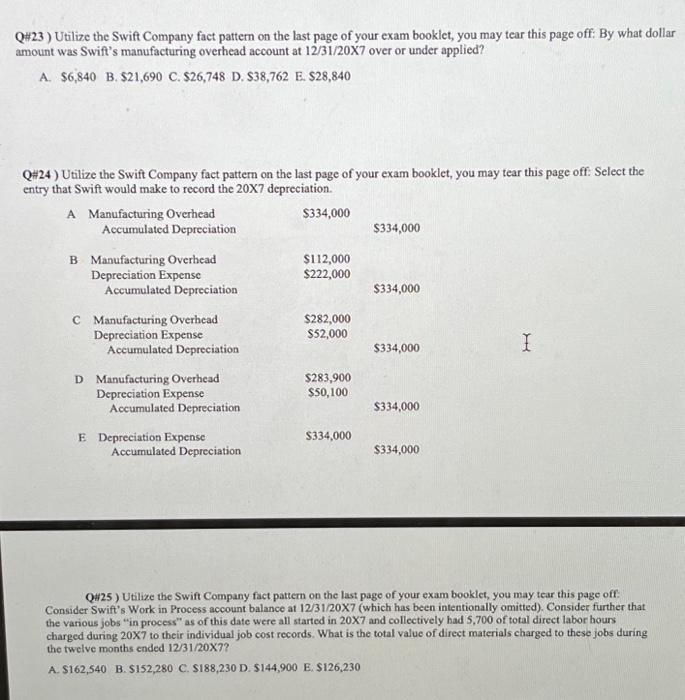

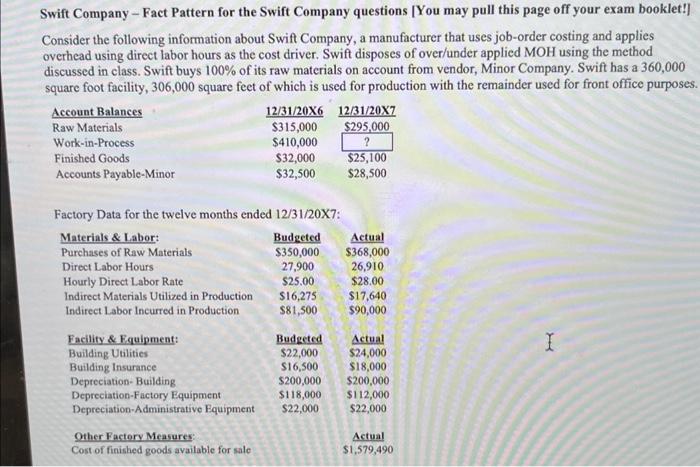

Q\#23) Utilize the Swift Company fact pattem on the last page of your exam booklet, you may tear this page off: By what dollar amount was Swift's manufacturing overhead account at 12/31/20X7 over or under applied? A. $6,840 B. $21,690 C. $26,748 D. $38,762 E. $28,840 Q=24) Utilize the Swift Company fact pattern on the last page of your exam booklet, you may tear this page off: Select the entry that Swit would make to record the 20X7 depreciation. QH25) Utilize the Swift Company fact pattern on the last page of your exam booklet, you may tear this page off. Consider Swift's Work in Process account balance at 12/31/20X7 (which has been intentionally omitted). Consider further that the various jobs "in process" as of this date were all started in 20X7 and collectively had 5,700 of total direct labor hours charged during 20X7 to their individual job cost records. What is the total value of direct materials charged to these jobs during the twelve months ended 12/31/207 ? A. $162,540 B. $152,280 C. $188,230 D. $144,900 E. $126,230 Swift Company - Fact Pattern for the Swift Company questions [You may pull this page off your exam booklet!] Consider the following information about Swift Company, a manufacturer that uses job-order costing and applies overhead using direct labor hours as the cost driver. Swift disposes of over/under applied MOH using the method discussed in class. Swift buys 100\% of its raw materials on account from vendor, Minor Company. Swift has a 360,000 square foot facility, 306,000 square feet of which is used for production with the remainder used for front office purposes. Factory Data for the twelve months ended 12/31/20X7 : Q\#23) Utilize the Swift Company fact pattem on the last page of your exam booklet, you may tear this page off: By what dollar amount was Swift's manufacturing overhead account at 12/31/20X7 over or under applied? A. $6,840 B. $21,690 C. $26,748 D. $38,762 E. $28,840 Q=24) Utilize the Swift Company fact pattern on the last page of your exam booklet, you may tear this page off: Select the entry that Swit would make to record the 20X7 depreciation. QH25) Utilize the Swift Company fact pattern on the last page of your exam booklet, you may tear this page off. Consider Swift's Work in Process account balance at 12/31/20X7 (which has been intentionally omitted). Consider further that the various jobs "in process" as of this date were all started in 20X7 and collectively had 5,700 of total direct labor hours charged during 20X7 to their individual job cost records. What is the total value of direct materials charged to these jobs during the twelve months ended 12/31/207 ? A. $162,540 B. $152,280 C. $188,230 D. $144,900 E. $126,230 Swift Company - Fact Pattern for the Swift Company questions [You may pull this page off your exam booklet!] Consider the following information about Swift Company, a manufacturer that uses job-order costing and applies overhead using direct labor hours as the cost driver. Swift disposes of over/under applied MOH using the method discussed in class. Swift buys 100\% of its raw materials on account from vendor, Minor Company. Swift has a 360,000 square foot facility, 306,000 square feet of which is used for production with the remainder used for front office purposes. Factory Data for the twelve months ended 12/31/20X7