Answered step by step

Verified Expert Solution

Question

1 Approved Answer

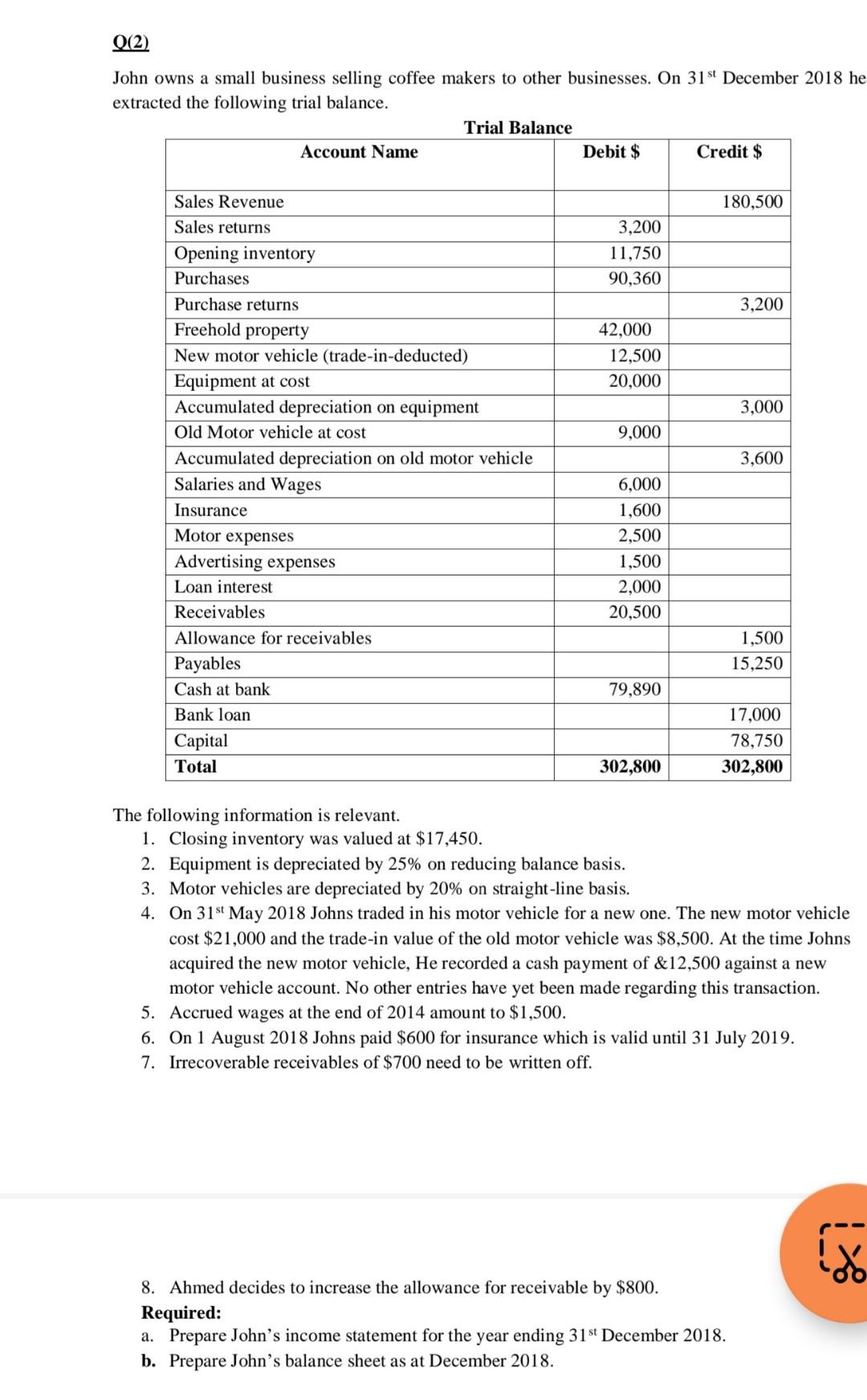

Q(2) John owns a small business selling coffee makers to other businesses. On 31st December 2018 he extracted the following trial balance. The following information

Q(2) John owns a small business selling coffee makers to other businesses. On 31st December 2018 he extracted the following trial balance. The following information is relevant. 1. Closing inventory was valued at $17,450. 2. Equipment is depreciated by 25% on reducing balance basis. 3. Motor vehicles are depreciated by 20% on straight-line basis. 4. On 31st May 2018 Johns traded in his motor vehicle for a new one. The new motor vehicle cost $21,000 and the trade-in value of the old motor vehicle was $8,500. At the time Johns acquired the new motor vehicle, He recorded a cash payment of &12,500 against a new motor vehicle account. No other entries have yet been made regarding this transaction. 5. Accrued wages at the end of 2014 amount to $1,500. 6. On 1 August 2018 Johns paid $600 for insurance which is valid until 31 July 2019 . 7. Irrecoverable receivables of $700 need to be written off. 8. Ahmed decides to increase the allowance for receivable by $800. Required: a. Prepare John's income statement for the year ending 31st December 2018. b. Prepare John's balance sheet as at December 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started