Answered step by step

Verified Expert Solution

Question

1 Approved Answer

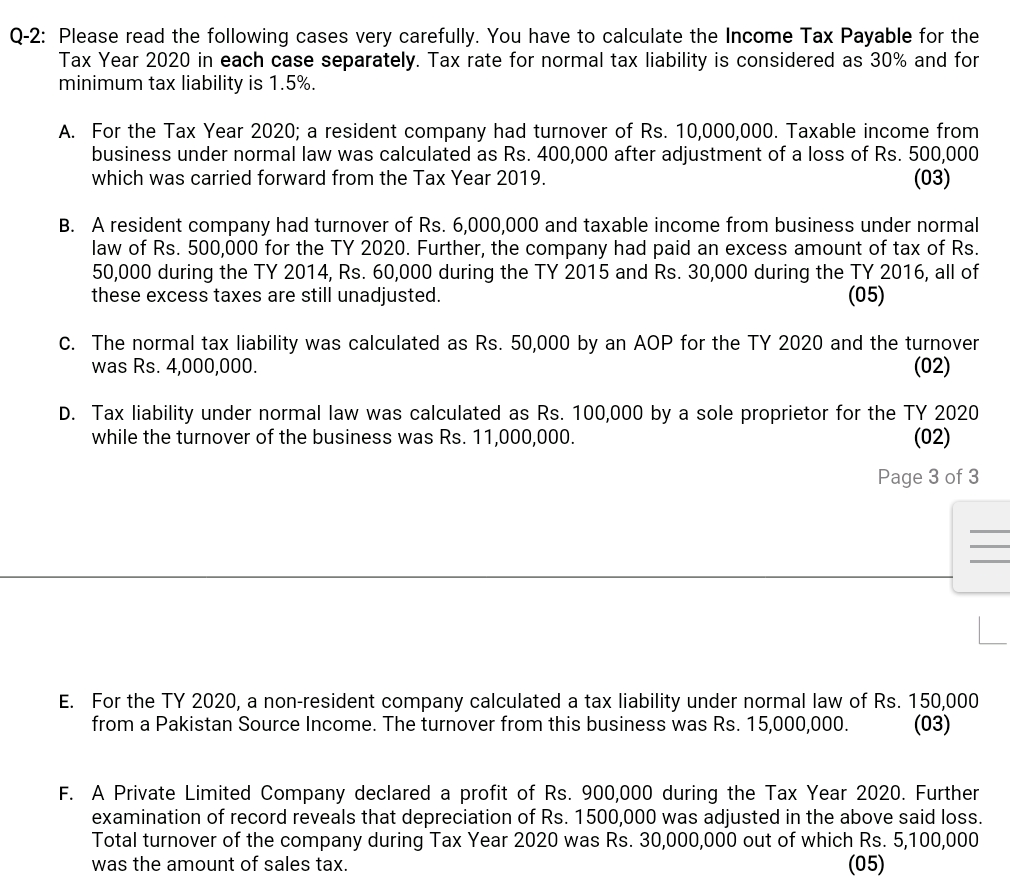

Q-2: Please read the following cases very carefully. You have to calculate the Income Tax Payable for the Tax Year 2020 in each case separately.

Q-2: Please read the following cases very carefully. You have to calculate the Income Tax Payable for the Tax Year 2020 in each case separately. Tax rate for normal tax liability is considered as 30% and for minimum tax liability is 1.5%. A. For the Tax Year 2020; a resident company had turnover of Rs. 10,000,000. Taxable income from business under normal law was calculated as Rs. 400,000 after adjustment of a loss of Rs. 500,000 which was carried forward from the Tax Year 2019. (03) B. A resident company had turnover of Rs. 6,000,000 and taxable income from business under normal law of Rs. 500,000 for the TY 2020. Further, the company had paid an excess amount of tax of Rs. 50,000 during the TY 2014, Rs. 60,000 during the TY 2015 and Rs. 30,000 during the TY 2016, all of these excess taxes are still unadjusted. (05) C. The normal tax liability was calculated as Rs. 50,000 by an AOP for the TY 2020 and the turnover was Rs. 4,000,000. (02) D. Tax liability under normal law was calculated as Rs. 100,000 by a sole proprietor for the TY 2020 while the turnover of the business was Rs. 11,000,000. (02) Page 3 of 3 E. For the TY 2020, a non-resident company calculated a tax liability under normal law of Rs. 150,000 from a Pakistan Source Income. The turnover from this business was Rs. 15,000,000. (03) F. A Private Limited Company declared a profit of Rs. 900,000 during the Tax Year 2020. Further examination of record reveals that depreciation of Rs. 1500,000 was adjusted in the above said loss. Total turnover of the company during Tax Year 2020 was Rs. 30,000,000 out of which Rs. 5,100,000 was the amount of sales tax. (05)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started