Answered step by step

Verified Expert Solution

Question

1 Approved Answer

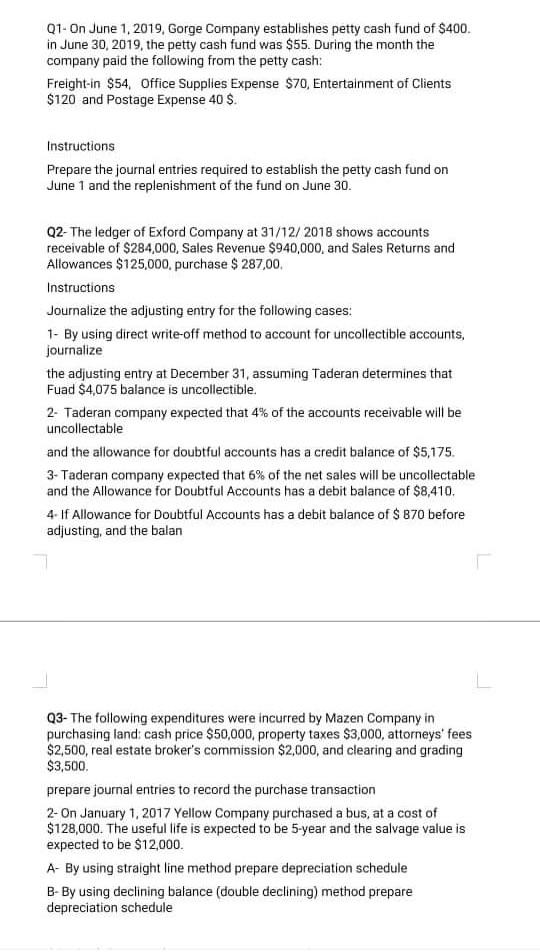

Q1-On June 1, 2019. Gorge Company establishes petty cash fund of $400. in June 30, 2019, the petty cash fund was $55. During the month

Q1-On June 1, 2019. Gorge Company establishes petty cash fund of $400. in June 30, 2019, the petty cash fund was $55. During the month the company paid the following from the petty cash: Freight-in $54, Office Supplies Expense 570, Entertainment of Clients $120 and Postage Expense 40 $. Instructions Prepare the journal entries required to establish the petty cash fund on June 1 and the replenishment of the fund on June 30. Q2-The ledger of Exford Company at 31/12/2018 shows accounts receivable of $284,000, Sales Revenue $940,000, and Sales Returns and Allowances $125,000, purchase $ 287,00 Instructions Journalize the adjusting entry for the following cases 1- By using direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Taderan determines that Fuad $4,075 balance is uncollectible. 2- Taderan company expected that 4% of the accounts receivable will be uncollectable and the allowance for doubtful accounts has a credit balance of $5,175. 3- Taderan company expected that 6% of the net sales will be uncollectable and the Allowance for Doubtful Accounts has a debit balance of $8.410. 4- If Allowance for Doubtful Accounts has a debit balance of $ 870 before adjusting, and the balan Q3- The following expenditures were incurred by Mazen Company in purchasing land cash price $50,000, property taxes $3,000, attorneys' fees $2,500, real estate broker's commission $2,000, and clearing and grading $3,500 prepare journal entries to record the purchase transaction 2- On January 1, 2017 Yellow Company purchased a bus, at a cost of $128,000. The useful life is expected to be 5-year and the salvage value is expected to be $12,000. A- By using straight line method prepare depreciation schedule B-By using declining balance (double declining) method prepare depreciation schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started