Q1(B),,,, Ignore Q1(a)

Q1(B),,,, Ignore Q1(a)

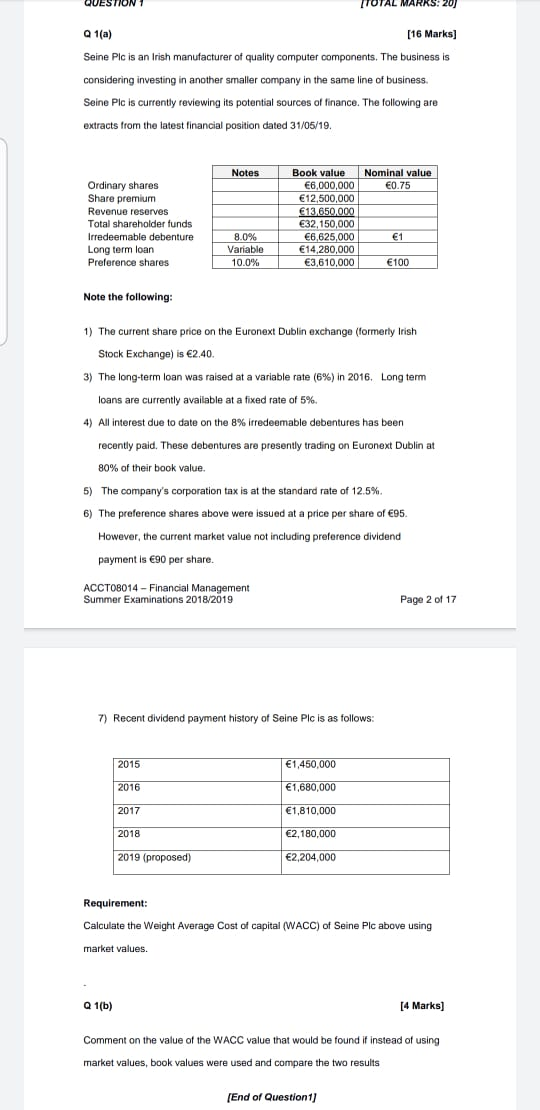

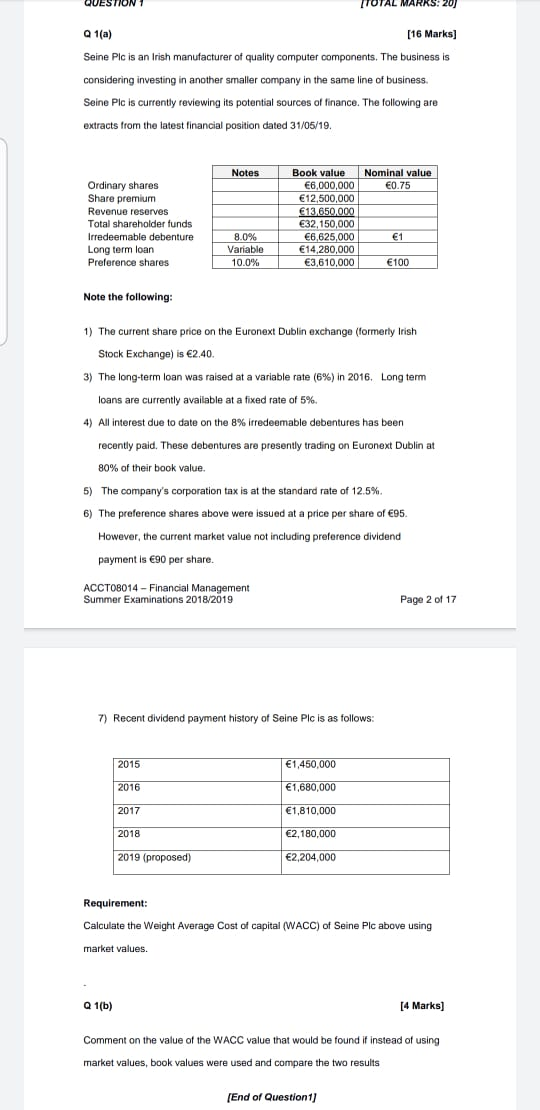

QUESTION TOTAL MARRS:20) Q 1(a) [16 Marks) Seine Plc is an Irish manufacturer of quality computer components. The business is considering investing in another smaller company in the same line of business. Seine Plc is currently reviewing its potential sources of finance. The following are extracts from the latest financial position dated 31/05/19 Notes Nominal value 0.75 Ordinary shares Share premium Revenue reserves Total shareholder funds Irredeemable debenture Long term loan Preference shares Book value 6,000,000 12,500,000 13,650,000 32,150,000 6,625,000 14,280,000 3,610,000 1 8.0% Variable 10.0% 100 Note the following: 1) The current share price on the Euronext Dublin exchange (formerly Irish Stock Exchange) is 2.40 3) The long-term loan was raised at a variable rate (6%) in 2016. Long term loans are currently available at a fixed rate of 5% 4) All interest due to date on the 8% irredeemable debentures has been recently paid. These debentures are presently trading on Euronext Dublin at 80% of their book value. 5) The company's corporation tax is at the standard rate of 12.5%. 6) The preference shares above were issued at a price per share of 95. However, the current market value not including preference dividend payment is 90 per share. ACCT08014 - Financial Management Summer Examinations 2018/2019 Page 2 of 17 7) Recent dividend payment history of Seine Plc is as follows: 2015 1,450,000 2016 1,680,000 2017 1,810,000 2018 2,180,000 2019 (proposed) 2,204,000 Requirement: Calculate the Weight Average Cost of capital (WACC) of Seine Plc above using market values. Q 1(b) [4 Marks) Comment on the value of the WACC value that would be found if instead of using market values, book values were used and compare the two results [End of Question 1) QUESTION TOTAL MARRS:20) Q 1(a) [16 Marks) Seine Plc is an Irish manufacturer of quality computer components. The business is considering investing in another smaller company in the same line of business. Seine Plc is currently reviewing its potential sources of finance. The following are extracts from the latest financial position dated 31/05/19 Notes Nominal value 0.75 Ordinary shares Share premium Revenue reserves Total shareholder funds Irredeemable debenture Long term loan Preference shares Book value 6,000,000 12,500,000 13,650,000 32,150,000 6,625,000 14,280,000 3,610,000 1 8.0% Variable 10.0% 100 Note the following: 1) The current share price on the Euronext Dublin exchange (formerly Irish Stock Exchange) is 2.40 3) The long-term loan was raised at a variable rate (6%) in 2016. Long term loans are currently available at a fixed rate of 5% 4) All interest due to date on the 8% irredeemable debentures has been recently paid. These debentures are presently trading on Euronext Dublin at 80% of their book value. 5) The company's corporation tax is at the standard rate of 12.5%. 6) The preference shares above were issued at a price per share of 95. However, the current market value not including preference dividend payment is 90 per share. ACCT08014 - Financial Management Summer Examinations 2018/2019 Page 2 of 17 7) Recent dividend payment history of Seine Plc is as follows: 2015 1,450,000 2016 1,680,000 2017 1,810,000 2018 2,180,000 2019 (proposed) 2,204,000 Requirement: Calculate the Weight Average Cost of capital (WACC) of Seine Plc above using market values. Q 1(b) [4 Marks) Comment on the value of the WACC value that would be found if instead of using market values, book values were used and compare the two results [End of Question 1)

Q1(B),,,, Ignore Q1(a)

Q1(B),,,, Ignore Q1(a)