Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2: What is the required annual lease payment (including executory costs) to be paid by Chestnut Hill to Plymouth Finance? A. 35,591 B. 36,046 C.

Q2: What is the required annual lease payment (including executory costs) to be paid by Chestnut Hill to Plymouth Finance?

Q2: What is the required annual lease payment (including executory costs) to be paid by Chestnut Hill to Plymouth Finance?

A. 35,591

B. 36,046

C. 38,591

D. 39,046

Q3: What is the prevent value of the guaranteed residual value included in Plymouth Finance Company's lease receivable at the inception of the lease?

A. 5,946

B. 1,486

C. 7,432

D. 1,542

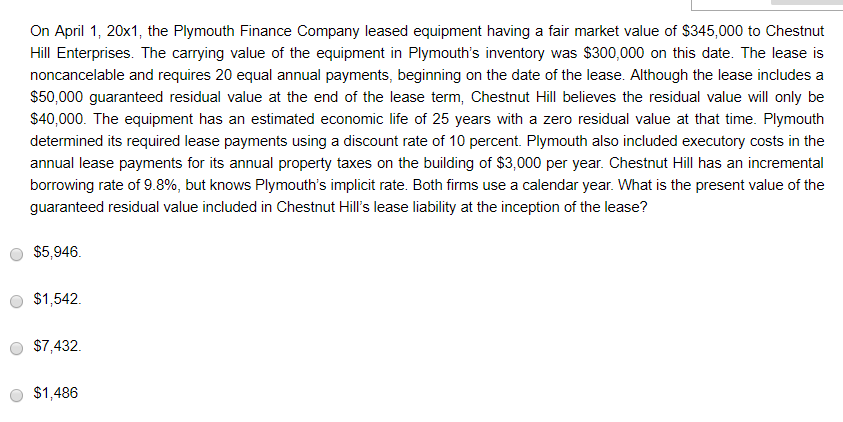

On April 1, 20x1, the Plymouth Finance Company leased equipment having a fair market value of $345,000 to Chestnut Hill Enterprises. The carrying value of the equipment in Plymouth's inventory was $300,000 on this date. The lease is noncancelable and requires 20 equal annual payments, beginning on the date of the lease. Although the lease includes a $50,000 guaranteed residual value at the end of the lease term, Chestnut Hill believes the residual value will only be $40,000. The equipment has an estimated economic life of 25 years with a zero residual value at that time. Plymouth determined its required lease payments using a discount rate of 10 percent. Plymouth also included executory costs in the annual lease payments for its annual property taxes on the building of $3,000 per year. Chestnut Hill has an incremental borrowing rate of 9.8%, but knows Plymouth's implicit rate. Both firms use a calendar year. What is the present value of the guaranteed residual value included in Chestnut Hill's lease liability at the inception of the lease? $5,946. $1,542 $7,432 $1,486Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started