Answered step by step

Verified Expert Solution

Question

1 Approved Answer

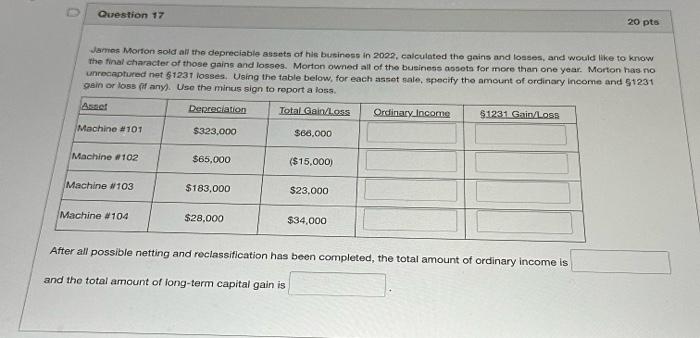

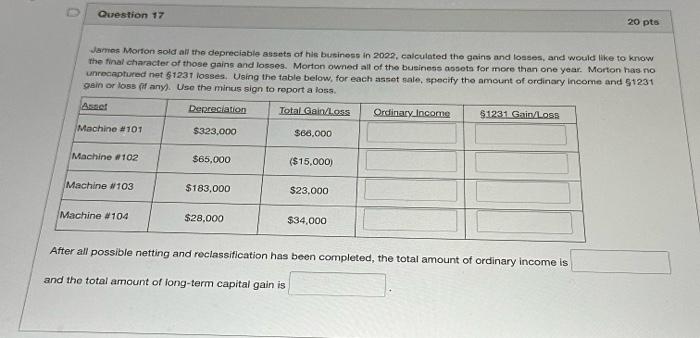

q17 Wames Morton sold all the depreciable Bssets of his business in 2022, calculated the gains and loases, and would like to know the final

q17

Wames Morton sold all the depreciable Bssets of his business in 2022, calculated the gains and loases, and would like to know the final character of those gains and losges. Morton owned all of the beseinens aosots for more than one year. Morton has no unnocaptured net $1231 losses, Using the table below, for each asset nale, gpecify the amount of ordinary income and 51231 gsin or loss pid any). Use the miricis sign to roport a loss. After all possible netting and roclassification has been completed, the total amount of ordinary income is and the total amount of long-term capital gain is Wames Morton sold all the depreciable Bssets of his business in 2022, calculated the gains and loases, and would like to know the final character of those gains and losges. Morton owned all of the beseinens aosots for more than one year. Morton has no unnocaptured net $1231 losses, Using the table below, for each asset nale, gpecify the amount of ordinary income and 51231 gsin or loss pid any). Use the miricis sign to roport a loss. After all possible netting and roclassification has been completed, the total amount of ordinary income is and the total amount of long-term capital gain is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started