Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASSIGNMENT SPECIFICATIONS 1. Assignment Tasks This assignment task is a written report that include 3 parts: Part 1: Reflective journal of one assigned topic

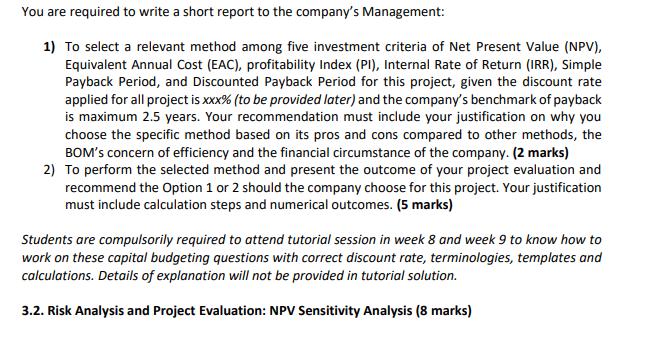

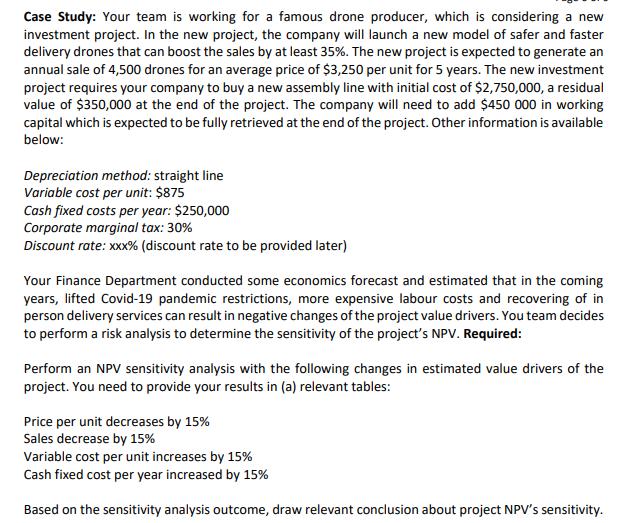

ASSIGNMENT SPECIFICATIONS 1. Assignment Tasks This assignment task is a written report that include 3 parts: Part 1: Reflective journal of one assigned topic among 9 first topics of the course. Part 2: Fact finding of securities market in Australia. Part 3: Capital Budgeting and Project Evaluation. Please also note: group assignment for H15002 is DIFFERENT every trimester. Attempt to submit a PREVIOUS TRIMESTER ASSIGNMENT or A WRONG ASSIGNMENT will be graded as ZERO (0) mark without any consideration for resubmission. Using SECONDARY DATA (researches done by others) for Reflective Journal in Part 1 and Case Study in Part 3 is not recommended and will be penalised. References in Part 2 should be provided as instructed in Submission Guidelines. II. Contribution of group members Each group needs to ensure that members are equally contribute in group work (10% each for a four member group). Non-responding and non-contributing members need to be reported by groups t Unit Coordinator for removal from the groups before week 10. Percentage of contribution and tasks (for example: Part 1. Question 1 and 2) done by each grou member must be agreed by all group members and specified clearly in the table of Information fo HI5002 Group Assignment T1 2022 Marking (below). Marks for each group member will be awarded by markers in accordance with percentage contribution and quality of the parts done by that member. III. Assignment structure and questions The assignment should cover the structure and contents described below. ASSIGNMENT COVERPAGE Please use the provided template Information for H15002 Group Assignment T1 2022 Marking: (Please fill in this table and put it right before Introduction part in your assignment. It is important for marking, penalty is applied for missing information) Student name and ID Campus and Tutorial Group Number Which section(s) did each Contribution (%) person work on Introduction A brief introduction of your group's work: the purpose of assignment, key findings and structure of the assignment (not more than 150 words) Part 1. Reflective journal of a selected topic among 9 first topics of the course (13 marks) Your group is required to write a reflective journal of what you had learnt in a tutorial session that covers one assigned topic among 9 first topics of H15002 course. Once your groups are formed on Black Board, you need to contact H15002 Unit Coordinator to get the topic assigned to your groups. The following requirements must be met for this Reflective Journal to be marked: 1) Correct name of the assigned topic as per syllabus, lectures and tutorials must be provided 2) Correct time, date and name of the lecturer who delivered the tutorial session should be provided. 3) Evidence of your discussion with HI5002 Unit Coordinator of on the assigned topic of Part 1. Reflective Journal: screen shots of email exchanges submitted in an appendix to your assignment. To complete the reflective journal, answer the following reflective questions: Reflective questions: Question 1: What are the financial concepts you have learnt in the session? Briefly explain the concepts? (please note that only list the financial concepts discussed in the interactive tutorial session, not all the financial concepts discussed in the recorded lecture) (3 marks) Question 2: What are the important issues your lecturer reminded you to note down and pay your special attention to regarding the financial concepts/formulas/calculations/skills/techniques you have learnt in that session? (5 marks) Question 3: How many practice questions did you work on the class with your lecturer? Briefly summarize the content of that questions and what you have done with your lecturer in practicing with those questions. What are the problems did you encounter when you worked on that practice questions? (3 marks) Question 4: How can you potentially apply what you have learnt in that class in your real life? (2 marks) Part 2. Fact finding of securities market in Australia (10 marks) You are required to go to Online Portals of ASX and ASIC, explore the data and information in the portals and perform the following tasks: Part 2. Fact finding of securities market in Australia (10 marks) You are required to go to Online Portals of ASX and ASIC, explore the data and information in the portals and perform the following tasks: Task 1: Search for information of connectivity and data on ASX and answer the questions assigned to your group. Students are required to attend the tutorial session in week 9 to get the guidance from lecturers as to what questions they need to answer in this Task. This information will not be available in tutorial solutions (3 marks). Task 2: Search for guidance of ASX on securities issuance and answer two questions assigned to your group. Students are required to attend the tutorial session in week 9 to know what are the questions you need to answer in this Task. This information will not be available in tutorial solutions. (3 marks). Task 3: Search for information in the ASIC Portal for Finance Professional and answer two questions assigned to your group. Students are required to attend tutorial session in week 9 to get the guidance from lecturers as to what questions your group will need to answer in this Task. This information will not be available in tutorial solutions. (2 marks) Task 4: Search for information in the ASIC Portal for Business and answer two questions assigned to your group. Students are required to attend tutorial session in week 9 to get the guidance from lecturers as to what questions your group will need to answer in this Task. This information will not be available in tutorial solutions. (2 marks) Note that these are fact finding questions and all the information need to be taken from the provided sources (ASX and ASIC websites). Students need to explore data and information in the websites to HI5002 Finance for Business Group Assignment T1 2022 get necessary inputs and use your own wordings to rephrase the facts, then make a proper intext citation and references to the ASX and ASIC sources (See the guideline of Adapted Harvard Referencing at the end of assignment Instructions). High similarity index showing the source of ASX with proper references is FINE but copy and paste the content of the courses is plagiarism. Links of websites for your fact finding are: Australia Stock Exchange: www.asx.com.au and Australian Securities and Investment Commission: https://asic.gov.au/. Part 3: Capital Budgeting and Project Evaluation (15 marks) 3.1. Capital Budgeting Decision Making (7 marks) Case Study: Assume that your group is working in Finance Department of a construction company. Your company is considering to invest in a 5-year project. Two options are recommended: Option 1: Build a new commercial building in the central city of Brisbane. Option 2: Build a new residential apartment block in the suburban area of Sydney. Your company's Management Board is very concerned about the efficiency in utilizing the invested capital in the recent projects and has especially requested your financial team to recommend a project evaluation method that can address the concern and take into consideration the limited available financing resources. The table below shows the estimated cash flows available for each option: Option 1 Commercial building Option 2 Residential block Initial Investment 3,500,000 Cash flow in Year 1 720,000 Year 2 860,000 Year 3 875,000 Year 4 956,000 Year 5 900,000 2,300,000 460,000 550,000 570,000 660,000 720,000 You are required to write a short report to the company's Management: 1) To select a relevant method among five investment criteria of Net Present Value (NPV), Equivalent Annual Cost (EAC), profitability Index (PI), Internal Rate of Return (IRR), Simple Payback Period, and Discounted Payback Period for this project, given the discount rate applied for all project is xxx % (to be provided later) and the company's benchmark of payback is maximum 2.5 years. Your recommendation must include your justification on why you choose the specific method based on its pros and cons compared to other methods, the BOM's concern of efficiency and the financial circumstance of the company. (2 marks) 2) To perform the selected method and present the outcome of your project evaluation and recommend the Option 1 or 2 should the company choose for this project. Your justification must include calculation steps and numerical outcomes. (5 marks) Students are compulsorily required to attend tutorial session in week 8 and week 9 to know how to work on these capital budgeting questions with correct discount rate, terminologies, templates and calculations. Details of explanation will not be provided in tutorial solution. 3.2. Risk Analysis and Project Evaluation: NPV Sensitivity Analysis (8 marks) Case Study: Your team is working for a famous drone producer, which is considering a new investment project. In the new project, the company will launch a new model of safer and faster delivery drones that can boost the sales by at least 35%. The new project is expected to generate an annual sale of 4,500 drones for an average price of $3,250 per unit for 5 years. The new investment project requires your company to buy a new assembly line with initial cost of $2,750,000, a residual value of $350,000 at the end of the project. The company will need to add $450 000 in working capital which is expected to be fully retrieved at the end of the project. Other information is available below: Depreciation method: straight line Variable cost per unit: $875 Cash fixed costs per year: $250,000 Corporate marginal tax: 30% Discount rate: xxx% (discount rate to be provided later) Your Finance Department conducted some economics forecast and estimated that in the coming years, lifted Covid-19 pandemic restrictions, more expensive labour costs and recovering of in person delivery services can result in negative changes of the project value drivers. You team decides to perform a risk analysis to determine the sensitivity of the project's NPV. Required: Perform an NPV sensitivity analysis with the following changes in estimated value drivers of the project. You need to provide your results in (a) relevant tables: Price per unit decreases by 15% Sales decrease by 15% Variable cost per unit increases by 15% Cash fixed cost per year increased by 15% Based on the sensitivity analysis outcome, draw relevant conclusion about project NPV's sensitivity. Note: Each group will work with different discount rate. Students are required to attend interactive tutorial class in week 9 to know discount rate assigned to your group. This information will not be available in week 9 tutorial solution. Conclusion Summarize / Reflection the outcomes of your group's works (not more than 150 words)

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Topic 4 Market Efficiency Risk Returns and Portfolio Evaluation HI5002 Finance For Business Lecture 4 Market Efficiency RiskReturn and Portfolio Evaluation Interactive Tutorial Session 6 Reflec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started