Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2,3,4,5 FIRE 371 Or d $30 mi net fixed assets. It has sales of $35mi, costs m, depreciation expense of $2.5mi.. interest expense of $750,000,

Q2,3,4,5

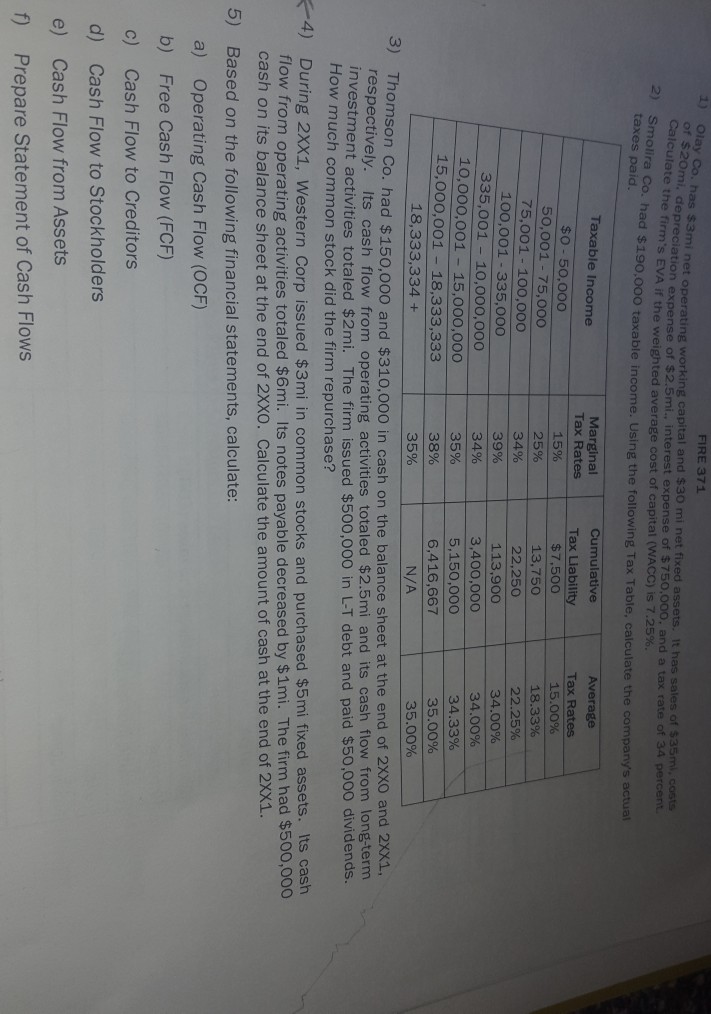

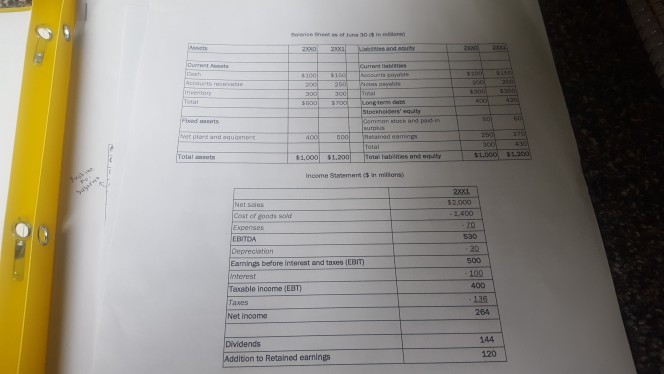

FIRE 371 Or d $30 mi net fixed assets. It has sales of $35mi, costs m, depreciation expense of $2.5mi.. interest expense of $750,000, and a tax rate of 34 percent culate the firm's EVA if the weighted average cost of capital (WACC) IS 7.25 molra Co. had $190,000 taxable income. Using the following Tax Table, calculate the company Marginal Cumulative Taxable Income RatesTax Liability Tax Rates $O-50,000 50,001 - 75,000 75,001- 100,000 100,001-335,o00 335,001 10,000,000 10,000,001 15,000,00o 15,000,001 18,333,333 1 + $7.500 13,750 22,250 113,900o 3,400,000 5,150,000 6,416,667 15% 25% 15.00% 18.33% 22.25% 34.00% 39% 34% 34.00% 34.33% 35.00% 35.00% 38% 8.333,334 3) T homson Co. had $150,000 and $310,000 in cash on the balance sheet at the end of 2xx0 and 2XX1, respectively. Its cash flow from operating activities totaled $2.5mi and its cash flow from long-term investment activities totaled $2mi. The firm issued $500,000 in L-T debt and paid $50,000 dividends. How much common stock did the firm repurchase? 4) During 2XX1, Western Corp issued $3mi in common stocks and purchased $5mi fixed assets. Its cash flow from operating activities totaled $6mi. Its notes payable decreased by $1mi. The firm had $500,000 cash on its balance sheet at the end of 2XXO. Calculate the amount of cash at the end of 2XX1. Based on the following financial statements, calculate: a) Operating Cash Flow (OCF) b) Free Cash Flow (FCF) c) Cash Flow to Creditors 5) d) e) f) Cash Flow to Stockholders Cash Flow from Assets Prepare Statement of Cash FlowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started