Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The

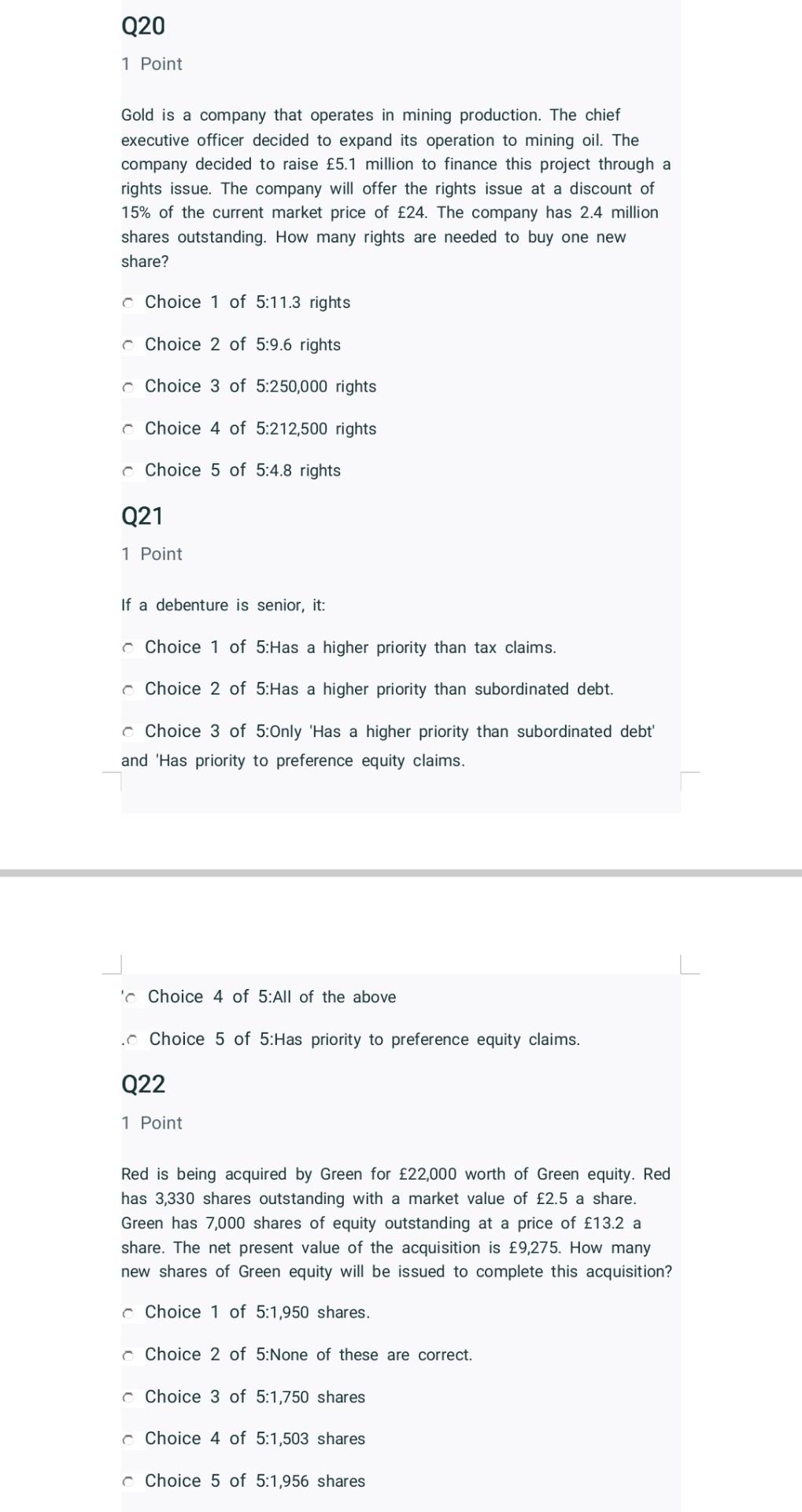

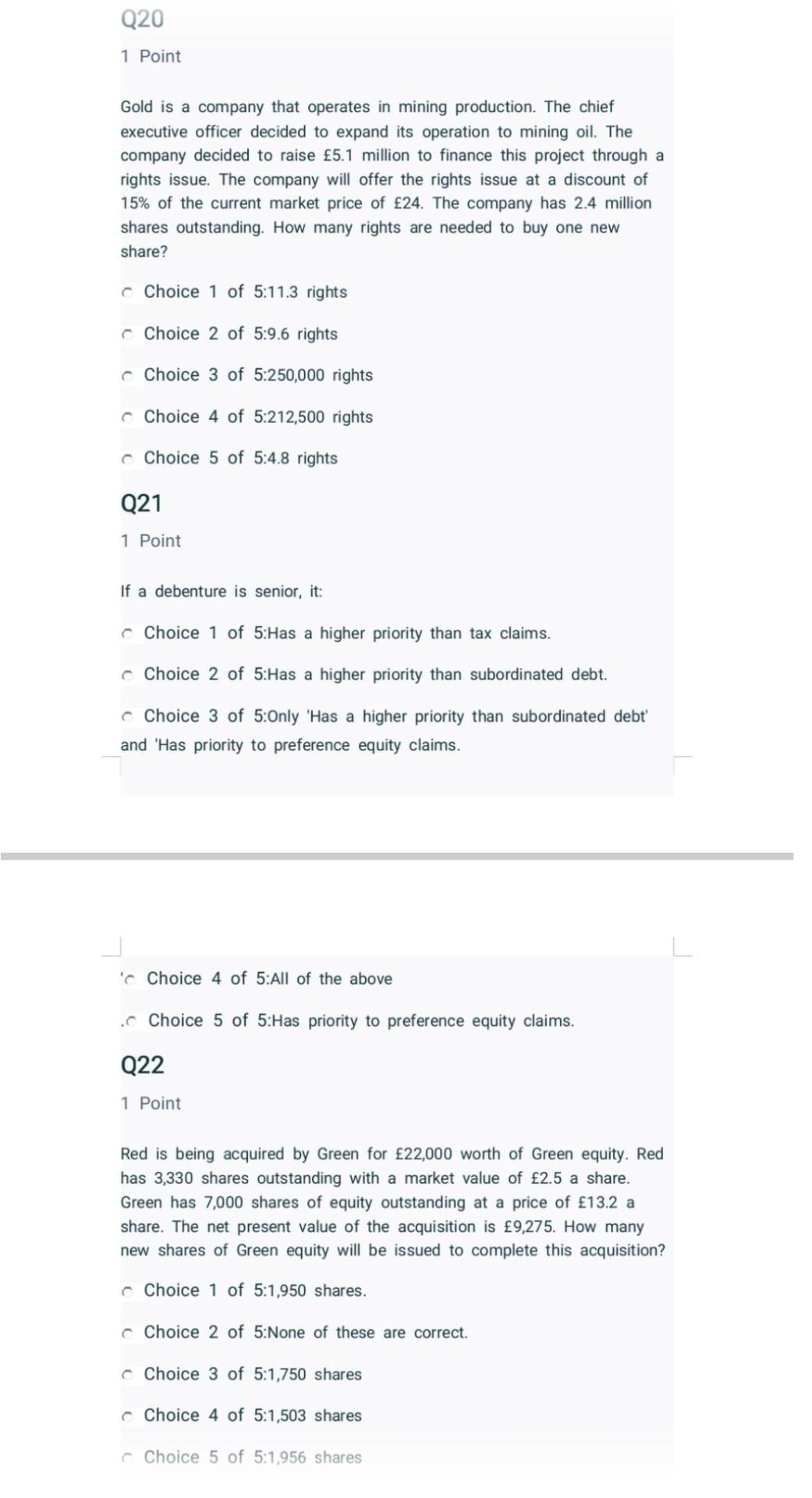

Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The company decided to raise 5.1 million to finance this project through a rights issue. The company will offer the rights issue at a discount of 15% of the current market price of 24. The company has 2.4 million shares outstanding. How many rights are needed to buy one new share? Choice 1 of 5:11.3 rights Choice 2 of 5:9.6 rights Choice 3 of 5:250,000 rights Choice 4 of 5:212,500 rights Choice 5 of 5:4.8 rights Q21 1 Point If a debenture is senior, it: Choice 1 of 5:Has a higher priority than tax claims. Choice 2 of 5:Has a higher priority than subordinated debt. Choice 3 of 5:Only 'Has a higher priority than subordinated debt' and 'Has priority to preference equity claims. ' Choice 4 of 5:All of the above . Choice 5 of 5:Has priority to preference equity claims. Q22 1 Point Red is being acquired by Green for 22,000 worth of Green equity. Red has 3,330 shares outstanding with a market value of 2.5 a share. Green has 7,000 shares of equity outstanding at a price of 13.2 a share. The net present value of the acquisition is 9,275. How many new shares of Green equity will be issued to complete this acquisition? Choice 1 of 5:1,950 shares. Choice 2 of 5:None of these are correct. Choice 3 of 5:1,750 shares Choice 4 of 5:1,503 shares Choice 5 of 5:1,956 shares Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The company decided to raise 5.1 million to finance this project through a rights issue. The company will offer the rights issue at a discount of 15% of the current market price of 24. The company has 2.4 million shares outstanding. How many rights are needed to buy one new share? Choice 1 of 5:11.3 rights c Choice 2 of 5:9.6 rights c Choice 3 of 5:250,000 rights Choice 4 of 5:212,500 rights c Choice 5 of 5:4.8 rights Q21 1 Point If a debenture is senior, it: c Choice 1 of 5:Has a higher priority than tax claims. Choice 2 of 5:Has a higher priority than subordinated debt. Choice 3 of 5:Only 'Has a higher priority than subordinated debt' and 'Has priority to preference equity claims. ' Choice 4 of 5:All of the above . Choice 5 of 5:Has priority to preference equity claims. Q22 1 Point Red is being acquired by Green for 22,000 worth of Green equity. Red has 3,330 shares outstanding with a market value of 2.5 a share. Green has 7,000 shares of equity outstanding at a price of 13.2 a share. The net present value of the acquisition is 9,275. How many new shares of Green equity will be issued to complete this acquisition? Choice 1 of 5:1,950 shares. Choice 2 of 5:None of these are correct. Choice 3 of 5:1,750 shares Choice 4 of 5:1,503 shares Choice 5 of 5:1,956 shares Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The company decided to raise 5.1 million to finance this project through a rights issue. The company will offer the rights issue at a discount of 15% of the current market price of 24. The company has 2.4 million shares outstanding. How many rights are needed to buy one new share? Choice 1 of 5:11.3 rights Choice 2 of 5:9.6 rights Choice 3 of 5:250,000 rights Choice 4 of 5:212,500 rights Choice 5 of 5:4.8 rights Q21 1 Point If a debenture is senior, it: Choice 1 of 5:Has a higher priority than tax claims. Choice 2 of 5:Has a higher priority than subordinated debt. Choice 3 of 5:Only 'Has a higher priority than subordinated debt' and 'Has priority to preference equity claims. ' Choice 4 of 5:All of the above . Choice 5 of 5:Has priority to preference equity claims. Q22 1 Point Red is being acquired by Green for 22,000 worth of Green equity. Red has 3,330 shares outstanding with a market value of 2.5 a share. Green has 7,000 shares of equity outstanding at a price of 13.2 a share. The net present value of the acquisition is 9,275. How many new shares of Green equity will be issued to complete this acquisition? Choice 1 of 5:1,950 shares. Choice 2 of 5:None of these are correct. Choice 3 of 5:1,750 shares Choice 4 of 5:1,503 shares Choice 5 of 5:1,956 shares Q20 1 Point Gold is a company that operates in mining production. The chief executive officer decided to expand its operation to mining oil. The company decided to raise 5.1 million to finance this project through a rights issue. The company will offer the rights issue at a discount of 15% of the current market price of 24. The company has 2.4 million shares outstanding. How many rights are needed to buy one new share? Choice 1 of 5:11.3 rights c Choice 2 of 5:9.6 rights c Choice 3 of 5:250,000 rights Choice 4 of 5:212,500 rights c Choice 5 of 5:4.8 rights Q21 1 Point If a debenture is senior, it: c Choice 1 of 5:Has a higher priority than tax claims. Choice 2 of 5:Has a higher priority than subordinated debt. Choice 3 of 5:Only 'Has a higher priority than subordinated debt' and 'Has priority to preference equity claims. ' Choice 4 of 5:All of the above . Choice 5 of 5:Has priority to preference equity claims. Q22 1 Point Red is being acquired by Green for 22,000 worth of Green equity. Red has 3,330 shares outstanding with a market value of 2.5 a share. Green has 7,000 shares of equity outstanding at a price of 13.2 a share. The net present value of the acquisition is 9,275. How many new shares of Green equity will be issued to complete this acquisition? Choice 1 of 5:1,950 shares. Choice 2 of 5:None of these are correct. Choice 3 of 5:1,750 shares Choice 4 of 5:1,503 shares Choice 5 of 5:1,956 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started