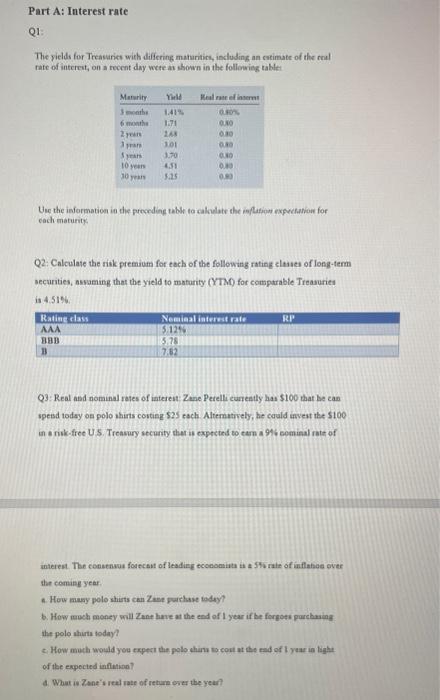

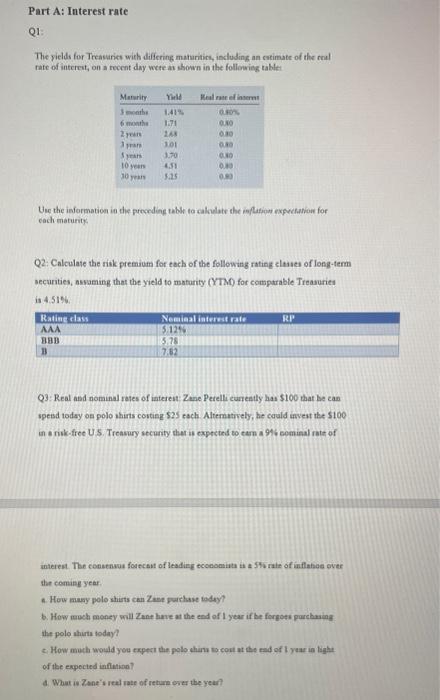

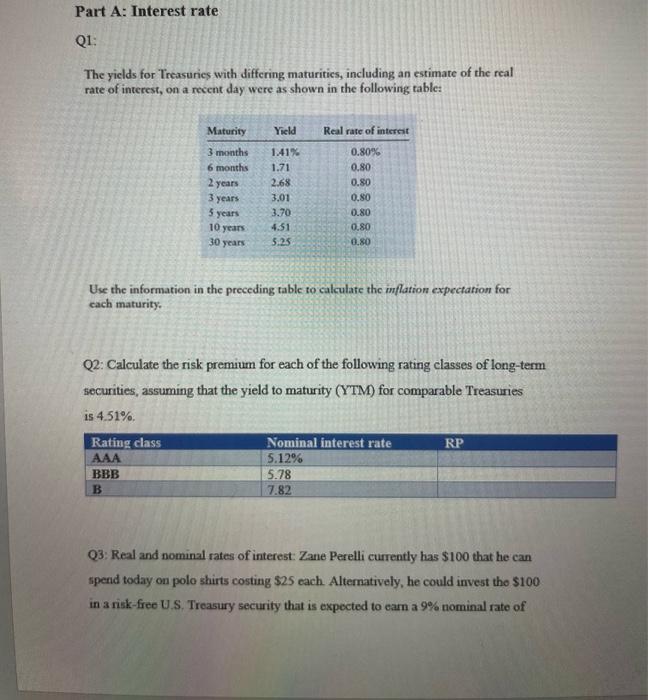

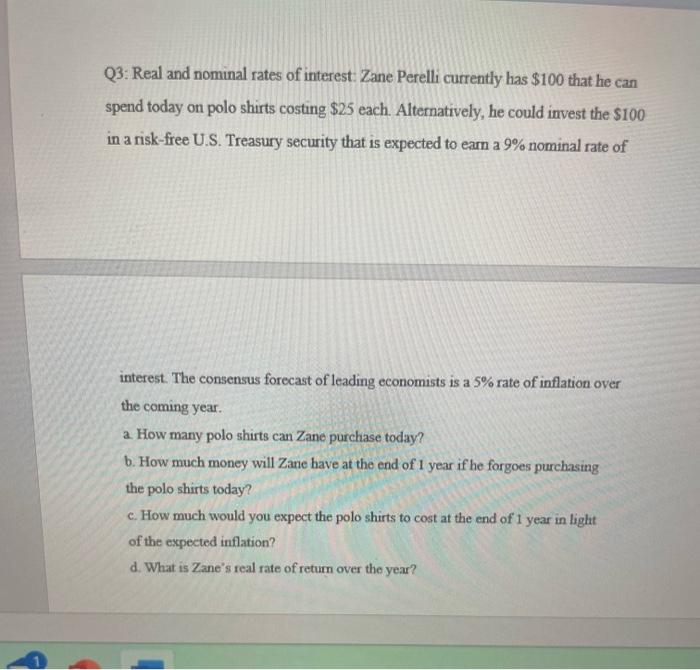

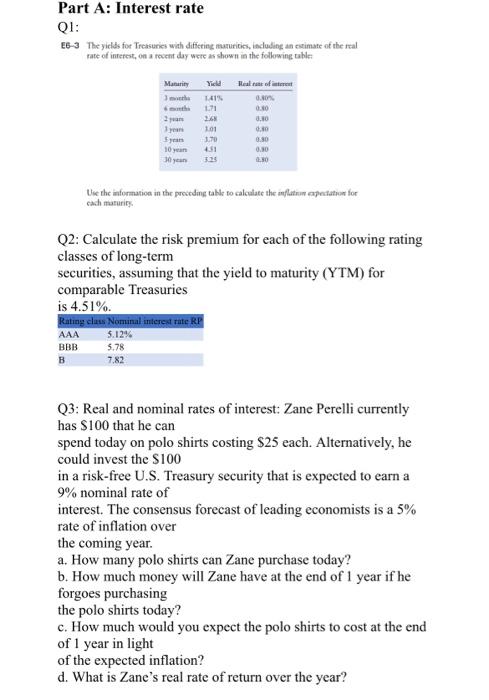

Part A: Interest rafe Q1: The vields for Treasuries with differing mataritics, including an cstimate of the mal tate of interest, on a recent day wete as ahown in the followieg tablet Une the information in the preording table to calkulate the inflation expectanion for cach maturity Q2. Calculaie the riak premium for cach of the following rating elasies of long-term oecurities, nwyaming that the yield to matarity (YTM) for comptrable Treasuries is 4.51% i Q3: Real asd nominal rates of iaterent: Zene Perelli eureatly has $100 that be can spesd today on polo shirts conting $25 each. Altematriely, he cauld anvest the $100 in o risk-free U'S. Treasury security thet is expected to carn a 916 cominal rate of anterest. The conseniva fosecan of leadieg eccoomiata as a 5% rate of inflahis over the coming year. 4. How many polo shirsts can Zase purthase tadey? b. How woch money will Zene have at the end of 1 year if be forgote purebaing the pole thurt today? c. How much would you cxpect the polo churu so cont at be med of t year in light of the expected infitition? 4. What is Zang's real rate of return over the year? Part A: Interest rate Q1: The yiclds for Treasuries with differing maturitics, including an estimate of the real rate of interest, on a recent day were as shown in the following table: Use the information in the preceding table to calculate the inflation expectation for cach maturity. Q2: Calculate the risk premium for each of the following rating classes of long-term securities, assuming that the yield to maturity (YTM) for comparable Treasuries 154.51% Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Altermatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Alternatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of interest. The consensus forecast of leading economists is a 5% rate of inflation over the coming year. a. How many polo shirts can Zane purchase today? b. How much money will Zane have at the end of 1 year if he forgoes purchasing the polo shirts today? c. How much would you expect the polo shirts to cost at the end of 1 year in light of the expected inflation? d. What is Zane's real rate of return over the year? Part A: Interest rate Q1: E6-3 The yiclds for Treasuries with dificting muzuricici, isclucling an citimate of the ral rate of inrerest, on a recent day were as shown ia the following table cach masurity, Q2: Calculate the risk premium for each of the following rating classes of long-term securities, assuming that the yield to maturity (YTM) for comparable Treasuries is 4.51%. Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing \$25 each. Alternatively, he could invest the S100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of interest. The consensus forecast of leading economists is a 5% rate of inflation over the coming year. a. How many polo shirts can Zane purchase today? b. How much money will Zane have at the end of 1 year if he forgoes purchasing the polo shirts today? c. How much would you expect the polo shirts to cost at the end of 1 year in light of the expected inflation? d. What is Zane's real rate of return over the year? Part A: Interest rafe Q1: The vields for Treasuries with differing mataritics, including an cstimate of the mal tate of interest, on a recent day wete as ahown in the followieg tablet Une the information in the preording table to calkulate the inflation expectanion for cach maturity Q2. Calculaie the riak premium for cach of the following rating elasies of long-term oecurities, nwyaming that the yield to matarity (YTM) for comptrable Treasuries is 4.51% i Q3: Real asd nominal rates of iaterent: Zene Perelli eureatly has $100 that be can spesd today on polo shirts conting $25 each. Altematriely, he cauld anvest the $100 in o risk-free U'S. Treasury security thet is expected to carn a 916 cominal rate of anterest. The conseniva fosecan of leadieg eccoomiata as a 5% rate of inflahis over the coming year. 4. How many polo shirsts can Zase purthase tadey? b. How woch money will Zene have at the end of 1 year if be forgote purebaing the pole thurt today? c. How much would you cxpect the polo churu so cont at be med of t year in light of the expected infitition? 4. What is Zang's real rate of return over the year? Part A: Interest rate Q1: The yiclds for Treasuries with differing maturitics, including an estimate of the real rate of interest, on a recent day were as shown in the following table: Use the information in the preceding table to calculate the inflation expectation for cach maturity. Q2: Calculate the risk premium for each of the following rating classes of long-term securities, assuming that the yield to maturity (YTM) for comparable Treasuries 154.51% Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Altermatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Alternatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of interest. The consensus forecast of leading economists is a 5% rate of inflation over the coming year. a. How many polo shirts can Zane purchase today? b. How much money will Zane have at the end of 1 year if he forgoes purchasing the polo shirts today? c. How much would you expect the polo shirts to cost at the end of 1 year in light of the expected inflation? d. What is Zane's real rate of return over the year? Part A: Interest rate Q1: E6-3 The yiclds for Treasuries with dificting muzuricici, isclucling an citimate of the ral rate of inrerest, on a recent day were as shown ia the following table cach masurity, Q2: Calculate the risk premium for each of the following rating classes of long-term securities, assuming that the yield to maturity (YTM) for comparable Treasuries is 4.51%. Q3: Real and nominal rates of interest: Zane Perelli currently has $100 that he can spend today on polo shirts costing \$25 each. Alternatively, he could invest the S100 in a risk-free U.S. Treasury security that is expected to earn a 9% nominal rate of interest. The consensus forecast of leading economists is a 5% rate of inflation over the coming year. a. How many polo shirts can Zane purchase today? b. How much money will Zane have at the end of 1 year if he forgoes purchasing the polo shirts today? c. How much would you expect the polo shirts to cost at the end of 1 year in light of the expected inflation? d. What is Zane's real rate of return over the year