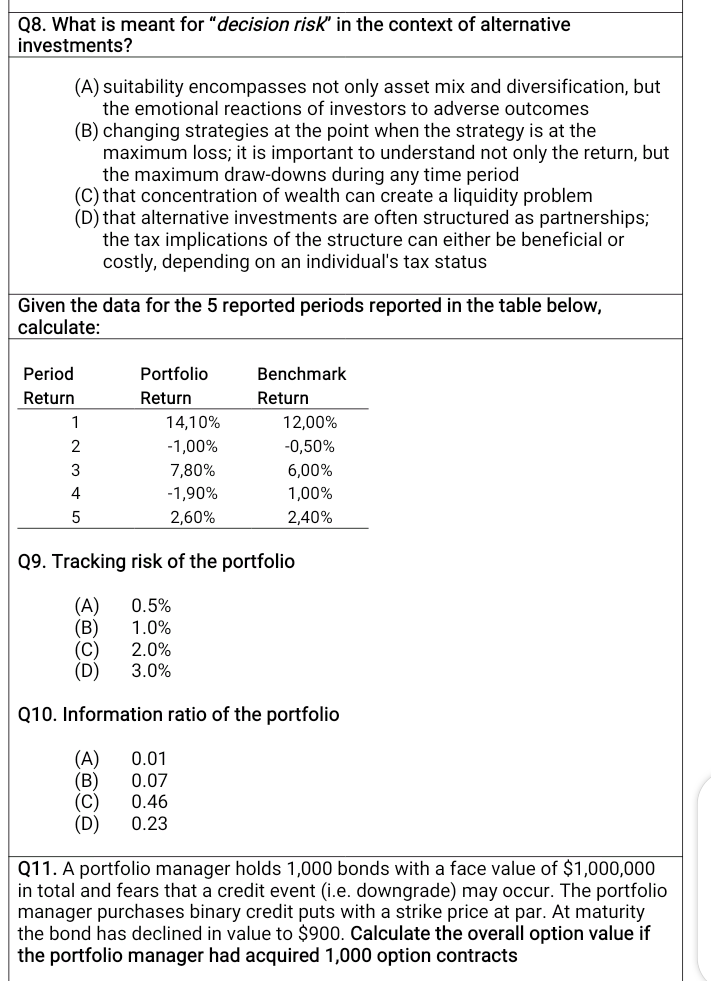

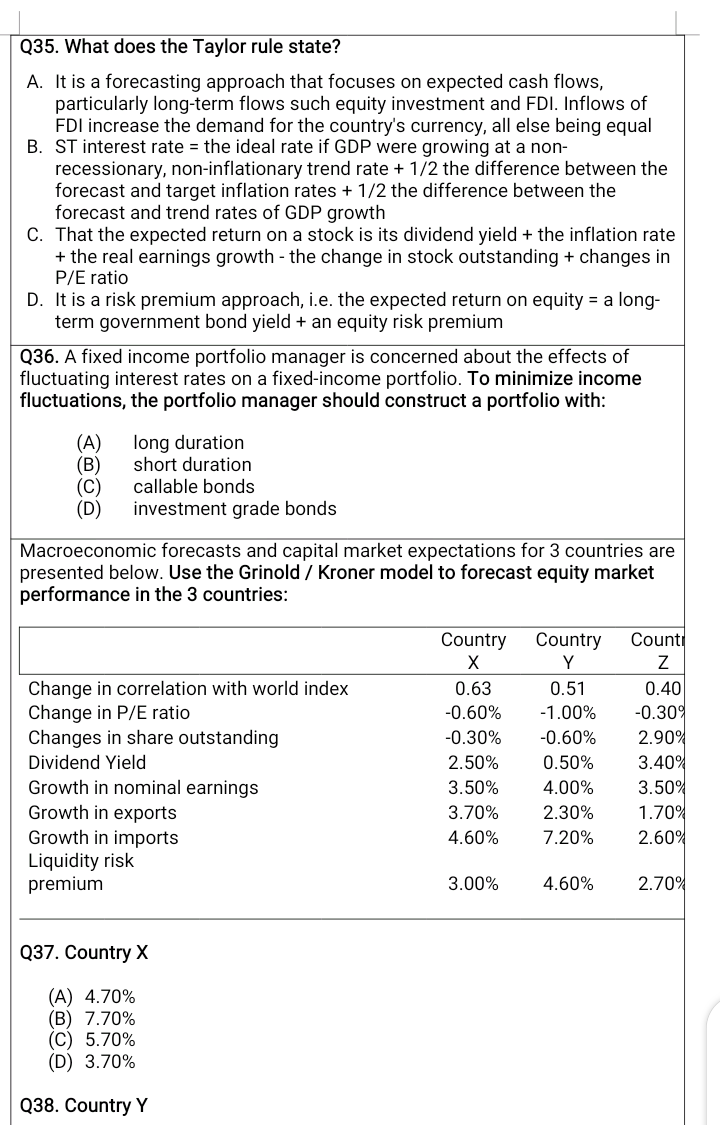

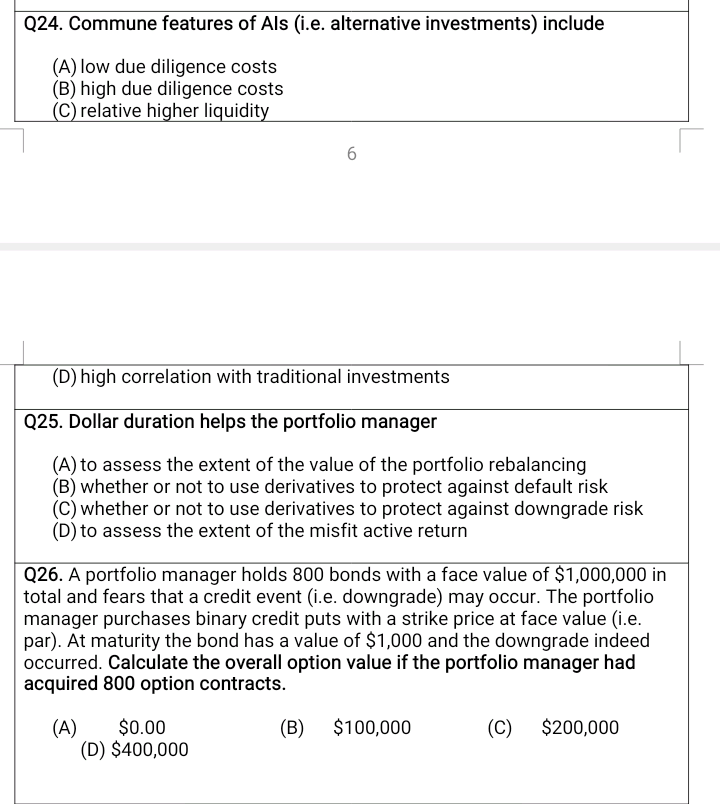

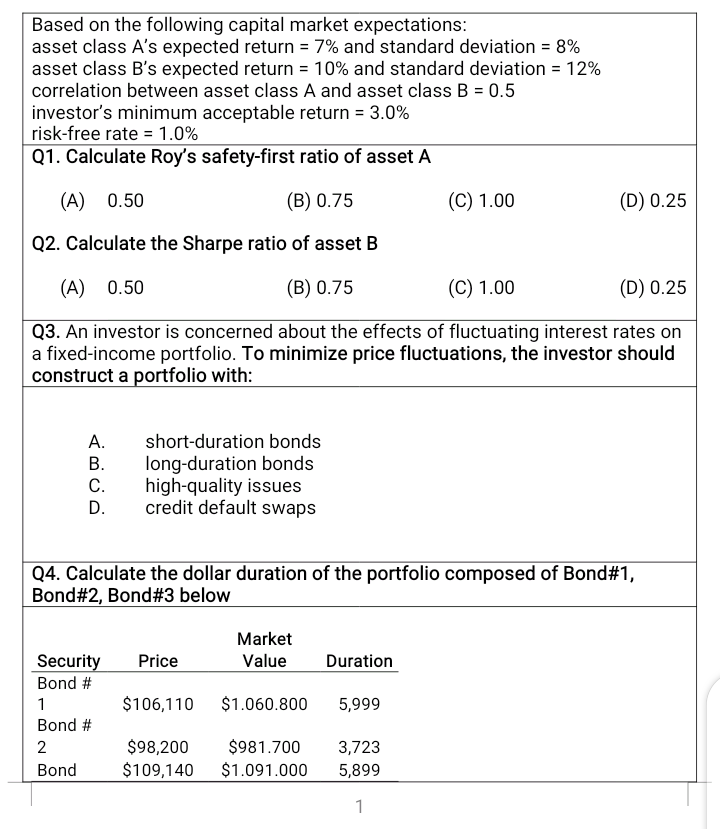

Q16. What is the prepayment risk faced by an investor? (A) the risk of loss if an issuer or counter-party does not fulfill contractual obligations (B) the risk of a cap on the adjustment to the coupon on a floating rate security (C) the risk of reinvesting the principal or the proceeds from the coupons at a reduced rate of return (D) the risk of rating agencies modifying the rating of an issue leading to the prepayment of the bond Q17. How is Human Capital defined? (A) Present value of earned income, including social security and employer-related pension payments (B) Present value of earned income, excluding social security and employer-related pension payments (C) Present value of earned income, excluding social security and employer-related pension payments, but including passive income generated by investments (D) Present value of financial income, excluding social security and employer-related pension payments, but including passive income generated by investments Based on the information provided in the following table related to the performance of a portfolio manager (Smith Investment Management, SIM") versus his own normal benchmark and versus its client (the investor)'s benchmark, calculate Smith Investment Management ("SIM") Selected Annualized Risk & Return Data - Period Ending 2011 Investment Style: International Value Normal Benchmark: MSCI World ex-US Value Index Total Return 11,00% 9,50% SIM's Return = MSCI World ex-US Index (Investor's Benchmark) MSCI World ex-US Value Index = SIM Total Active Risk (vs. MSCI World ex-US Index) = SIM "Misfit" Risk = 13,00% 5,00% 3,50% Q12. SIM "true" active return: (B) -2.0% (C) 0.0% (A) 3.5% (D) 1.5% Q13. SIM "misfit" active return: (B) -2.0% (C) 0.0% (A) 3.5% (D) 1.5% Q14. A portfolio manager holds 1,000 bonds with a face value of $1,000,000 in total. The current spread over a comparable U.S. Treasury is 300bps. The portfolio manager purchases credit spread calls with a strike price of 310bps, notional principal of $1 million, and a risk factor of 10. At the option's maturity, the spread reached 340bps. Calculate the value of the option (i.e. the payoff) on the credit spread for the seller of the option at maturity (do not consider the cost of the option). (B) $200,000 (C) $30,000 (A) -$30,000 (D) $200,000 Q24. Commune features of Als (i.e. alternative investments) include (A) low due diligence costs (B) high due diligence costs (C) relative higher liquidity 6 (D) high correlation with traditional investments Q25. Dollar duration helps the portfolio manager (A) to assess the extent of the value of the portfolio rebalancing (B) whether or not to use derivatives to protect against default risk (C) whether or not to use derivatives to protect against downgrade risk (D) to assess the extent of the misfit active return Q26. A portfolio manager holds 800 bonds with a face value of $1,000,000 in total and fears that a credit event (i.e. downgrade) may occur. The portfolio manager purchases binary credit puts with a strike price at face value (i.e. par). At maturity the bond has a value of $1,000 and the downgrade indeed occurred. Calculate the overall option value if the portfolio manager had acquired 800 option contracts. (A) $0.00 (D) $400,000 (B) $100,000 (C) $200,000 Based on the following capital market expectations: asset class A's expected return = 7% and standard deviation = 8% asset class B's expected return = 10% and standard deviation = 12% correlation between asset class A and asset class B = 0.5 investor's minimum acceptable return = 3.0% risk-free rate = 1.0% Q1. Calculate Roy's safety-first ratio of asset A (A) 0.50 (B) 0.75 (C) 1.00 (D) 0.25 Q2. Calculate the Sharpe ratio of asset B (A) 0.50 (B) 0.75 (C) 1.00 (D) 0.25 Q3. An investor is concerned about the effects of fluctuating interest rates on a fixed-income portfolio. To minimize price fluctuations, the investor should construct a portfolio with: A. B. C. D. short-duration bonds long-duration bonds high-quality issues credit default swaps Q4. Calculate the dollar duration of the portfolio composed of Bond#1, Bond#2, Bond#3 below Market Value Price Duration Security Bond # 1 Bond # 2 Bond $106,110 $1.060.800 5,999 $98,200 $109,140 $981.700 $1.091.000 3,723 5,899 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started