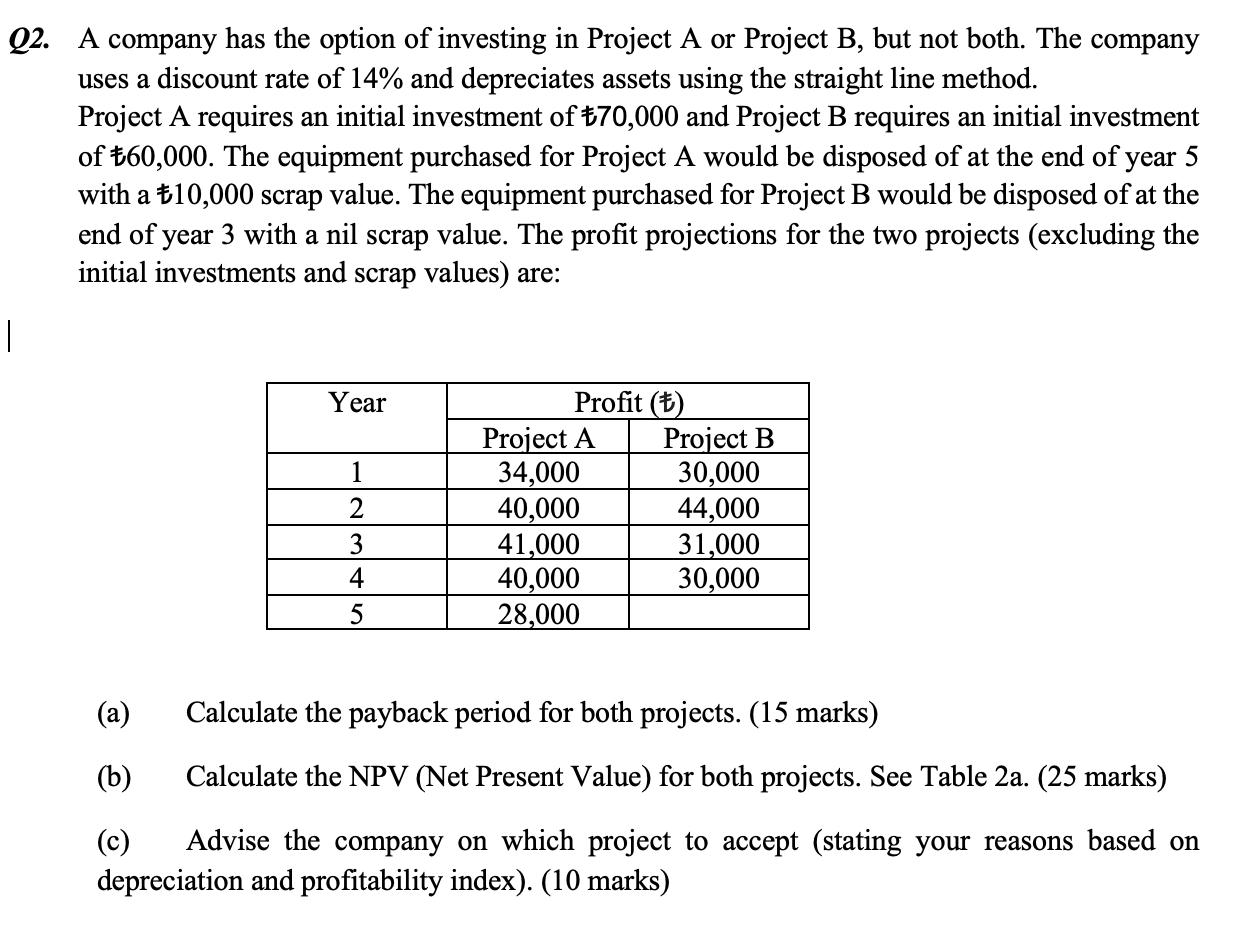

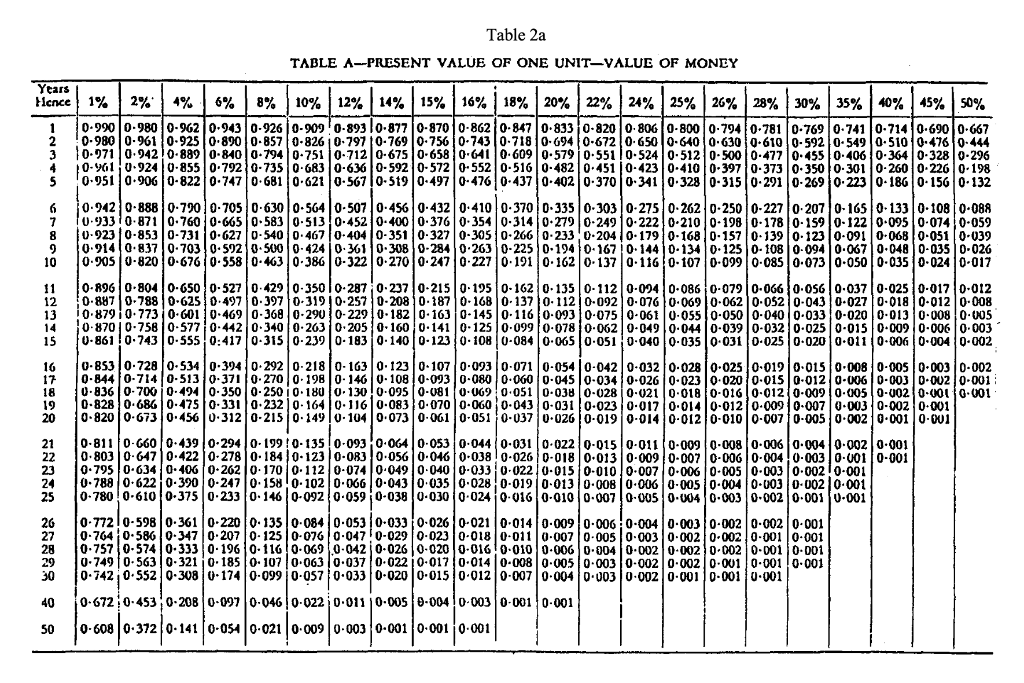

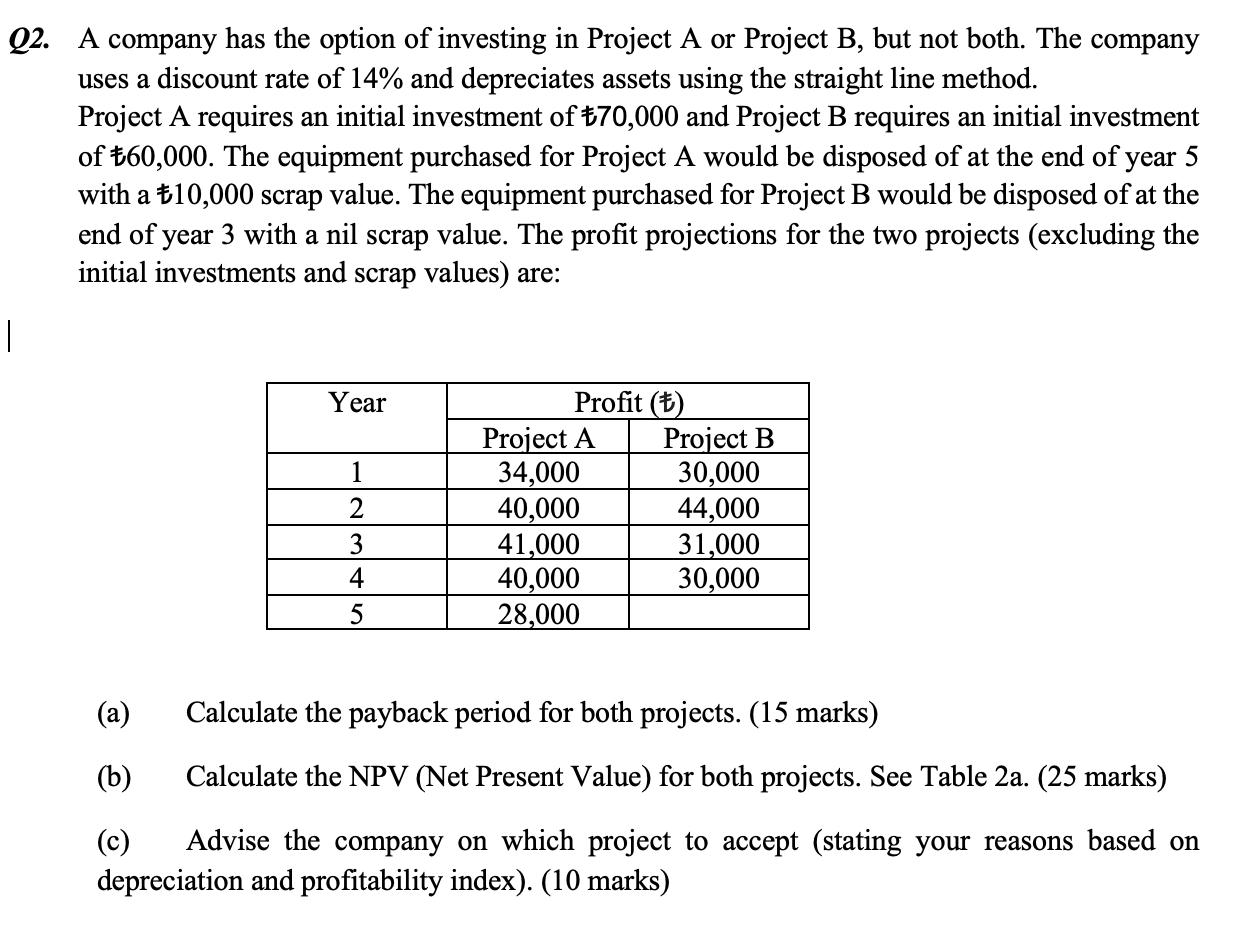

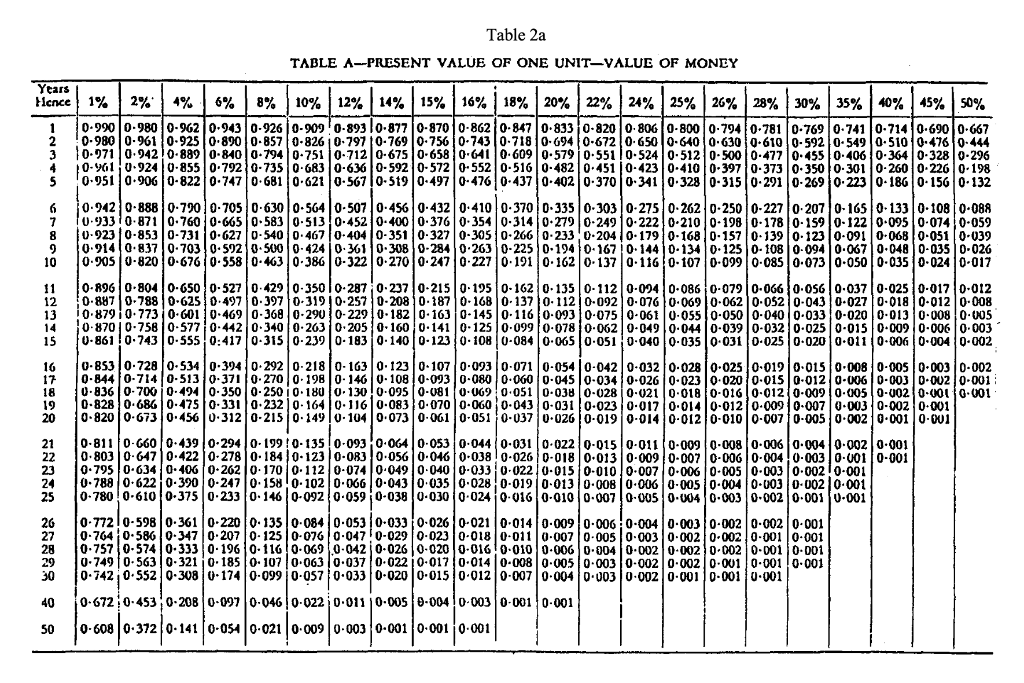

Q2. A company has the option of investing in Project A or Project B, but not both. The company uses a discount rate of 14% and depreciates assets using the straight line method. Project A requires an initial investment of 70,000 and Project B requires an initial investment of 60,000. The equipment purchased for Project A would be disposed of at the end of year 5 with a $10,000 scrap value. The equipment purchased for Project B would be disposed of at the end of year 3 with a nil scrap value. The profit projections for the two projects (excluding the initial investments and scrap values) are: | Year 1 2 3 4 5 Profit ($) Project A Project B 34,000 30,000 40,000 44,000 41,000 31,000 40,000 30,000 28,000 (a) Calculate the payback period for both projects. (15 marks) (b) Calculate the NPV (Net Present Value) for both projects. See Table 2a. (25 marks) (c) Advise the company on which project to accept (stating your reasons based on depreciation and profitability index). (10 marks) Table 2a TABLE A--PRESENT VALUE OF ONE UNIT-VALUE OF MONEY Years Hience 1% 2% 4% 6% 8% 10% 12% 14% 15% 16% 18% 20% 22% 24% 25%26% 28% 30% 35% 40% 45% 50% 1 0-990 0.980 0-962 0.903 0.9260-9090-89310-877 0-8700-862 0-847 0.8330-8200-8060-800 0-794 0-7810.7690-7410-714 0.690 0.667 2 0-980 0.961 0.925 0.890 0-857 (0-82610-7970-769 0.756 0-7430.7180-6940-672 0-6500-6400-6300-610 0-592 0-5490-510 0.476 0 444 10.971 0.9420-8890-8100-794 0-751 0-7120-6750-658 0-6410-609 0.5790-551 0.524 0-512 0-500 10-4770-4550-406 0-364 0-328 0-296 0-961 0.924 0-855 0.792 0-735 0-683 0-636 0-592 0-5720-552 0-5160-48210.4510-423 0.4100-397 0.373 0-350 0-301 0-260 0.226 0-198 5 0.951 0.906 0-822 0.747 0.681 0.621 0-5670-519 0-4970-4760-437 0-402 0-370 0-341 0-3280-315 0.291 0-269 0.2230-1860-156 0-132 6 0.942 0-8880-7900-705 0-6300-5640-5070-4560-4320-410 0.370 0.3350-303 0-275 0.262 0-2500-2270-2070-165 0-1330-1080-088 7 0-93310.8710-7600-665 0-5830-513 0-452 0.400 0.376 0.3540-314 0-2790-2490-222 0.210 0-1980-1780-1590-122 0-095 0.074 0-059 8 0.923 0-8530-731 0.627 0-540 0.467 0-4040-351 0-327 0-305 0-2660-2330-2040-1790-1680-157 0-139 0.123 0-091 0-068 0-0510-039 9 0.914 0.837 0.703 0.5920-500 0.424 0.3610-308 0-284 0.263 0-225 0-1940-167 0.144 0.134 0.125 0-108 0-094 0.06710-0480-035 D-026 10 0.9050-820 0-676 0-558 0.463 0-3860-3220-2700-247 0.227 0.191 0.162 0-137 0.116 0-107 0-099 0-085 0.0730-050 0.035 0.024 0-017 0-896 0-8040-650 0-527 0.429 0-350 | 0.287 0.237 10-215 0.1950-162 0-1350-1120-094 0-086 0-0790-066 0.0560-0370-0250-0170-012 12 0.887 0.788 0-625 0.497 0-397 0-31910-257 0-208 0.187 0.168 0-1370-112 0-092 0.0760.0690-062 10-052 0-043 0.027 0.018 0-0120-008 13 0.8791 0.773 10-601 0.4690-368 0-2900-22910-1820-163 -145 0.116 0-0930-0750-061 0-0550-0500-040 0.0330-0200-013 0.008 0.005 14 0-8700-7580-5770-442 0-340 0.263 0.2050-160 0.141 0.125 0-0990-078 0.0620-049 0.0440-0390-032 0.0250-015 0-009 0.006 0.003 15 0-8610.7430-555 0:4170-3150-239 0-183 0.140 0-1230-1080-084 0.065 0.0510-040 0.035 0.031 0.025 0.0200-0110-006 0-004 0-002 16 0-8530-7280-534 0-394 0 2920-218 0.163 0.123 0.1070-093 0-071 0-0540-04210-032 0.028 10.025 0.019 0-015 0-008 0.005 0.003 0-002 17 0-844 0-7140-513 0-3710 2700-1980-146 0.1080-093 0-080 0.060 0-04510-034 0-026 0-0230-0200-015 0-0120-0060-003 0-0020-001 18 0-8369-7000-4940-3500-250 10-180 0.1300-095 0-081 0-069 0.051 0-038 0-028 0.021 0.018 0-01610-012 0-009 0.005 0-102 0.001 0.001 19 0-828 0 686 0.4750-331 0.232 10.1640.116 0-083 0.0700-060 0.043 0-031 0-023 0-0170-0140-0120-009 0.007 0.003 0-0020-001 20 0-8200-673 0.456 0.3120-215 0.149 0.104 0.073 0.061 0-051 0-037 0.026 0-019 0-014 0-0120-0100-0070-005 0.002 0.001 0.001 21 0-811 0-660 0.4390-2940-1990-1350-093 0.0640-053 0.044 0.031 (0-022 0-015 0-0110-009 0.008 0.006 0.004 0.002 0.001 22 0-803 0-6470.4220-278 0.1840-123 0-083 0.0560-0460-0380-026 0-018 0-013 0-00910-0070-0060-0040-0030-001 0-001 23 0.795 0-634 0.4060-262 0.170 0.112 0-0740-049 0.040 0-033 0.0220-015 0-010 0.007 0.006 0.005 0.003 0.00210-001 0.788 0-622 0-390 0-247 0.158 0-102 0.066 0-043 0.035 0.028 0-019 0-013 0.00810-006 0.005 0.004 0.003 0.00210-001 25 0-780 0-610 0.375 0.233 0.146 0-092 0-0590-0380-030 0.024 0-016 0-010 0.007 0.005 0.004 0.003 0.002 0.001 0-001 26 0.772 0-598 0.361 0.220 0-1350-084 0.0530-033 0.0260-021 0.014 0.009 0.0060-004 0.003 0-0020-0020-001 0-764 0-586 0-3470-207 0-1250-0760-0470-029 0-023 0-018 0-0110-007 0.005 0.003 0.002 0.002 0.001 0.001 28 0.757 0-574 0-3330-1960-116 0.0690-0420-0260-0200-016 0010 0-006 0.004 0.002 0.002 0.002 0.001 0.001 29 0.749f0-563 0.321 0.1850-107 0.063 0.037 0.022 10-0170-0140-008 0.005 0.003 0.002 0.002 0.001 0.001 0.001 30 0.742 0.552 0-3080-1740-09910-057 0.033 0.0200-015 0-0120-007 0.004 0.003 0.002 0.001 0.001 0.001 40 0-6720-4530-208 0-0970-0460-022 0.0110.005 0-0040-003 0-001 0.001 0-6080-3720-141 (0-051 0.021 0.0090.003 0-001 0.001 0.001 50