Question

Q1A-QF accounting Question 1 (50 marks) Francis Chan lived in London and worked in the research department of a pharmaceutical company (Company A) in the

Q1A-QF accounting Question 1 (50 marks) Francis Chan lived in London and worked in the research department of a pharmaceutical company (Company A) in the United Kingdom (UK) for years. In 2017 he was assigned to work in the research team of Company H which is incorporated and carrying on business in Hong Kong and is an affiliated company of Company A. The secondment was for one year stated in the agreement between him and Company A dated 1 June 2017, but it could be capable of termination by three months notice in writing by either party. When he arrived in Hong Kong on 1 May 2017, there was a further contract agreement also dated 1 June 2017 between Francis and Company H, confirming this offer of employment whereby he was to be seconded to Company H on various terms and conditions in accordance to the law of Hong Kong. He signed and accepted the contract. Francis has brothers and parents in Hong Kong. He stayed with them when he arrived in Hong Kong until he got married with Judy Ong. With the assistance of his brother, he opened a bank account in Hong Kong and his monthly salary is paid to this account by Company H. On 1 June 2018 Francis was invited to extend the assignment for another year by Company H which revised the agreement to have salary increment of 15% and longer annual leave. He signed the contract with Company H. However, his employment status visa in Hong Kong expired and Company H submitted the applications to Immigration Department for extending his work visa, claiming they were Francis Chans employer. When it was almost one year, his performance was so excellent that he was promoted to be the Head of Research Department with annual salary of $720,000 offered by Company H. This offer also includes medical insurance for senior level, provision of a company car as well as housing benefit of $30,000 per month starting from 1 April 2019. This new contract which states that the employment can be terminated by either party in three months written notice was agreed and signed by Francis. Company H continued to apply for the employment status visa of Francis for another two years. Francis met Ms Judy Ong who is a Singaporean, but she has obtained Hong Kong Identity Card. They have become very close together and started to plan for their future. Francis and Judy purchased a Qualifying Deferred Annuity Policy (QDAP) as joint policy holders and Judy as the sole annuitant in April 2019. The premium paid by Francis for the period from April 2019 to March 2020 was $5,000 per month. They got married in December 2019 and moved to a flat in Quarry Bay. The following information is also available. 1. Francis does not need to make contributions to the MPF Fund in Hong Kong as he got a Certificate of Exemption under the Occupational Retirement Schemes Ordinance and accepted by MPF Schemes Authority. He does not need to declare his employment income to relevant tax authorities in the UK but he continues to make payment for his Employment Provident Fund in the UK, and it was done by deductions from his salary in Hong Kong by Company H. 2. The housing benefit of $30,000 is included in the monthly salary paid to Francis by Company H under its automatic transfer payment system with employees banks. The tenancy agreement of the flat in Quarry Bay started on 1 December 2019 and monthly rental of $28,000 is paid by Francis. The Human Resource Department never asks Francis to produce the rental receipt of the landlord. 3. Francis has purchased some equipment and software which are similar to those in the research laboratory of the Research Department to work at home to show his excellent performance over the other members of the team. The equipment costs him $50,000 but he expects that this expenditure could be allowed as deduction from his income for Hong Kong salaries tax purpose. 3 4. In May 2019 Company H purchased a business class ticket for Francis to travel to Singapore for business purpose for five days from Monday to Friday. The cost of the ticket was $14,000. Francis and Judy took this opportunity to visit Judys parents before their marriage in December 2019. Therefore, Judy flew to Singapore on Saturday to join Francis. They spent another 4 days in Singapore after Franciss business ended on Friday. Francis traded in the business class air ticket for two economy class tickets for him and Judy and paid an additional sum of $2,000 to the airline company. During the days in Singapore, they stayed in a hotel charging a total amount of $18,000 for 9 nights which was paid by Company H. 5. In the years of assessment 2018/19 and 2019/20, Francis continued to state Company A is his employer. Furthermore, in filing the tax return of 2019/20, he declared the housing benefit provided by his employer is $28,000 per month. 6. In filing an Employers Tax Return Form, Company H reported the salaries and benefits paid to Francis Chan as the employer and Francis spent 120 days and 80 days outside Hong Kong for the years of assessment 2018/19 and 2019/20 respectively. Required

Question 1 (50 marks) Francis Chan lived in London and worked in the research department of a pharmaceutical company (Company A) in the United Kingdom (UK) for years. In 2017 he was assigned to work in the research team of Company H which is incorporated and carrying on business in Hong Kong and is an affiliated company of Company A. The secondment was for one year stated in the agreement between him and Company A dated 1 June 2017, but it could be capable of termination by three months notice in writing by either party. When he arrived in Hong Kong on 1 May 2017, there was a further contract agreement also dated 1 June 2017 between Francis and Company H, confirming this offer of employment whereby he was to be seconded to Company H on various terms and conditions in accordance to the law of Hong Kong. He signed and accepted the contract. Francis has brothers and parents in Hong Kong. He stayed with them when he arrived in Hong Kong until he got married with Judy Ong. With the assistance of his brother, he opened a bank account in Hong Kong and his monthly salary is paid to this account by Company H. On 1 June 2018 Francis was invited to extend the assignment for another year by Company H which revised the agreement to have salary increment of 15% and longer annual leave. He signed the contract with Company H. However, his employment status visa in Hong Kong expired and Company H submitted the applications to Immigration Department for extending his work visa, claiming they were Francis Chans employer. When it was almost one year, his performance was so excellent that he was promoted to be the Head of Research Department with annual salary of $720,000 offered by Company H. This offer also includes medical insurance for senior level, provision of a company car as well as housing benefit of $30,000 per month starting from 1 April 2019. This new contract which states that the employment can be terminated by either party in three months written notice was agreed and signed by Francis. Company H continued to apply for the employment status visa of Francis for another two years. Francis met Ms Judy Ong who is a Singaporean, but she has obtained Hong Kong Identity Card. They have become very close together and started to plan for their future. Francis and Judy purchased a Qualifying Deferred Annuity Policy (QDAP) as joint policy holders and Judy as the sole annuitant in April 2019. The premium paid by Francis for the period from April 2019 to March 2020 was $5,000 per month. They got married in December 2019 and moved to a flat in Quarry Bay. The following information is also available. 1. Francis does not need to make contributions to the MPF Fund in Hong Kong as he got a Certificate of Exemption under the Occupational Retirement Schemes Ordinance and accepted by MPF Schemes Authority. He does not need to declare his employment income to relevant tax authorities in the UK but he continues to make payment for his Employment Provident Fund in the UK, and it was done by deductions from his salary in Hong Kong by Company H. 2. The housing benefit of $30,000 is included in the monthly salary paid to Francis by Company H under its automatic transfer payment system with employees banks. The tenancy agreement of the flat in Quarry Bay started on 1 December 2019 and monthly rental of $28,000 is paid by Francis. The Human Resource Department never asks Francis to produce the rental receipt of the landlord. 3. Francis has purchased some equipment and software which are similar to those in the research laboratory of the Research Department to work at home to show his excellent performance over the other members of the team. The equipment costs him $50,000 but he expects that this expenditure could be allowed as deduction from his income for Hong Kong salaries tax purpose. 3 4. In May 2019 Company H purchased a business class ticket for Francis to travel to Singapore for business purpose for five days from Monday to Friday. The cost of the ticket was $14,000. Francis and Judy took this opportunity to visit Judys parents before their marriage in December 2019. Therefore, Judy flew to Singapore on Saturday to join Francis. They spent another 4 days in Singapore after Franciss business ended on Friday. Francis traded in the business class air ticket for two economy class tickets for him and Judy and paid an additional sum of $2,000 to the airline company. During the days in Singapore, they stayed in a hotel charging a total amount of $18,000 for 9 nights which was paid by Company H. 5. In the years of assessment 2018/19 and 2019/20, Francis continued to state Company A is his employer. Furthermore, in filing the tax return of 2019/20, he declared the housing benefit provided by his employer is $28,000 per month. 6. In filing an Employers Tax Return Form, Company H reported the salaries and benefits paid to Francis Chan as the employer and Francis spent 120 days and 80 days outside Hong Kong for the years of assessment 2018/19 and 2019/20 respectively. Required

Questions

(a) With reference to relevant cases, Departmental Interpretation and Practice Notes(DIPNs) and/or sections of Inland Revenue Ordinance (IRO), explain whether Francis Chans employment was located in Hong Kong for the year of assessment 2019/20 and determine the extent of his income that should be assessed to Hong Kong salaries (calculation of assessable income is not required). (20 marks) (b) Explain whether the cost of purchasing the equipment, $50,000 incurred by Francis Chan can be deductible from his income for the purpose of salaries tax (refer to point 3). Support your answer with relevant cases, DIPNs and/or sections of the IRO. (7 marks) (c) Explain whether the expenses paid by Company H in respect of the Singapore trip are assessable in the income of Francis Chan and calculate the amount, if any, for the year of assessment 2019/20 (refer to point 4). (9 marks) (d) Explain how the housing benefit would be assessable in the income of Francis Chan for the year of assessment 2019/20 and calculate the amount if any. Support your answer with relevant cases, DIPNs and/or sections of the IRO. (8 marks) (e) With reference to sections of Inland Revenue Ordinance (IRO), explain whether the premiums paid by Francis Chan under the QDAP can be allowed for deduction in the year of assessment 2019/20 and calculate the amount if any. (6 marks)

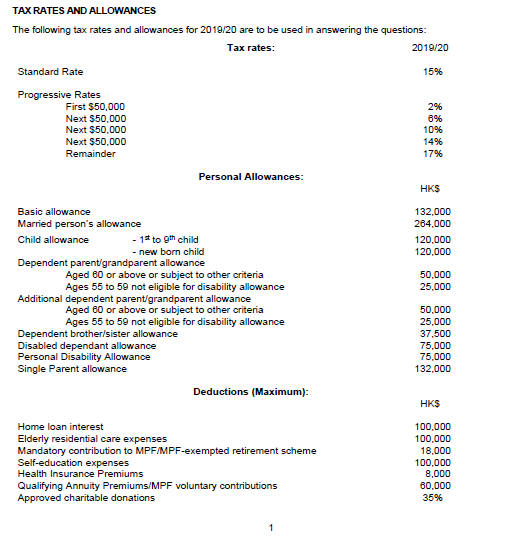

TAX RATES AND ALLOWANCES The following tax rates and allowances for 2019/20 are to be used in answering the questions: 2019/20 Tax rates: Standard Rate 15% Progressive Rates First $50,000 Next $50,000 Next $50.000 Next $50.000 Remainder 2% 6% 10% 14% 17% Personal Allowances: HKS 132.000 264.000 120,000 120.000 50.000 25.000 Basic allowance Married person's allowance Child allowance - 15 to 9th child -new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal Disability Allowance Single Parent allowance Deductions (Maximum): 50.000 25,000 37,500 75.000 75.000 132.000 HK$ Home loan interest Elderly residential care expenses Mandatory contribution to MPF/MPF-exempted retirement scheme Self-education expenses Health Insurance Premiums Qualifying Annuity Premiums/MPF voluntary contributions Approved charitable donations 100,000 100.000 18.000 100.000 8,000 60,000 35% 1 TAX RATES AND ALLOWANCES The following tax rates and allowances for 2019/20 are to be used in answering the questions: 2019/20 Tax rates: Standard Rate 15% Progressive Rates First $50,000 Next $50,000 Next $50.000 Next $50.000 Remainder 2% 6% 10% 14% 17% Personal Allowances: HKS 132.000 264.000 120,000 120.000 50.000 25.000 Basic allowance Married person's allowance Child allowance - 15 to 9th child -new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal Disability Allowance Single Parent allowance Deductions (Maximum): 50.000 25,000 37,500 75.000 75.000 132.000 HK$ Home loan interest Elderly residential care expenses Mandatory contribution to MPF/MPF-exempted retirement scheme Self-education expenses Health Insurance Premiums Qualifying Annuity Premiums/MPF voluntary contributions Approved charitable donations 100,000 100.000 18.000 100.000 8,000 60,000 35% 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started