Answered step by step

Verified Expert Solution

Question

1 Approved Answer

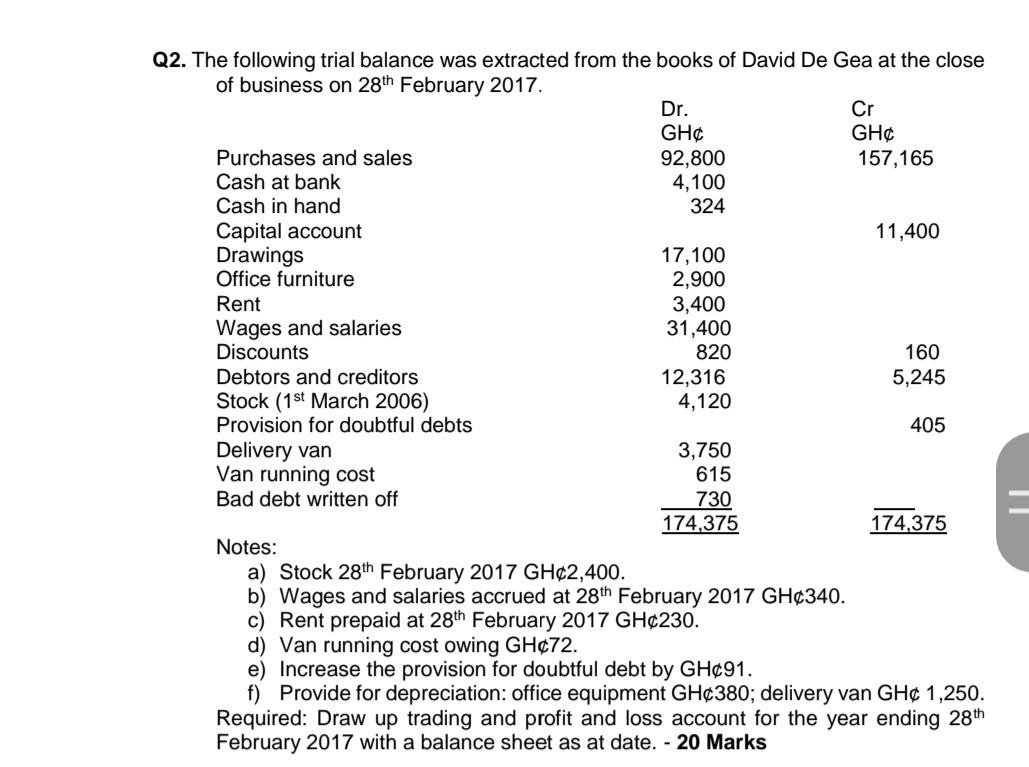

Q2. The following trial balance was extracted from the books of David De Gea at the close of business on 28th February 2017. Dr. Cr

Q2. The following trial balance was extracted from the books of David De Gea at the close of business on 28th February 2017. Dr. Cr GH GH Purchases and sales 92,800 157,165 Cash at bank 4,100 Cash in hand 324 Capital account 11,400 Drawings 17,100 Office furniture 2,900 Rent 3,400 Wages and salaries 31,400 Discounts 820 160 Debtors and creditors 12,316 5,245 Stock (1st March 2006) 4,120 Provision for doubtful debts 405 Delivery van 3,750 Van running cost 615 Bad debt written off 730 174,375 174,375 Notes: a) Stock 28th February 2017 GH2,400. b) Wages and salaries accrued at 28th February 2017 GH340. c) Rent prepaid at 28th February 2017 GH230. d) Van running cost owing GH72. e) Increase the provision for doubtful debt by GH91. f) Provide for depreciation: office equipment GH380; delivery van GH 1,250. Required: Draw up trading and profit and loss account for the year ending 28th February 2017 with a balance sheet as at date. - 20 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started