Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Q.2) Mary is a consultant living in Chicago. She is planning to visit three clients in citics A, B, and C to attend business

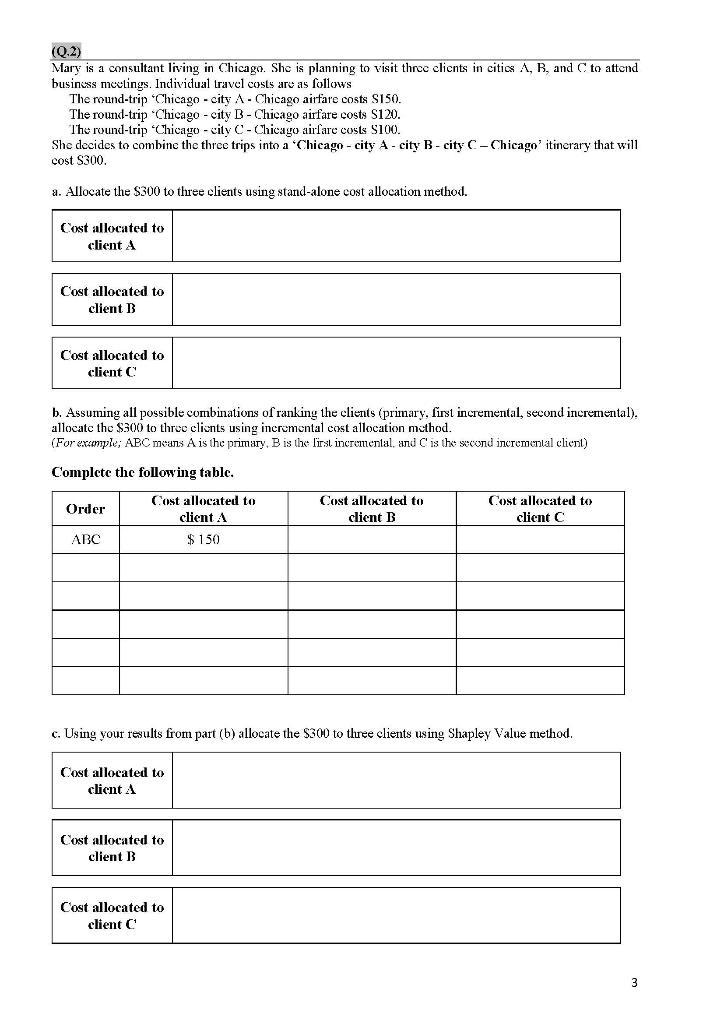

(Q.2) Mary is a consultant living in Chicago. She is planning to visit three clients in citics A, B, and C to attend business meetings. Individual travel costs are as follows The round-trip 'Chicago - city A Chicago airfare costs $150. The round-trip "Chicago - city B - Chicago airfare costs $120. The round-trip "Chicago - city C-Chicago airfare costs $100. She decides to combine the three trips into a 'Chicago - city A- city B-city C-Chicago' itinerary that will cost $300. a. Allocate the $300 to three clients using stand-alone cost allocation method. Cost allocated to client A Cost allocated to client B Cost allocated to client C b. Assuming all possible combinations of ranking the clients (primary, first incremental, second incremental). allocate the $300 to three clients using incremental cost allocation method. (For example; ABC means A is the primary, B is the first incremental, and C is the second incremental client) Complete the following table. Order ABC Cost allocated to client A $150 Cost allocated to client A c. Using your results from part (b) allocate the $300 to three clients using Shapley Value method. Cost allocated to client B Cost allocated to client B Cost allocated to client C Cost allocated to client C 3

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started