Answered step by step

Verified Expert Solution

Question

1 Approved Answer

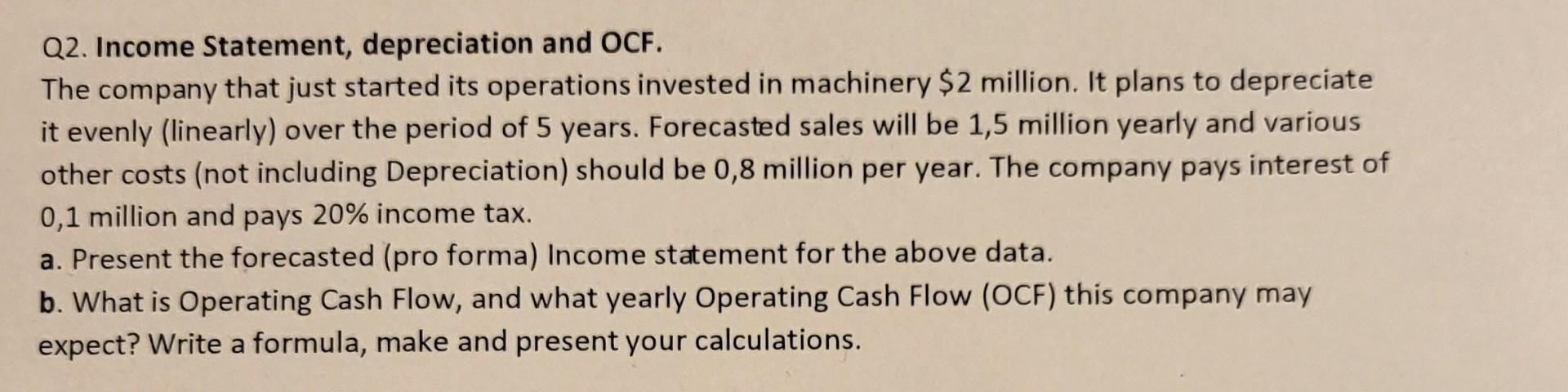

Q2. Income Statement, depreciation and OCF. The company that just started its operations invested in machinery $2 million. It plans to depreciate it evenly (linearly)

Q2. Income Statement, depreciation and OCF. The company that just started its operations invested in machinery $2 million. It plans to depreciate it evenly (linearly) over the period of 5 years. Forecasted sales will be 1,5 million yearly and various other costs (not including Depreciation) should be 0,8 million per year. The company pays interest of 0,1 million and pays 20% income tax. a. Present the forecasted (pro forma) Income statement for the above data. b. What is Operating Cash Flow, and what yearly Operating Cash Flow (OCF) this company may expect? Write a formula, make and present your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started