Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q18 1 Point A financial device designed to make unfriendly takeover attempts financially unappealing, if not impossible, is called: Choice 1 of 5:a poison pill.

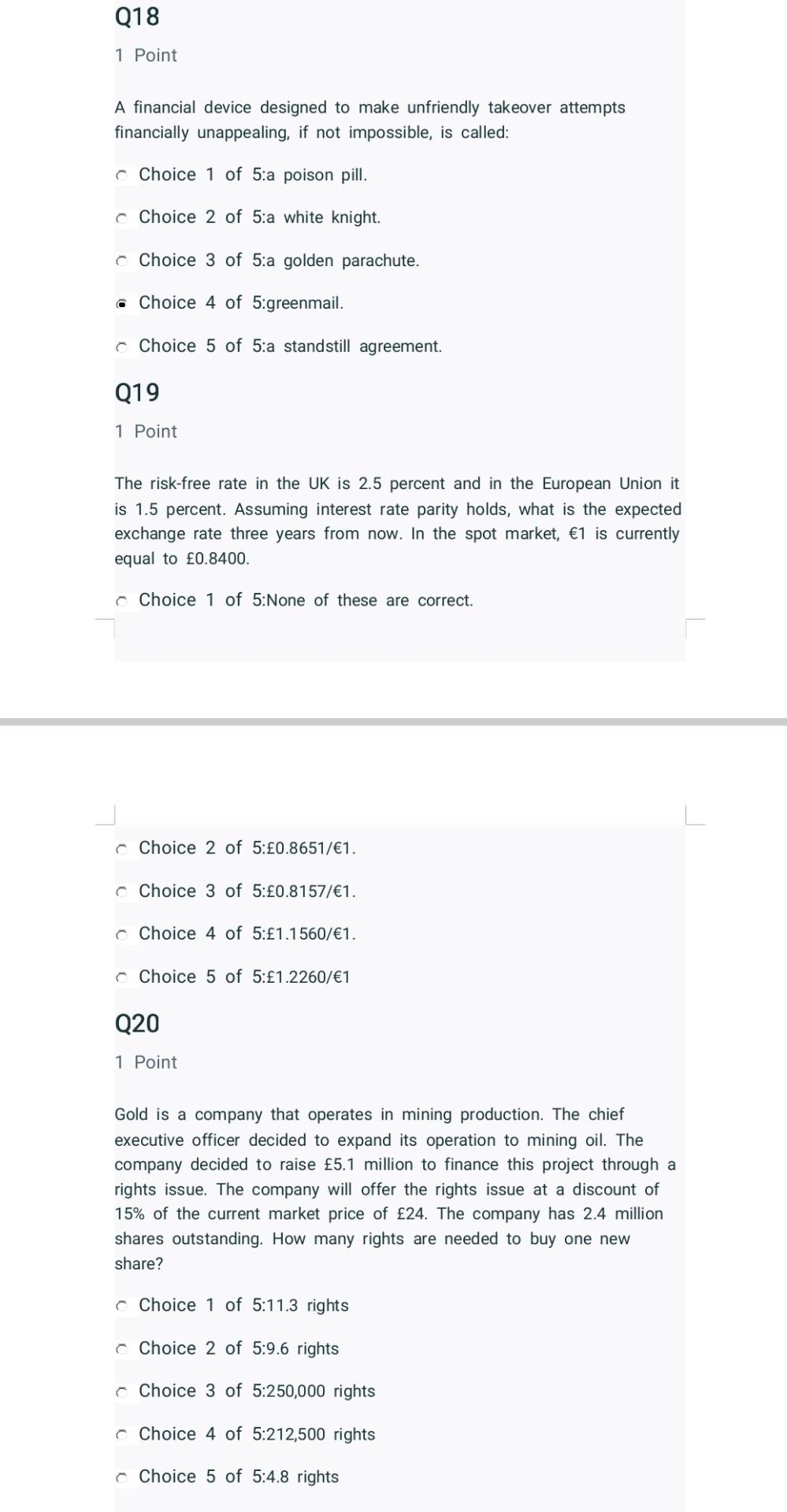

Q18 1 Point A financial device designed to make unfriendly takeover attempts financially unappealing, if not impossible, is called: Choice 1 of 5:a poison pill. Choice 2 of 5:a white knight. Choice 3 of 5:a golden parachute. Choice 4 of 5:greenmail. Choice 5 of 5:a stand still agreement. Q19 1 Point The risk-free rate in the UK is 2.5 percent and in the European Union it is 1.5 percent. Assuming interest rate parity holds, what is the expected exchange rate three years from now. In the spot market, 1 is currently equal to 0.8400. Choice 1 of 5:None of these are correct. Choice 2 of 5:0.8651/1. Choice 3 of 5:0.8157/1. Choice 4 of 5:1.1560/1. Choice 5 of 5:1.2260/1 Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The company decided to raise 5.1 million to finance this project through a rights issue. The company will offer the rights issue at a discount of 15% of the current market price of 24. The company has 2.4 million shares outstanding. How many rights are needed to buy one new share? Choice 1 of 5:11.3 rights Choice 2 of 5:9.6 rights Choice 3 of 5:250,000 rights Choice 4 of 5:212,500 rights Choice 5 of 5:4.8 rights

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started