Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2 Answer and question 3 answer i want. Java Source, Inc. lac USD is a small, Michigan-based processor and distributor of a variety of blends

Q2 Answer and question 3 answer i want.

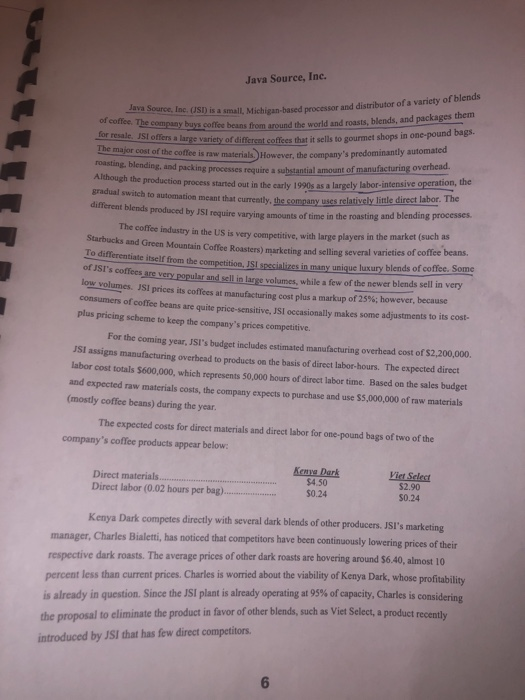

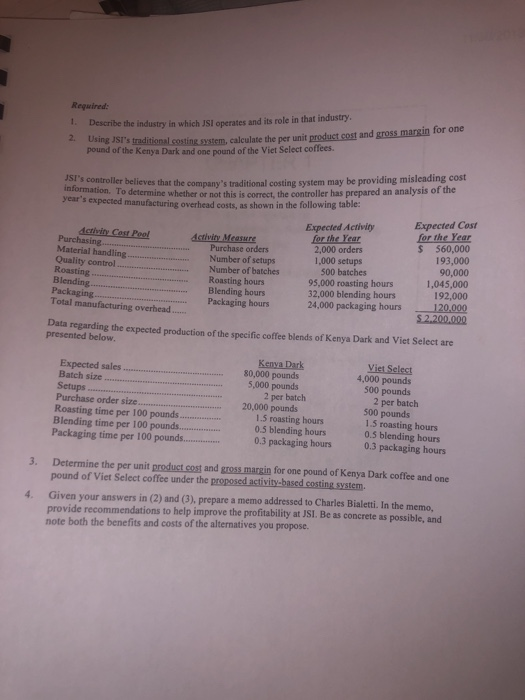

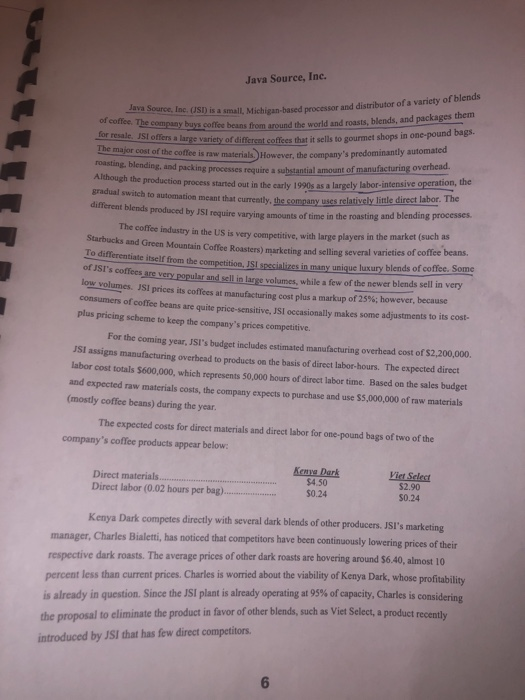

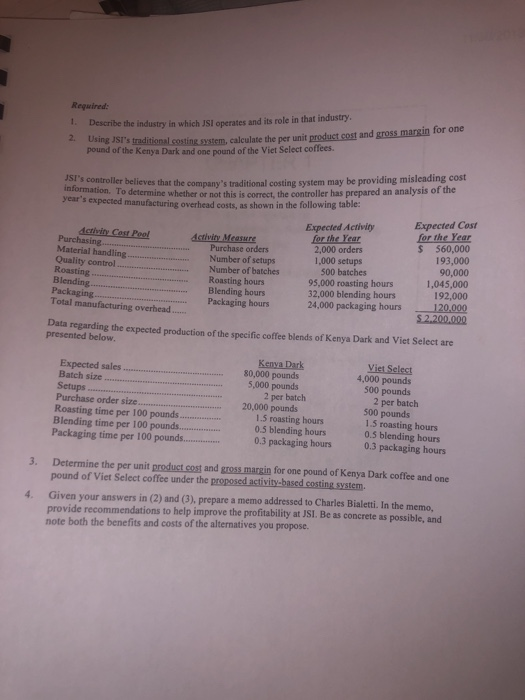

Java Source, Inc. lac USD is a small, Michigan-based processor and distributor of a variety of blends buys coffee beans from around the world and roasts, blends, and packages them Java Source, of coffee. The company co or resale iSt offers a luge variety of different offecs tat it sll to gourmet shops in one-pound The major cost of the coffe is raw material However, the company's predominantly automated overhead roasting, blending, and packing processes require a substantial amount of n gradual switch to automation meant that currently different blends produced by JSI require varying amounts of time in the roasting procduction process tarted out in the carly 1990s as a largely labor-intensive operation, the labor. The The coffee industry in the US is very competitive, with large players in the market (such as Starbucks and Green Mountain Cofee Roasters) marketing and selling several varieties of coffee beans. To differentiate itself from the competition, JSI spssializes in many unique luxury blends of coffee. of JSI's coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volumes. JSI prices its coffees at manufacturing cost plus a markup of 25%; however, because consumers of coffee beans are quite price-sensitive, JSI occasionally makes some adjustments to its cost plus pricing scheme to keep the company's prices competitive. For the coming year, JSI's budget includes estimated manufacturing overhead cost of S2,200,000. JSI assigns manufacturing overbead to products on the basis of direct labor-hours. The expected direct labor cost totals $600,000, which represents 50,000 bours of direct labor time. Based on the sales budget and expected raw materials costs, the company expects to purchase and use $$,000,000 of raw materials (mostly coffee beans) during the year The expected costs for direct materials and direct labor for one-pound bags of two of the company's coffee products appear below Kenya Darlk $4.50 Viet Selest $2.90 Direct materials Direct labor (0.02 hours per bag0.24 S0.24 Kenya Dark competes directly with several dark blends of other producers. JSI's marketing manager, Charles Bialetti, has noticed that competitors have been continuously lowering prices of their respective dark roasts. The average prices of other dark roasts are hovering around $6.40, almost 10 percent less than current prices. Charles is worried about the viability of Kenya Dark, whose profitability is already in question. Since the JSI plant is already operating at 95% of capacity, Charles is considering the proposal to eliminate the product in favor of other blends, such as Viet Select, a product recently introduced by JSI that has few direct competitors. 6 Reguired 1. Describe the industry in which JSI operates and its role in that industry poud s ditional costing system, calculate the per unit product cost and gross margin for one of the Kenya Dark and one pound of the Viet Select coffees. JSI's controller believes that the information. To determine whether or not this is correct, the contro year' informaion tr believes thar the company's traditional costing system may be providing mislcading or not this is correct, the controller has prepared an analysis of the s expected manufacturing overhead costs, as shown in the following table: Expected Cost Expected Activity for the Year 2,000 orders 1,000 setups S 560,000 193,000 90,000 1,045,000 192,000 8 Purchase orders Number of setups Number of batches Roasting hours Blending hours Material handling Quality control Blending... Total 500 batches 95,000 roasting hours 32,000 blending hours Packaging hours 24,000 packaging hours120,000 S2.200.000 overhead. Data regarding the expected production of the specific coffee blends of Kenya Dark and Viet Select are presented below Viet Select 4,000 pounds 500 pounds Expected sales Batch size Setups Purchase order size. Roasting time per 100 pounds. Blending time per 100 pounds. Packaging time per 100 pounds. 80,000 pounds 5,000 pounds 2 per batch 2 per batch 500 pounds 1.5 roasting hours 0.5 blending hours 0.3 packaging hours 20,000 pounds 1.5 roasting hours 0.5 blending hours 0.3 packaging hours 3. Determine the per unit product cost and gross margin for one pound of Kenya Dark coffee and one pound of Viet Select coffee under the proposed activity.based costing system. Given your answers in (2) and (3), prepare provide recommendations to help improve the profitability at JSI. Be as concrete as possible, and note both the benefits and costs of the alternatives you propose. 4. a memo addressed to Charles Bialetti. In the memo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started