Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2. A) Mr. Ali has bought a put option whereby volume of the currency to be exchanged is USD100,000 executeable in one week and the

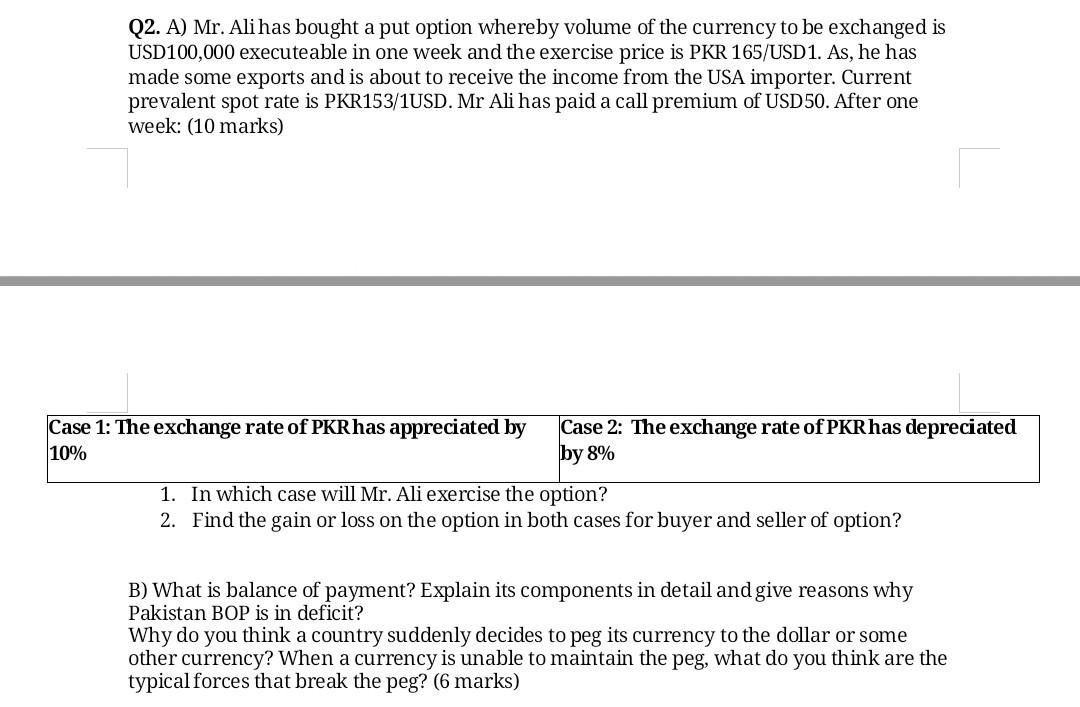

Q2. A) Mr. Ali has bought a put option whereby volume of the currency to be exchanged is USD100,000 executeable in one week and the exercise price is PKR 165/USD1. As, he has made some exports and is about to receive the income from the USA importer. Current prevalent spot rate is PKR153/1USD. Mr Ali has paid a call premium of USD50. After one week: (10 marks) Case 1: The exchange rate of PKR has appreciated by 10% Case 2: The exchange rate of PKRhas depreciated by 8% 1. In which case will Mr. Ali exercise the option? 2. Find the gain or loss on the option in both cases for buyer and seller of option? B) What is balance of payment? Explain its components in detail and give reasons why Pakistan BOP is in deficit? Why do you think a country suddenly decides to peg its currency to the dollar or some other currency? When a currency is unable to maintain the peg, what do you think are the typical forces that break the peg? (6 marks) Q2. A) Mr. Ali has bought a put option whereby volume of the currency to be exchanged is USD100,000 executeable in one week and the exercise price is PKR 165/USD1. As, he has made some exports and is about to receive the income from the USA importer. Current prevalent spot rate is PKR153/1USD. Mr Ali has paid a call premium of USD50. After one week: (10 marks) Case 1: The exchange rate of PKR has appreciated by 10% Case 2: The exchange rate of PKRhas depreciated by 8% 1. In which case will Mr. Ali exercise the option? 2. Find the gain or loss on the option in both cases for buyer and seller of option? B) What is balance of payment? Explain its components in detail and give reasons why Pakistan BOP is in deficit? Why do you think a country suddenly decides to peg its currency to the dollar or some other currency? When a currency is unable to maintain the peg, what do you think are the typical forces that break the peg? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started