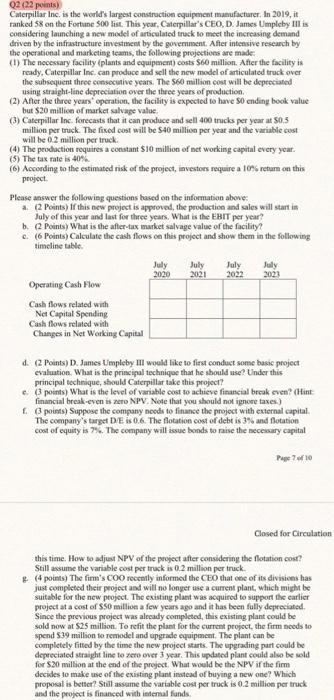

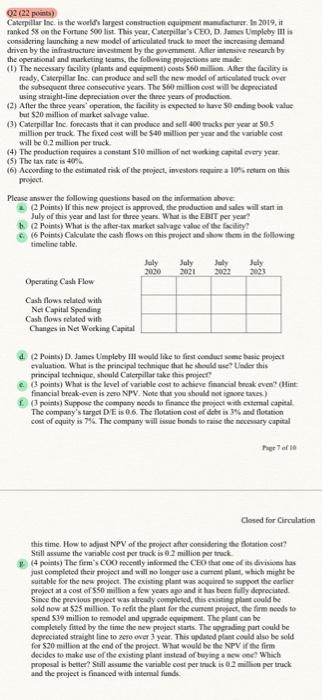

Q2 (22 points) Caterpillar Inc. is the world's largest construction equipment manufacturer. In 2019, it ranked 58 on the Fortune 500 list. This year, Caterpillar's CEO, D. James Umpleby Illis considering launching a new model of articulated track to meet the increasing demand driven by the infrastructure investment by the government. After intensive research by the operational and marketing teams, the following projections are made (1) The necessary facility (plants and equipment) costs $60 million. After the facility is ready. Caterpillar Inc. can produce and sell the new model of articulated truck over the subsequent three consecutive years. The 560 million cost will be depreciated using straight-line depreciation over the three years of production (2) After the three years operation, the facility is expected to have 50 ending book value but $20 million of market salvage value (3) Caterpillar Inc. forecasts that it can produce and sell 400 tricks per year at S05 million per truck. The fixed cost will be 540 million per year and the variable cost will be 0.2 million per truck. (4) The production requires a constant $10 million of net working capital every year. (5) The tax rate is 40% According to the estimated risk of the project, investors require a 10% retum ces this project Please answer the following questions based on the information above: a. (2 Points) If this new project is approved, the production and sales will start in July of this year and last for three years. What is the EBIT per year? bi (2 points) What is the after-tax market salvage value of the facility? c. (6 Points) Calculate the cash flows on this project and show them in the following timeline table. July July July Jully 2020 2021 2022 2023 Operating Cash Flow Cash flows related with Net Capital Spending Cash flows related with Changes in Net Working Capital d. (2 Points) D. James Impleby III would like to first conduct some basic project evaluation. What is the principal technique that he should use? Under this principal technique, should Caterpillar take this project? e. (3 points) What is the level of variable cost to achieve financial break even? (Hint financial break-even is zero NPV. Note that you should not ignore taxes.) 1 points) Suppose the company needs to finance the project with external capital. The company's target DE is 0.6. The flotation cost of debt is 3% and flotation cost of equity is 7%. The company will issue bonds to raise the necessary capital P10 Closed for Circulation this time. How to adjust NPV of the project after considering the flotation cost? Still assume the variable cost per truck is 0.2 million per truck (4 points) The fimm's COO recently informed the CEO that one of its divisions has just completed their project and will no longer use a current plant, which might be suitable for the new project. The existing plant was acquired to support the earlier project at a cost of SS0 million a few years ago and it has been fully depreciated. Since the previous project was already completed, this existing plant could be sold now at S25 million. To refit the plant for the current project, the firm needs to spend $39 million to remodel and upgrade equipment. The plant can be completely fitted by the time the new project starts. The upgrading part could be depreciated straight line to zero over 3 year. This updated plant could also be sold for $20 million at the end of the project. What would be the NPV if the firm decides to make use of the existing plant instead of buying a new one? Which proposal is better? Still assume the variable cost per truck is 0.2 million per truck and the project is financed with internal funds 02 (22 points) Caterpillar Inc. is the world's largest construction equipment manufacturers 2019. it ranked on the Fortune 500 list. This year. Caterpillar's CEO, D. James Umpleby it is considering launching a new model of articulated track to meet the increasing demand driven by the infrastructure investment by the government. After interesearch by the operational and marketing teams, the following projections made (1) The necessary facility (plants and equipment costs $60 million. After the facility is ready, Caterpillar loc. can produce and sell the new model of articulated truck over the subsequent three consecutive years. The 56 million cost will be depreciated sesing straight-line depreciation over the three years of production (2) After the three years operation, the facility is expected to have sending book value but $20 million of market salvage value (3) Caterpillar Inc. forecasts that it can produce and sell 400 ks per yene S05 million per truck. The fixed cost will be 540 million per year and the variable cost will be 0.2 million per truck (4) The production requires a constant S10 million of net wading capital every year. (5) The tax rate is 40% (6) According to the estimated risk of the project, investors require a 10% em on this project Please answer the following questions based on the information above 2 Points) If this new project is approved the producted sales will start in July of this year and last for three years. What is the EBIT per year (2 points) What is the aller-tax market salvage value of the facility (6 Points) Calculate the cash flows on this project and show them in the following timeline table July Sally July July 2020 2021 2022 2023 Operating Cash Flow Cash flows related with Net Capital Spending Cash flows related with Changes in Net Working Capital (2 Points) D. James Umplery III would like to first conduced some basic project evaluation. What is the principal technique that he would use Under this principal technique, should Caterpillat take this project e points) What is the level of variable cost to achieve financial break even (Hint financial break-even is zero NIV. Note that you should not protes) points) Suppose the company nou to finance the project with external capital The company's target DE is 06. The flotation cost of dich is 3% and location cost of equity is 79. The company will see boods to use the cry capital Prof Closed for Circulation this time. How to adjust NPV of the project after considering the festion cost? Still assume the variable cost per truck is 0.2 million per truck (4 points) The firm's COO recently informed the CEO that one of its divas las just completed their project and will no longer se a current plant, which might be suitable for the new project. The existing plant was acquired to support the earlier project at a cost of $50 million a few years ago and it has been fully deprecated. Since the previous project was already completed, this existing plant could be sold now at $25 million. To refit the plant for the current project, the firm needs to spend $39 million to remodel and upgrade equipment. The plans can be completely fitted by the time the new project starts. The prading part could be depreciated straight line to zero over 3 year. This updated plant could also be sold for $20 million at the end of the project. What would be the NPV (the fimm decides to make use of the existing plant instead of buying a new Which proposal is better? Still assume the variable cost per truck is pertrack and the project is financed with internal funds