Answered step by step

Verified Expert Solution

Question

1 Approved Answer

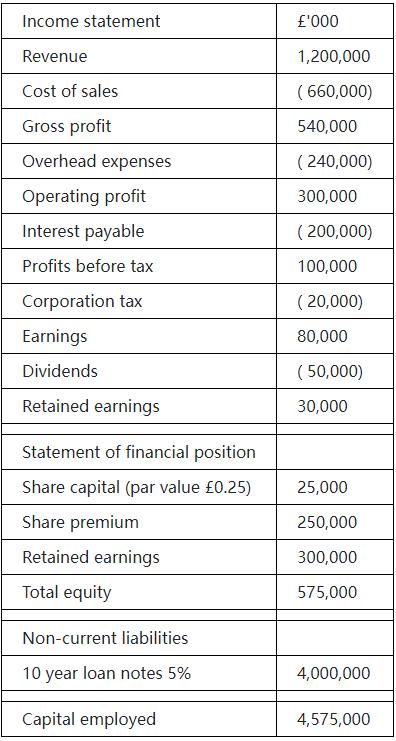

Q1.financial statements for the last financial year for Shabanie plc Shabanie plcs shares have a par value of 0.25. The loan notes have a market

Q1.financial statements for the last financial year for Shabanie plc

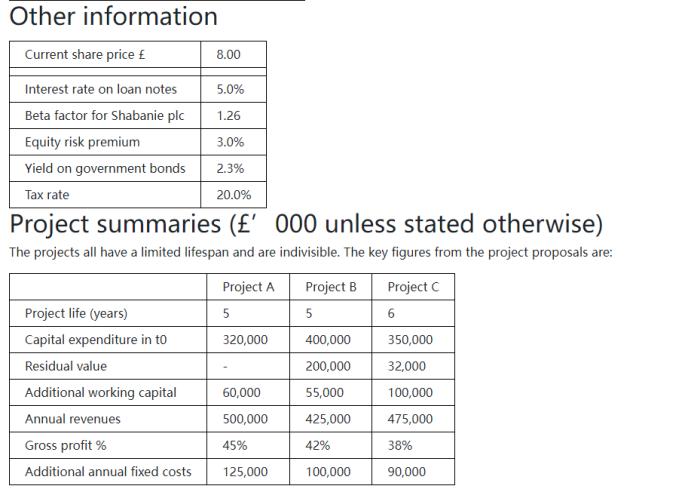

Shabanie plc’s shares have a par value of £0.25. The loan notes have a market value equal to their nominal value.

Shabanie plc’s policy is to depreciate capital expenditure in equal amounts over the estimated useful life of the asset. This policy matches the tax regulations that also state that tax must be paid at the appropriate rate on accounting profits on the last day of the year in which they are earned.

Required

- Calculate Shabanie’s weighted average cost of capital, capital gearing ratio and interest cover.

- Calculate the net present value for each of Shabanie plc’s three projects and select the preferred project(s) discussing the reasons for your selection.

Income statement Revenue Cost of sales Gross profit Overhead expenses Operating profit Interest payable Profits before tax Corporation tax Earnings Dividends Retained earnings Statement of financial position Share capital (par value 0.25) Share premium Retained earnings Total equity Non-current liabilities. 10 year loan notes 5% Capital employed '000 1,200,000 (660,000) 540,000 (240,000) 300,000 (200,000) 100,000 (20,000) 80,000 (50,000) 30,000 25,000 250,000 300,000 575,000 4,000,000 4,575,000

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Weighted average cost of capital The weighted average cost of capital WACC is the weighted average of the costs of all the different capital sources u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started