Q27

***READ And follow all directions***

Please answer questions with the answers and put the answers in the picture where they belong

Answers only

Please dont make it confusing

Please be clear

Please write or type neatly

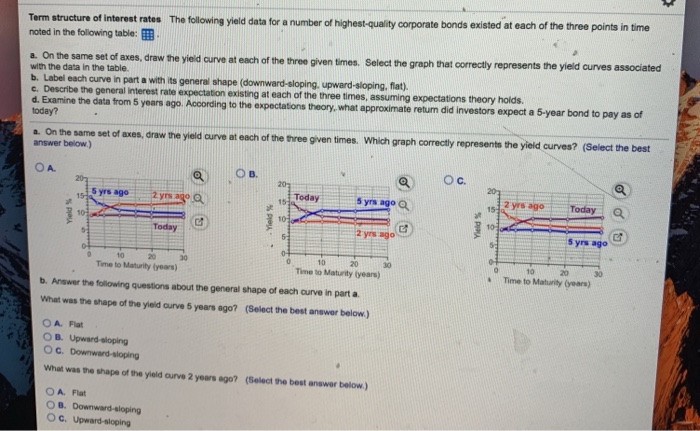

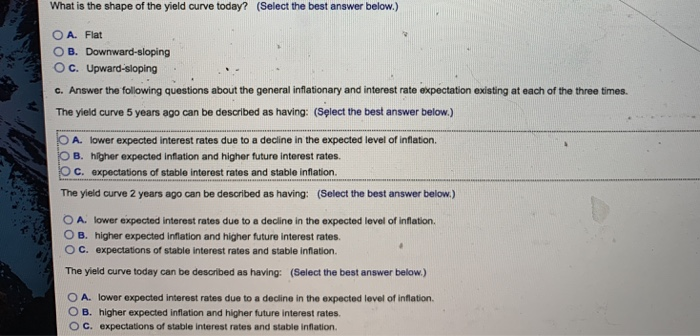

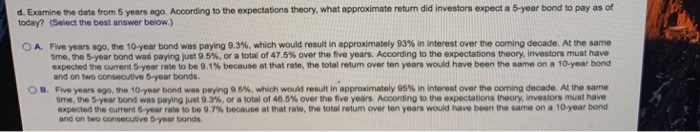

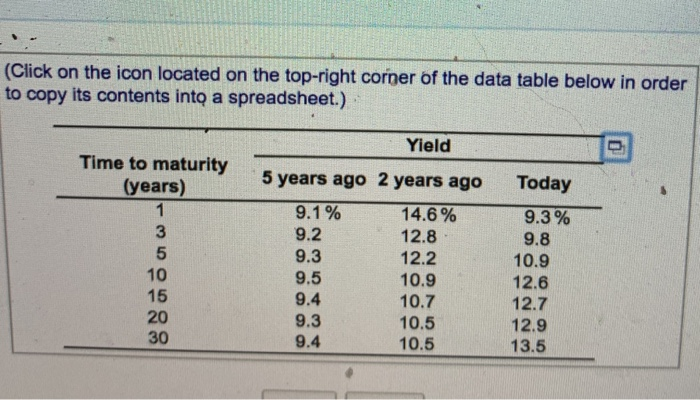

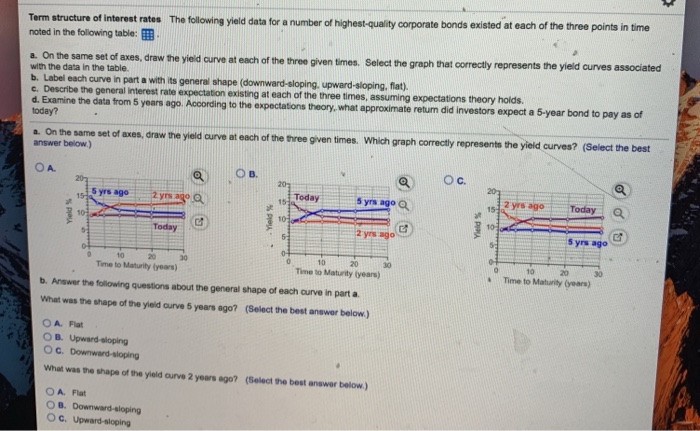

Term structure of interest rates The following yieild data for a number of highest-quality corporate bonds existed noted in the following table: E3 at each of the three points in time a. On the same set of axes, draw the yield curve at each of the three given times. on the se s o es, craw he yieid curve at each of the hree oven tmes. Select the graph that correcty represents the yieid curves associated with the data in the table b. Label each curve in part a with its general shape (downward-sloping, upward-sloping, flat) e. Describe the general Interest rate expectation existing at each of the three times, assuming expectations theory holds d. Examine the data from 5 years ago. According to the expectations theory, what approximate retum did investors expect a 5-year bond to pay as of today? a. On the same set of axes, answer below) draw the yield curve at each of the three given times. Which graph correctly represents the yield curves? (Select the best OA 5 yrs ago 2yrs ago s Today5yrs ago 152 yrs ago Today o 2 yrs ago 5 yrs ago 10 20 Time to Maturity (years) 30 10 20 30 10 20 Time to Maturity (years) 30 Time to Maturity (years) b. Answer the following questions about the general shape of each curve in part a What was the shape of the yieid curve 5 years ago? (Select the best answer below) , Fiat OB, Upward loping OC. Downward-sloping What was the shape of the yield ourve 2 years ago? (Select the best answer below.) O A. Flat What is the shape of the yield curve today? (Select the best answer below.) OA. Flat O B. Downward-sloping Oc. Upward-sloping C. Answer the following questions about the general inflationary and interest rate expectation existing at each of the three times. The yield curve 5 years ago can be described as having: (Select the best answer below.) A. lower expected interest rates due to a decline in the expected level of inflaton. O B. higher expected inflation and higher future interest rates OC. expectations of stable interest rates and stable inflation. The yield curve 2 years ago can be described as having: (Select the best answer below.) O A. lower expected interest rates due to a decline in the expected level of inflation. OB. higher expected infation and higher future interest rates O c. expectations of stable interest rates and stable infiation. The yield curve today can be described as having: (Select the best answer below.) O A. lower expected interest rates due to a decline in the expected level of inflation. O B. higher expected inflation and higher future interest rates. O C. expectations of stable interest rates and stable inflation. d. Examine the data from 5 years ago. Acoording to the expectations theory, what approximate return did investors expect a 5-year bond to pay as of today? (Select the best answer below.) paying 9.3%, which would result in approximately 83% in interest over the coming decade. At the same sme, the 5-year bond was paying st 9.5% or a total of 47.5% over the fie years. Accoring to the expectations theory, investors must have expected the current 5 year rate to bo 9.1% because at that rate, the total return over ten years would have been re same on a 10-year bond A. Five years ago, the 10-year bond was and on two consecutive S-year bonds. Fivo years agothe 10-year bond was paying 95%, which would result in approximataly 95% in interest over the coming decade. Atthe same time the 5-year bond was paying ust 9 3% or a total of 465% over the nve years. Aco ing to the expectations n eory investors st have expected tho orrem 5-year rate to be 97% because at that rate, the total return over ten years would have been he same on a 10-year bond . and on two consecutive 5-year bonds (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Yield Time to maturity (years) 1 3 5 10 15 20 30 5 years ago 2 years ago Today 9.1% 9.2 9.3 9.5 9.4 9.3 9.4 14.6% 12.8 12.2 10.9 10.7 10.5 10.5 9.3% 9.8 10.9 12.6 12.7 12.9 13.5