Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Q1-Q3) Tip: Read the CH10 Lecture Slides, solve the CH10 Problem 1 Handout, review the Handout Answer file, and watch the video (in Module 7).

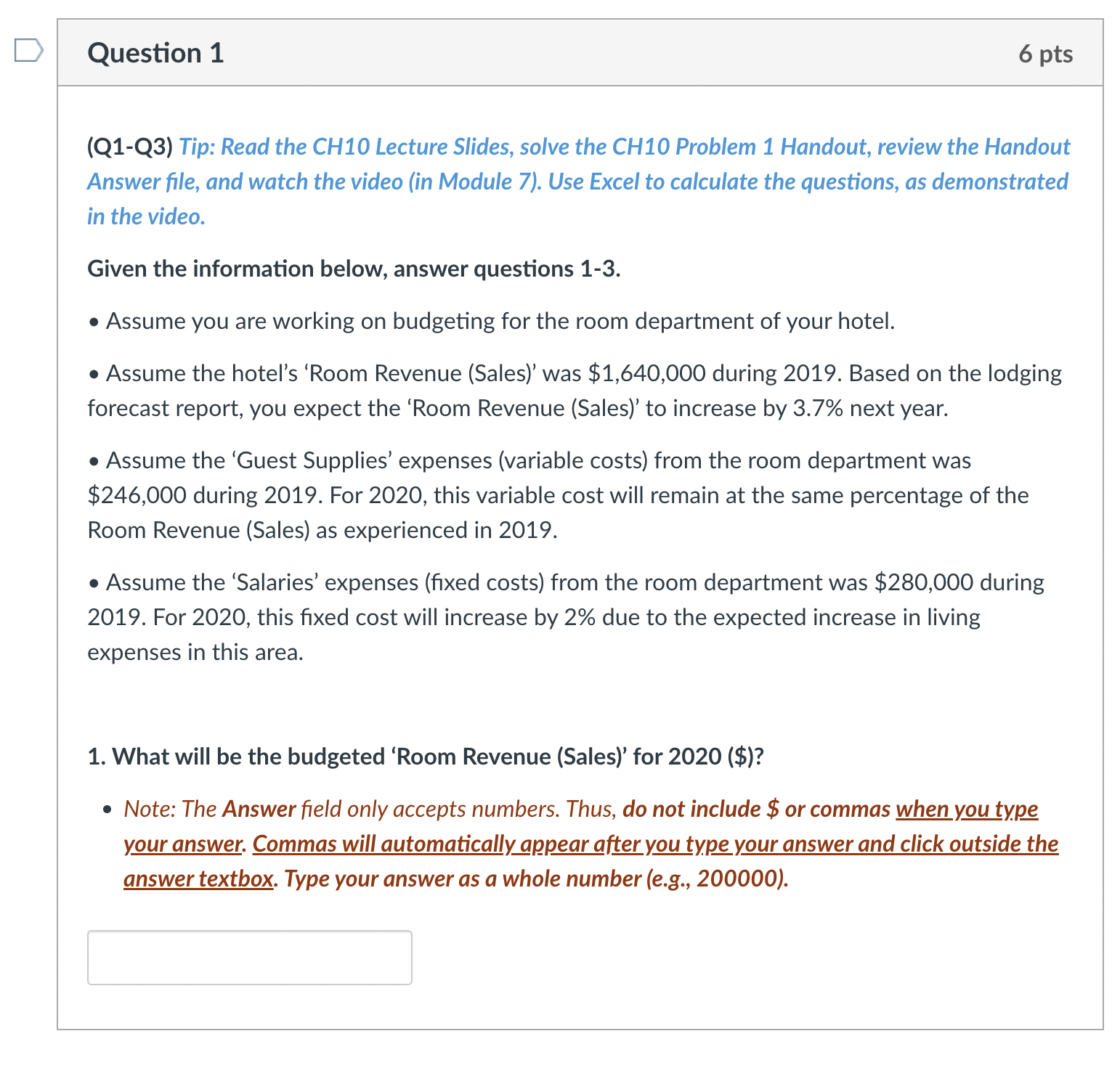

(Q1-Q3) Tip: Read the CH10 Lecture Slides, solve the CH10 Problem 1 Handout, review the Handout Answer file, and watch the video (in Module 7). Use Excel to calculate the questions, as demonstrated in the video. Given the information below, answer questions 1-3. - Assume you are working on budgeting for the room department of your hotel. - Assume the hotel's 'Room Revenue (Sales)' was \$1,640,000 during 2019. Based on the lodging forecast report, you expect the 'Room Revenue (Sales)' to increase by 3.7% next year. - Assume the 'Guest Supplies' expenses (variable costs) from the room department was $246,000 during 2019 . For 2020 , this variable cost will remain at the same percentage of the Room Revenue (Sales) as experienced in 2019. - Assume the 'Salaries' expenses (fixed costs) from the room department was $280,000 during 2019. For 2020 , this fixed cost will increase by 2% due to the expected increase in living expenses in this area. 1. What will be the budgeted 'Room Revenue (Sales)' for 2020 (\$)? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Commas will automatically appear after you type your answer and click outside the answer textbox. Type your answer as a whole number (e.g., 200000). 2. What will be the budgeted 'Guest Supplies' expenses for 2020($) ? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Type your answer as a whole number (e.g., 200000). Question 3 6 pts 3. What will be the budgeted 'Salaries' expenses for 2020($) ? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Type your answer as a whole number (e.g., 200000)

(Q1-Q3) Tip: Read the CH10 Lecture Slides, solve the CH10 Problem 1 Handout, review the Handout Answer file, and watch the video (in Module 7). Use Excel to calculate the questions, as demonstrated in the video. Given the information below, answer questions 1-3. - Assume you are working on budgeting for the room department of your hotel. - Assume the hotel's 'Room Revenue (Sales)' was \$1,640,000 during 2019. Based on the lodging forecast report, you expect the 'Room Revenue (Sales)' to increase by 3.7% next year. - Assume the 'Guest Supplies' expenses (variable costs) from the room department was $246,000 during 2019 . For 2020 , this variable cost will remain at the same percentage of the Room Revenue (Sales) as experienced in 2019. - Assume the 'Salaries' expenses (fixed costs) from the room department was $280,000 during 2019. For 2020 , this fixed cost will increase by 2% due to the expected increase in living expenses in this area. 1. What will be the budgeted 'Room Revenue (Sales)' for 2020 (\$)? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Commas will automatically appear after you type your answer and click outside the answer textbox. Type your answer as a whole number (e.g., 200000). 2. What will be the budgeted 'Guest Supplies' expenses for 2020($) ? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Type your answer as a whole number (e.g., 200000). Question 3 6 pts 3. What will be the budgeted 'Salaries' expenses for 2020($) ? - Note: The Answer field only accepts numbers. Thus, do not include \$ or commas when you type your answer. Type your answer as a whole number (e.g., 200000) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started