Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2 Q3 a. The expected payoff of Bank A. b. The expected payoff of Bank B. c. The standard deviation of the overall payoff of

Q2

Q3

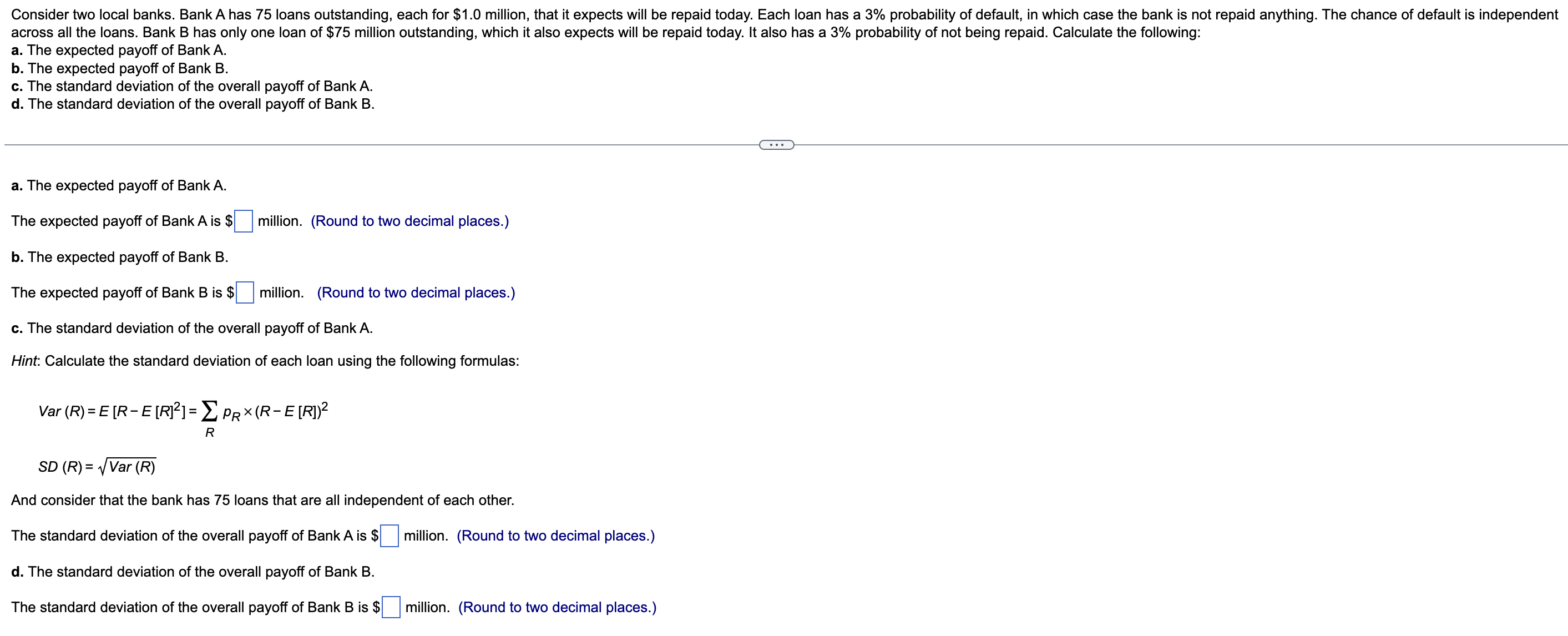

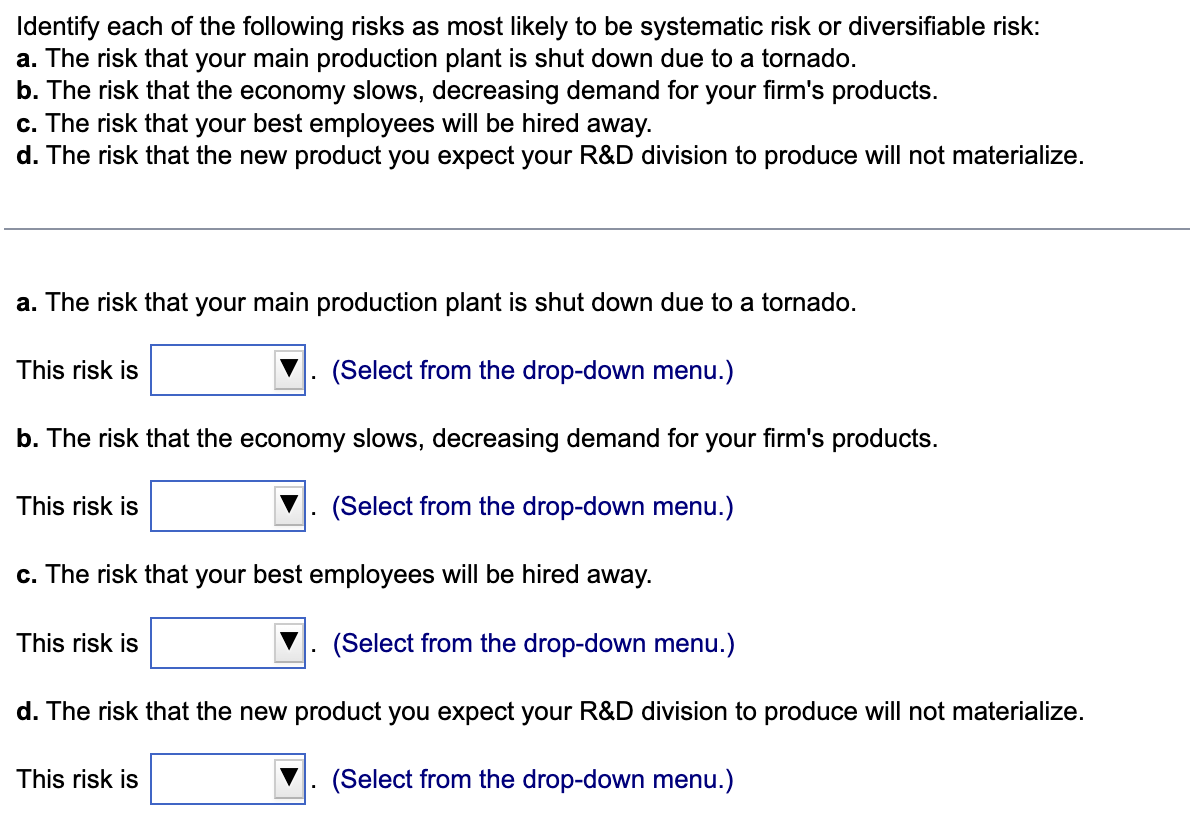

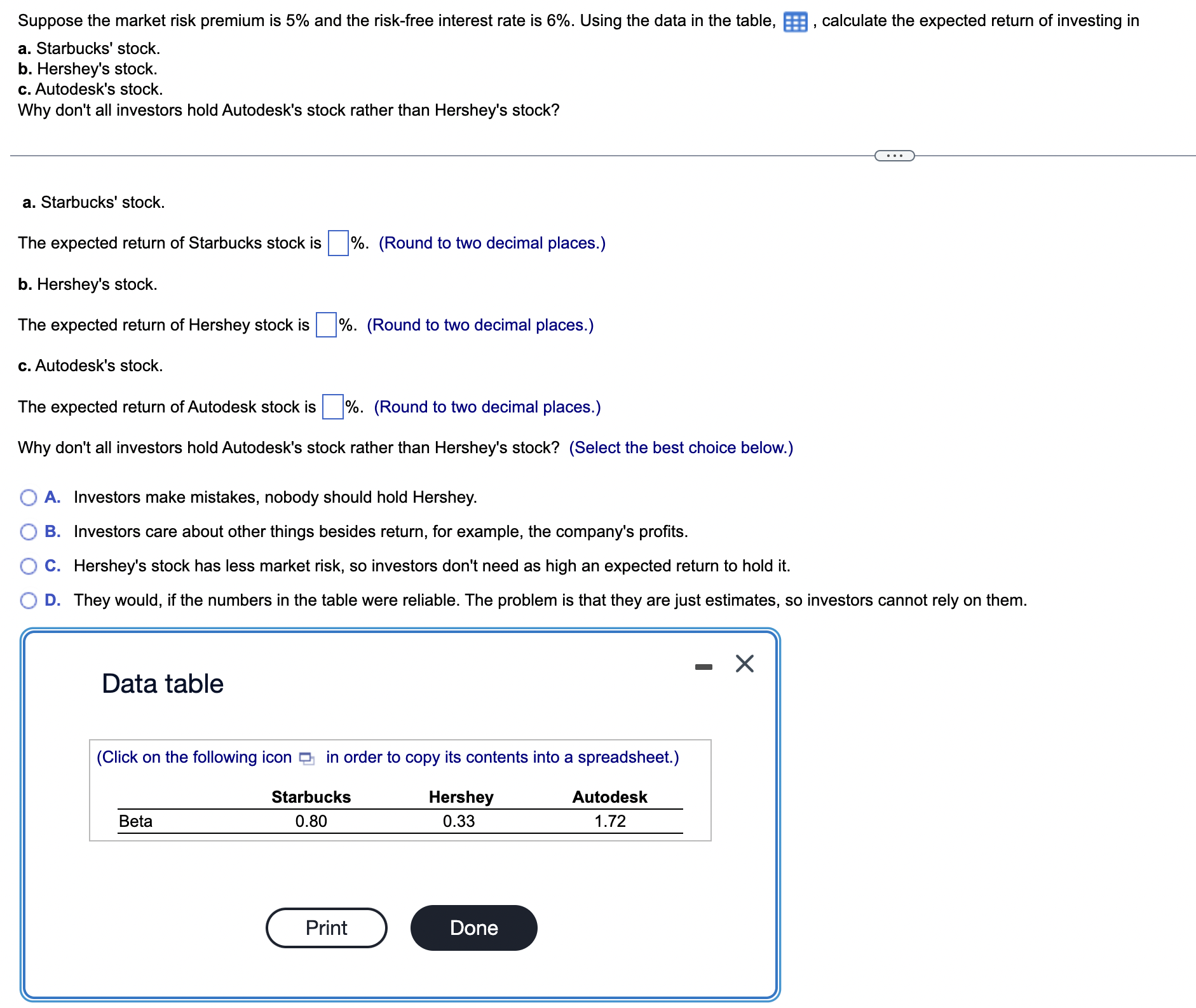

a. The expected payoff of Bank A. b. The expected payoff of Bank B. c. The standard deviation of the overall payoff of Bank A. d. The standard deviation of the overall payoff of Bank B. a. The expected payoff of Bank A. The expected payoff of Bank A is $ million. (Round to two decimal places.) b. The expected payoff of Bank B. The expected payoff of Bank B is $ million. (Round to two decimal places.) c. The standard deviation of the overall payoff of Bank A. Hint: Calculate the standard deviation of each loan using the following formulas: Var(R)=E[RE[R]2]=RpR(RE[R])2SD(R)=Var(R) And consider that the bank has 75 loans that are all independent of each other. The standard deviation of the overall payoff of Bank A is $ million. (Round to two decimal places.) d. The standard deviation of the overall payoff of Bank B. The standard deviation of the overall payoff of Bank B is $ million. (Round to two decimal places.) Identify each of the following risks as most likely to be systematic risk or diversifiable risk: a. The risk that your main production plant is shut down due to a tornado. b. The risk that the economy slows, decreasing demand for your firm's products. c. The risk that your best employees will be hired away. d. The risk that the new product you expect your R\&D division to produce will not materialize. a. The risk that your main production plant is shut down due to a tornado. This risk is (Select from the drop-down menu.) b. The risk that the economy slows, decreasing demand for your firm's products. This risk is (Select from the drop-down menu.) c. The risk that your best employees will be hired away. This risk is (Select from the drop-down menu.) d. The risk that the new product you expect your R\&D division to produce will not materialize. This risk is (Select from the drop-down menu.) Suppose the market risk premium is 5% and the risk-free interest rate is 6%. Using the data in the table, , calculate the expected return of investing in a. Starbucks' stock. b. Hershey's stock. c. Autodesk's stock. Why don't all investors hold Autodesk's stock rather than Hershey's stock? a. Starbucks' stock. The expected return of Starbucks stock is \%. (Round to two decimal places.) b. Hershey's stock. The expected return of Hershey stock is \%. (Round to two decimal places.) c. Autodesk's stock. The expected return of Autodesk stock is \%. (Round to two decimal places.) Why don't all investors hold Autodesk's stock rather than Hershey's stock? (Select the best choice below.) A. Investors make mistakes, nobody should hold Hershey. B. Investors care about other things besides return, for example, the company's profits. C. Hershey's stock has less market risk, so investors don't need as high an expected return to hold it. D. They would, if the numbers in the table were reliable. The problem is that they are just estimates, so investors cannot rely on them. Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

a. The expected payoff of Bank A. b. The expected payoff of Bank B. c. The standard deviation of the overall payoff of Bank A. d. The standard deviation of the overall payoff of Bank B. a. The expected payoff of Bank A. The expected payoff of Bank A is $ million. (Round to two decimal places.) b. The expected payoff of Bank B. The expected payoff of Bank B is $ million. (Round to two decimal places.) c. The standard deviation of the overall payoff of Bank A. Hint: Calculate the standard deviation of each loan using the following formulas: Var(R)=E[RE[R]2]=RpR(RE[R])2SD(R)=Var(R) And consider that the bank has 75 loans that are all independent of each other. The standard deviation of the overall payoff of Bank A is $ million. (Round to two decimal places.) d. The standard deviation of the overall payoff of Bank B. The standard deviation of the overall payoff of Bank B is $ million. (Round to two decimal places.) Identify each of the following risks as most likely to be systematic risk or diversifiable risk: a. The risk that your main production plant is shut down due to a tornado. b. The risk that the economy slows, decreasing demand for your firm's products. c. The risk that your best employees will be hired away. d. The risk that the new product you expect your R\&D division to produce will not materialize. a. The risk that your main production plant is shut down due to a tornado. This risk is (Select from the drop-down menu.) b. The risk that the economy slows, decreasing demand for your firm's products. This risk is (Select from the drop-down menu.) c. The risk that your best employees will be hired away. This risk is (Select from the drop-down menu.) d. The risk that the new product you expect your R\&D division to produce will not materialize. This risk is (Select from the drop-down menu.) Suppose the market risk premium is 5% and the risk-free interest rate is 6%. Using the data in the table, , calculate the expected return of investing in a. Starbucks' stock. b. Hershey's stock. c. Autodesk's stock. Why don't all investors hold Autodesk's stock rather than Hershey's stock? a. Starbucks' stock. The expected return of Starbucks stock is \%. (Round to two decimal places.) b. Hershey's stock. The expected return of Hershey stock is \%. (Round to two decimal places.) c. Autodesk's stock. The expected return of Autodesk stock is \%. (Round to two decimal places.) Why don't all investors hold Autodesk's stock rather than Hershey's stock? (Select the best choice below.) A. Investors make mistakes, nobody should hold Hershey. B. Investors care about other things besides return, for example, the company's profits. C. Hershey's stock has less market risk, so investors don't need as high an expected return to hold it. D. They would, if the numbers in the table were reliable. The problem is that they are just estimates, so investors cannot rely on them. Data table (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started