Answered step by step

Verified Expert Solution

Question

1 Approved Answer

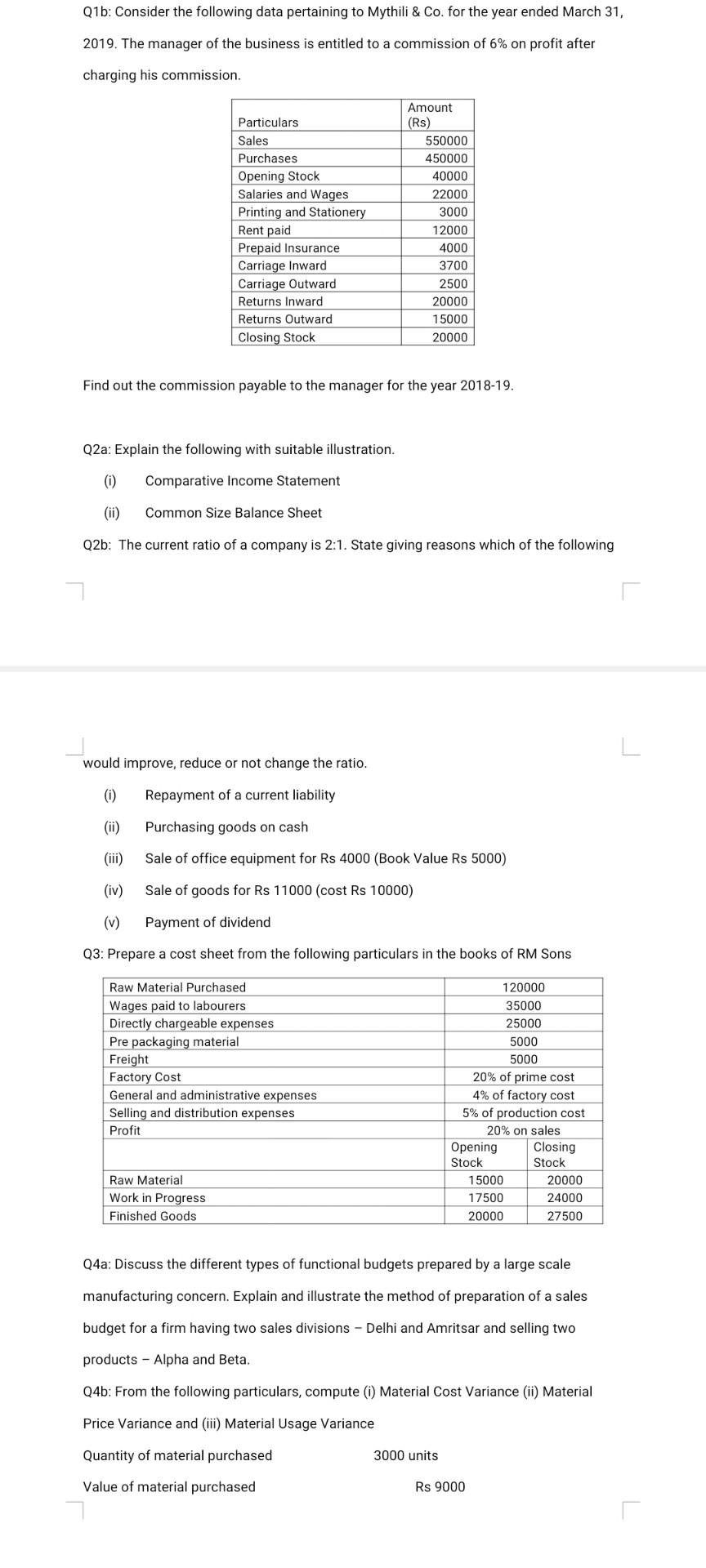

Q1b: Consider the following data pertaining to Mythili & Co. for the year ended March 31, 2019. The manager of the business is entitled to

Q1b: Consider the following data pertaining to Mythili & Co. for the year ended March 31, 2019. The manager of the business is entitled to a commission of 6% on profit after charging his commission. Particulars Sales Purchases Opening Stock Salaries and Wages Printing and Stationery Rent paid Prepaid Insurance Carriage Inward Carriage Outward Returns Inward Returns Outward Closing Stock Amount (Rs) 550000 450000 40000 22000 3000 12000 4000 3700 2500 20000 15000 20000 Find out the commission payable to the manager for the year 2018-19. Q2a: Explain the following with suitable illustration. () Comparative Income Statement Common Size Balance Sheet Q2b: The current ratio of a company is 2:1. State giving reasons which of the following L would improve, reduce or not change the ratio. (0) Repayment of a current liability (ii) Purchasing goods on cash Sale of office equipment for Rs 4000 (Book Value Rs 5000) (iv) Sale of goods for Rs 11000 (cost Rs 10000) (v) Payment of dividend Q3: Prepare a cost sheet from the following particulars in the books of RM Sons Raw Material Purchased Wages paid to labourers Directly chargeable expenses Pre packaging material Freight Factory Cost General and administrative expenses Selling and distribution expenses Profit 120000 35000 25000 5000 5000 20% of prime cost 4% of factory cost 5% of production cost 20% on sales Opening Closing Stock Stock 15000 20000 17500 24000 20000 27500 Raw Material Work in Progress Finished Goods Q4a: Discuss the different types of functional budgets prepared by a large scale manufacturing concern. Explain and illustrate the method of preparation of a sales budget for a firm having two sales divisions - Delhi and Amritsar and selling two products - Alpha and Beta. Q4b: From the following particulars, compute (1) Material Cost Variance (ii) Material Price Variance and (iii) Material Usage Variance Quantity of material purchased 3000 units Value of material purchased Rs 9000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started