Answered step by step

Verified Expert Solution

Question

1 Approved Answer

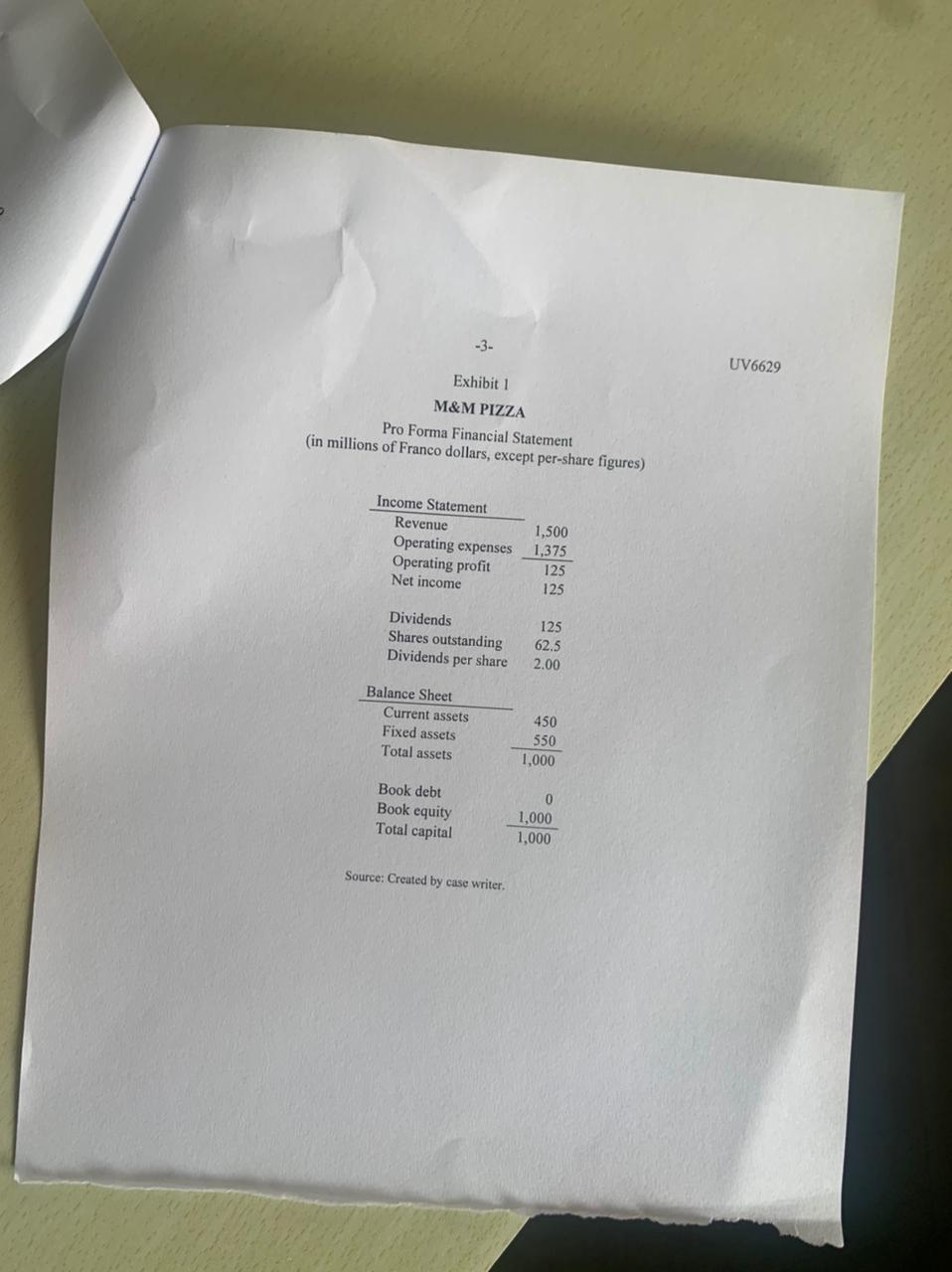

Q1How do the financial statements for M&M Pizza vary with the proposed repurchase plan? Do the alternative policies improve the expected dividends per share? Q2What

- Q1How do the financial statements for M&M Pizza vary with the proposed repurchase plan? Do the alternative policies improve the expected dividends per share?

- Q2What impact does the repurchase plan have on M&Ms weighted average cost of capital?

- Q3What are the debt and equity claim worth under the alternative scenarios? You may note that the present value of a perpetual cash flow stream is equal to the expected payment divided by the associated required return.

- Q4Which proposal is best for investors? What do you recommend that Miller do?

- Q5How would your analysis in questions 2 and 3 and recommendation in question 4 change if the new tax law is implemented? Please note that, with corporate taxes, the expected debt-to-equity ratio under the share repurchase plan is 0.588 and the number of remaining shares outstanding is 39.4 million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started