Q28

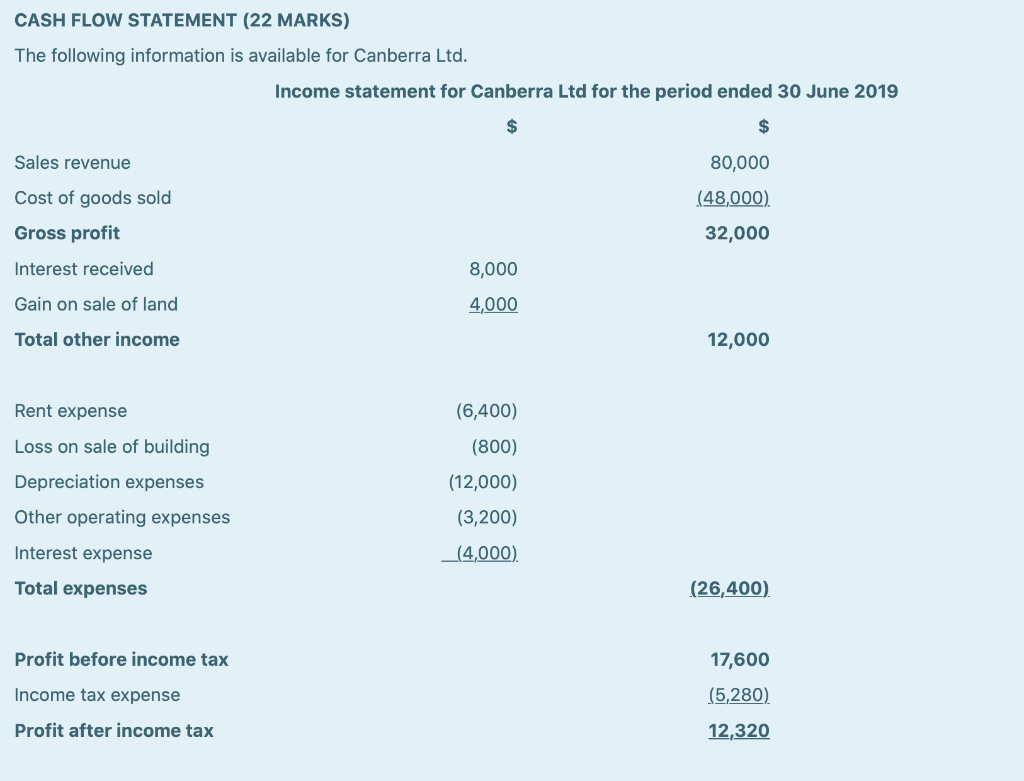

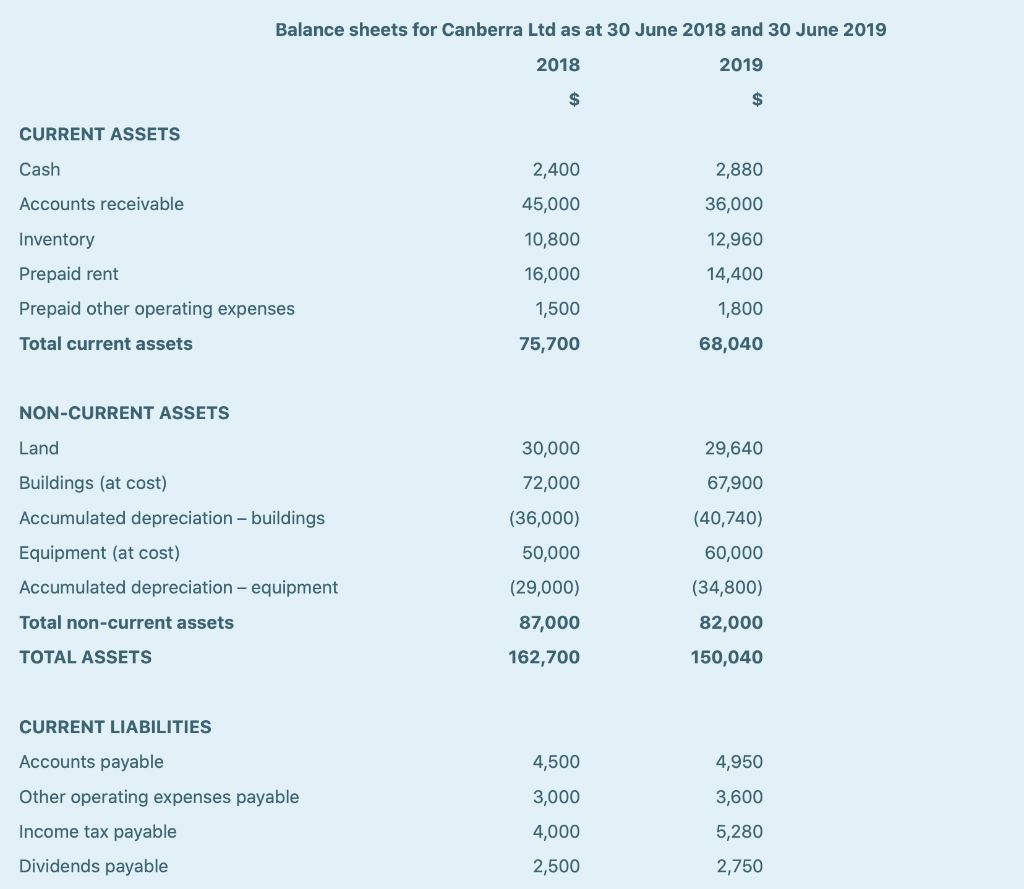

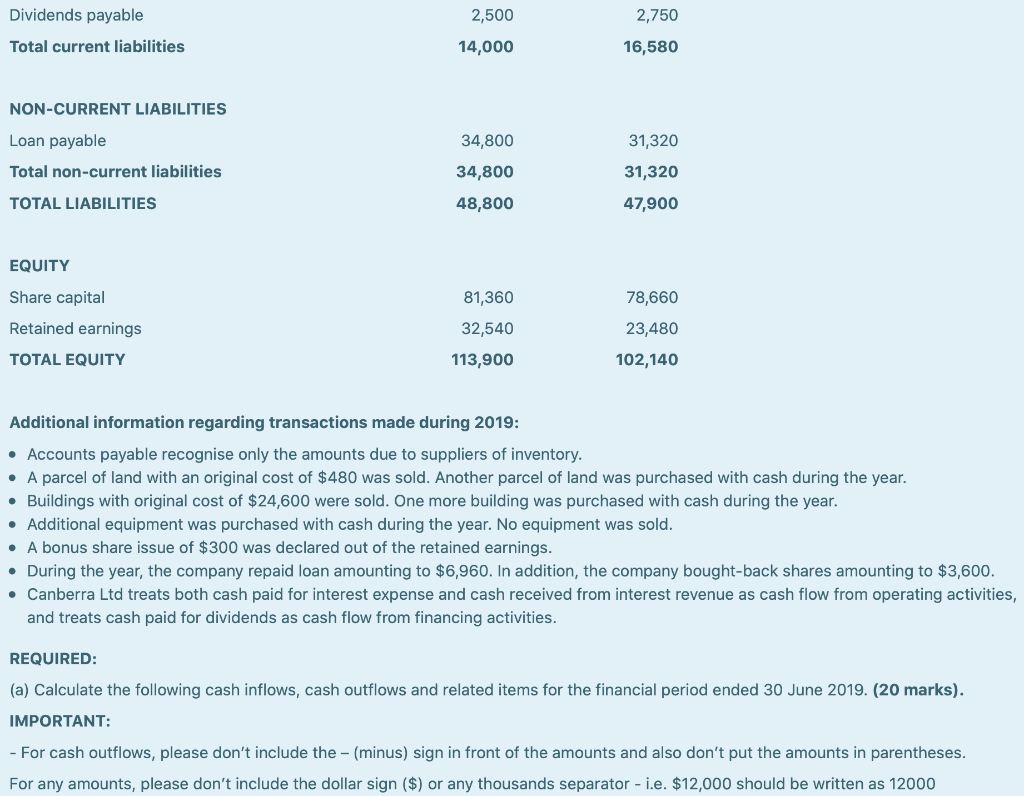

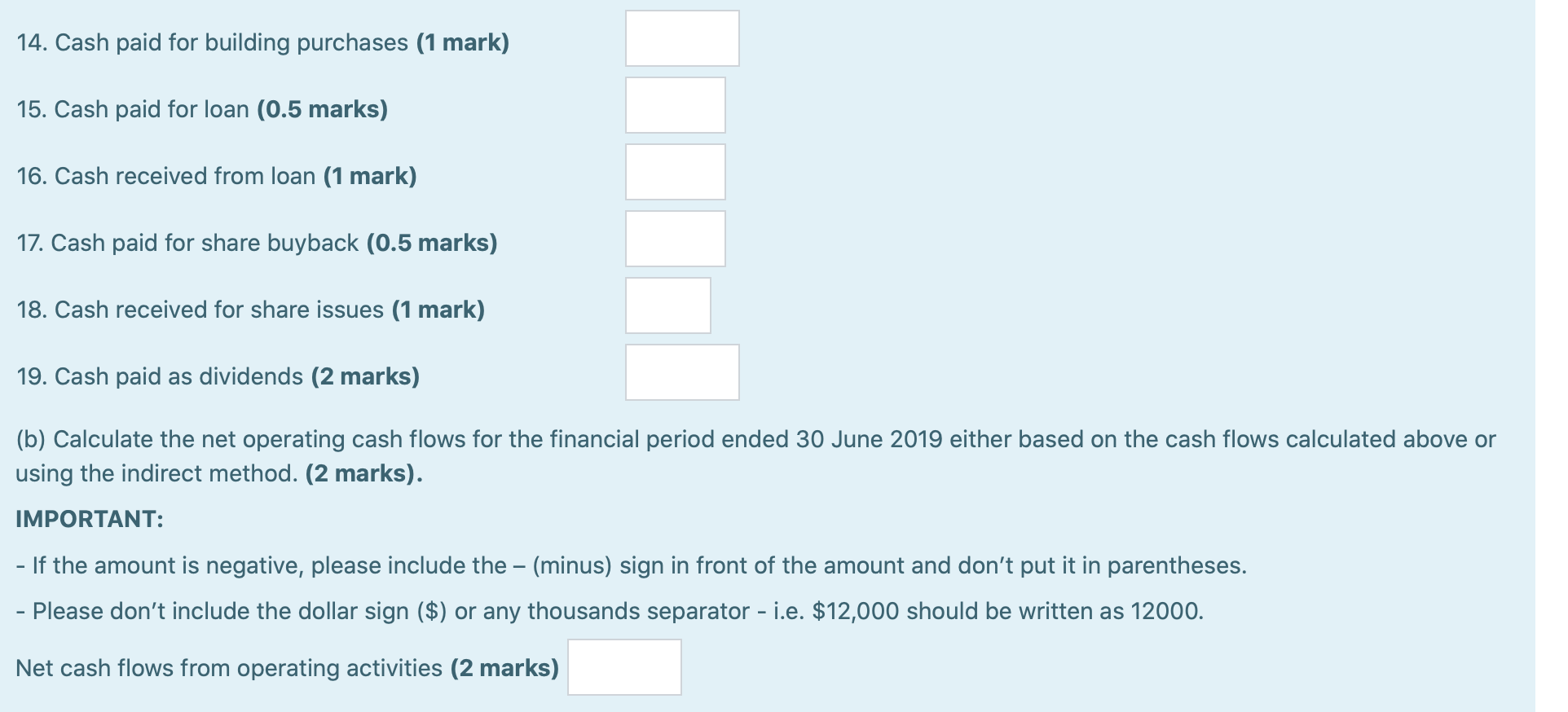

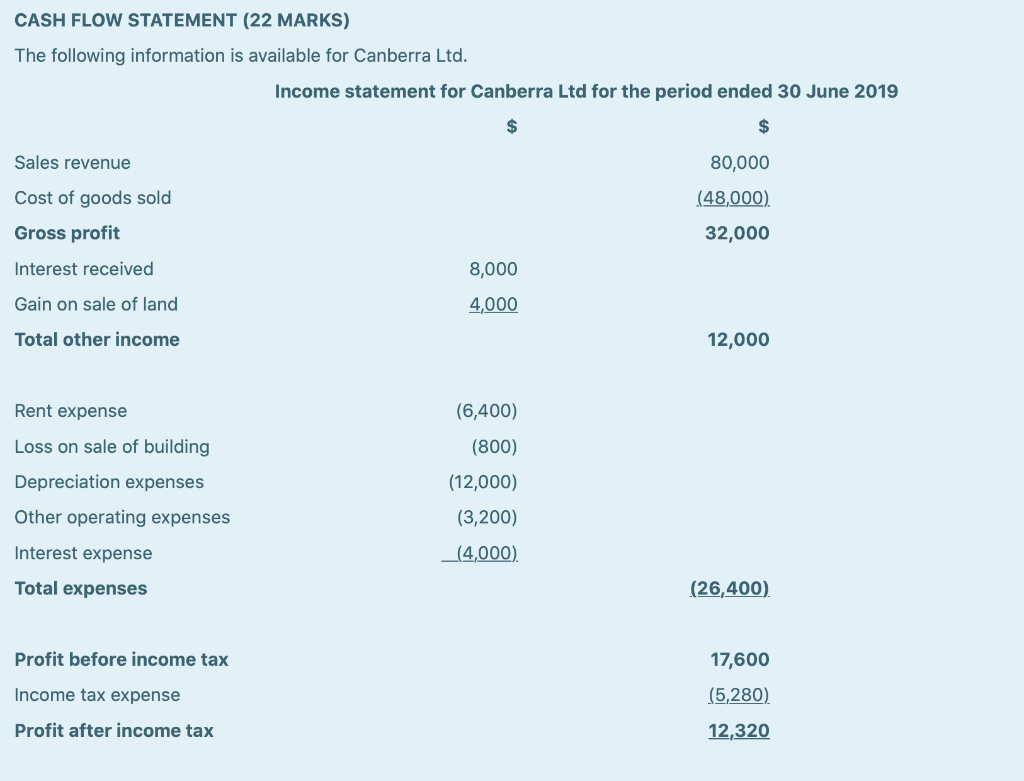

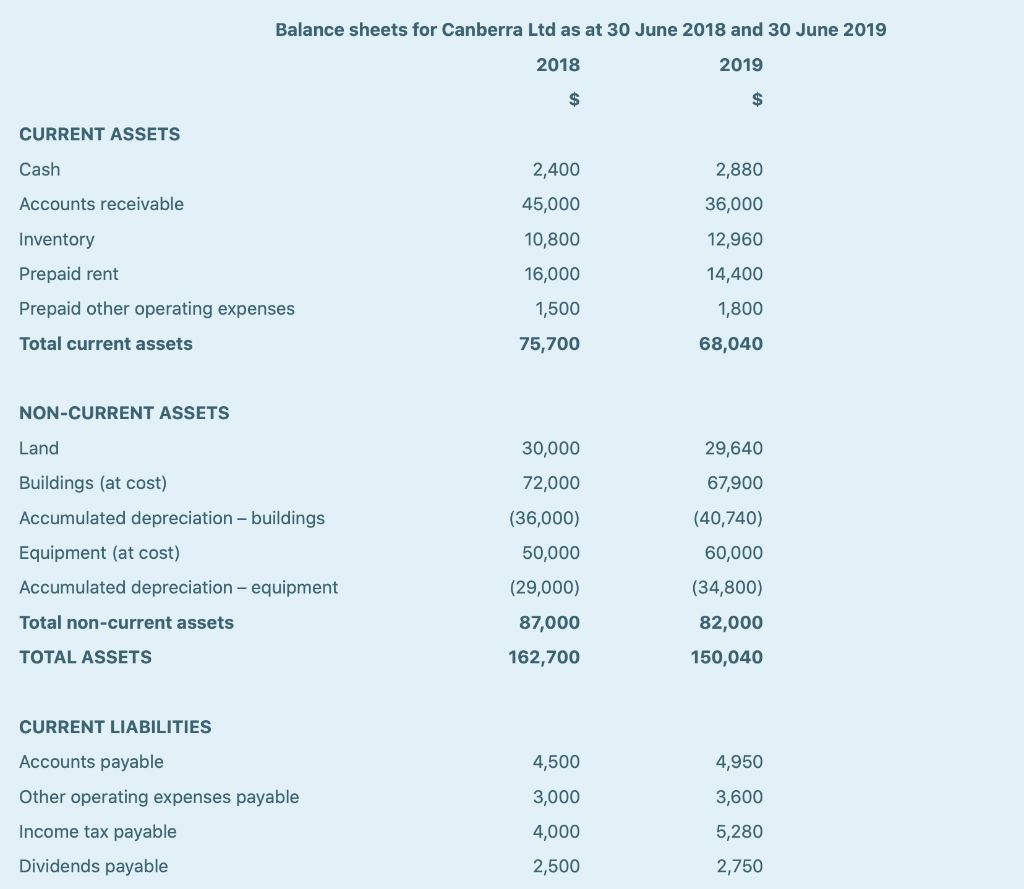

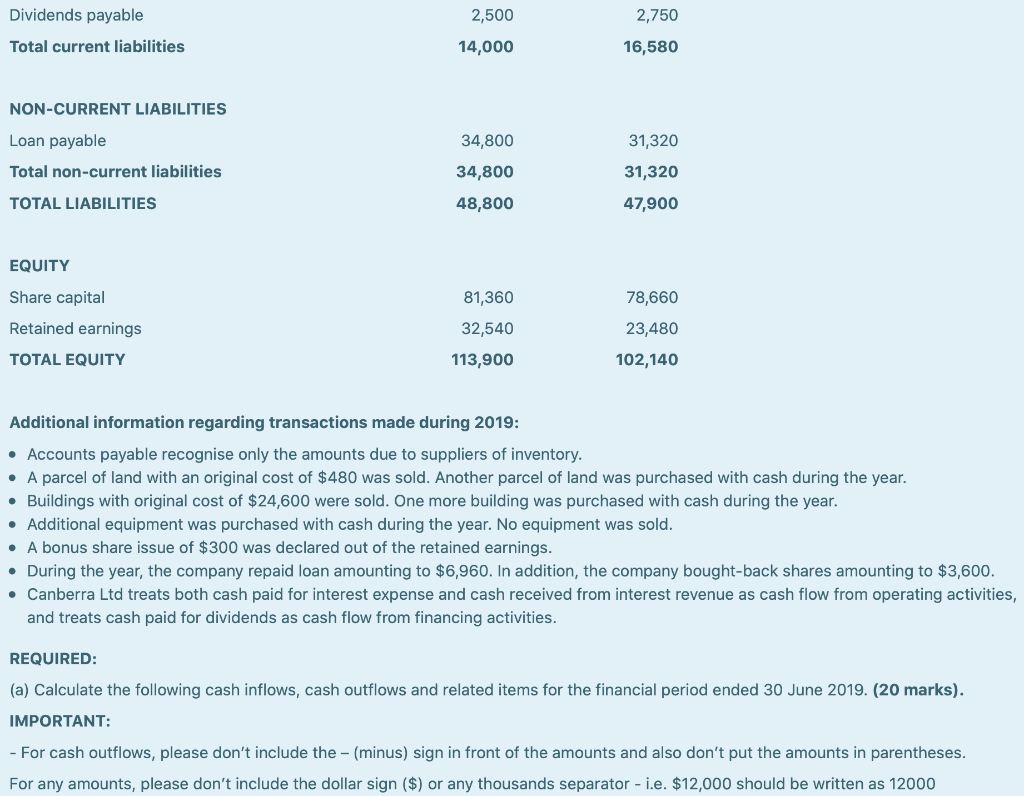

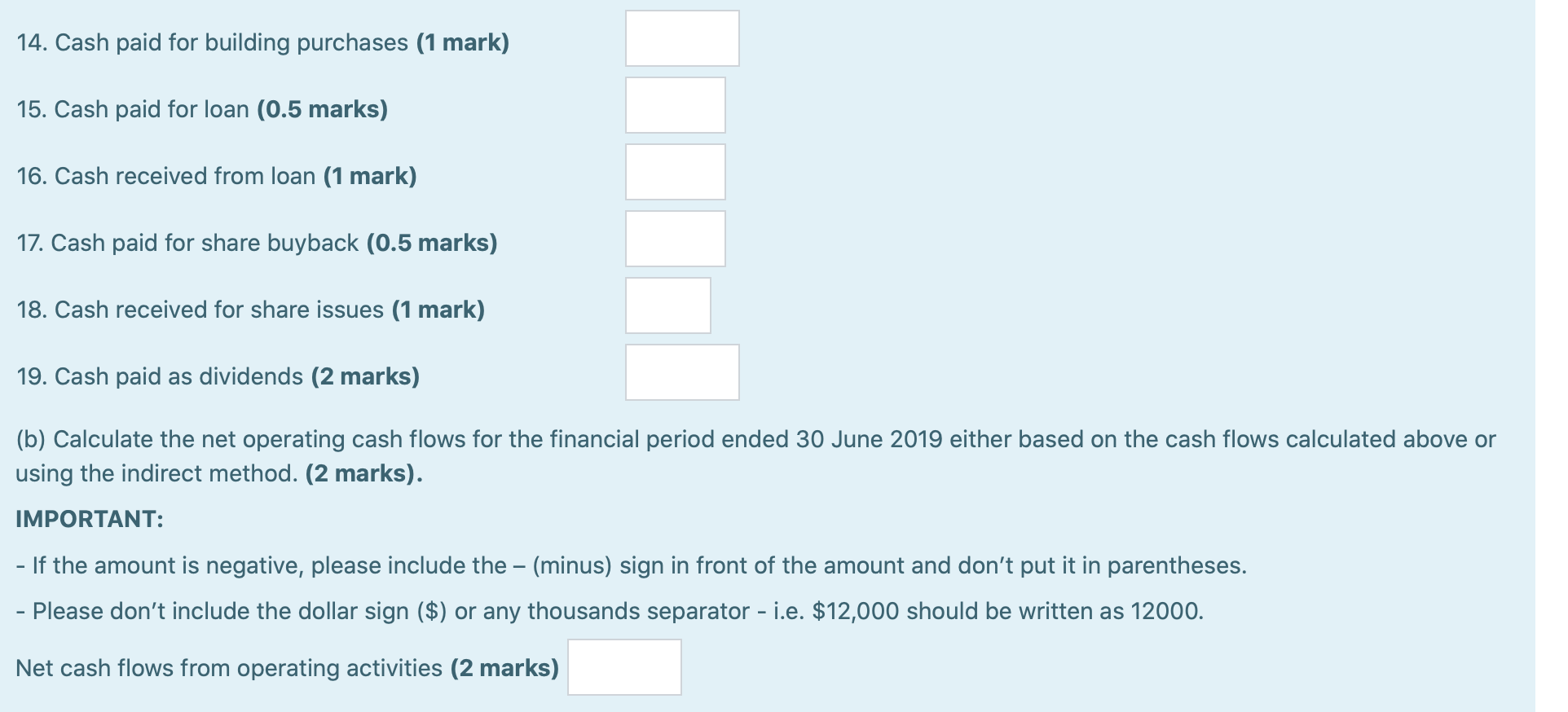

CASH FLOW STATEMENT (22 MARKS) The following information is available for Canberra Ltd. Income statement for Canberra Ltd for the period ended 30 June 2019 $ $ Sales revenue 80,000 (48,000). 32,000 Cost of goods sold Gross profit Interest received Gain on sale of land Total other income 8,000 4,000 12,000 Rent expense (6,400) Loss on sale of building Depreciation expenses Other operating expenses (800) (12,000) (3,200) (4,000) Interest expense Total expenses (26,400) Profit before income tax 17,600 (5,280) Income tax expense Profit after income tax 12,320 Balance sheets for Canberra Ltd as at 30 June 2018 and 30 June 2019 2018 2019 $ $ CURRENT ASSETS Cash 2,880 Accounts receivable 36,000 12,960 Inventory Prepaid rent Prepaid other operating expenses 2,400 45,000 10,800 16,000 1,500 75,700 14,400 1,800 Total current assets 68,040 NON-CURRENT ASSETS Land Buildings (at cost) Accumulated depreciation - buildings Equipment (at cost) Accumulated depreciation - equipment 30,000 72,000 (36,000) 50,000 (29,000) 29,640 67,900 (40,740) 60,000 (34,800) 82,000 150,040 Total non-current assets 87,000 TOTAL ASSETS 162,700 CURRENT LIABILITIES 4,500 4,950 3,000 Accounts payable Other operating expenses payable Income tax payable Dividends payable 3,600 5,280 4,000 2,500 2,750 Dividends payable 2,500 2,750 Total current liabilities 14,000 16,580 NON-CURRENT LIABILITIES 34,800 Loan payable Total non-current liabilities 34,800 48,800 31,320 31,320 47,900 TOTAL LIABILITIES EQUITY Share capital Retained earnings TOTAL EQUITY 81,360 32,540 113,900 78,660 23,480 102,140 Additional information regarding transactions made during 2019: Accounts payable recognise only the amounts due to suppliers of inventory. A parcel of land with an original cost of $480 was sold. Another parcel of land was purchased with cash during the year. Buildings with original cost of $24,600 were sold. One more building was purchased with cash during the year. Additional equipment was purchased with cash during the year. No equipment was sold. A bonus share issue of $300 was declared out of the retained earnings. During the year, the company repaid loan amounting to $6,960. In addition, the company bought-back shares amounting to $3,600. Canberra Ltd treats both cash paid for interest expense and cash received from interest revenue as cash flow from operating activities, and treats cash paid for dividends as cash flow from financing activities. REQUIRED: (a) Calculate the following cash inflows, cash outflows and related items for the financial period ended 30 June 2019. (20 marks). IMPORTANT: - For cash outflows, please don't include the - (minus) sign in front of the amounts and also don't put the amounts in parentheses. For any amounts, please don't include the dollar sign ($) or any thousands separator - i.e. $12,000 should be written as 12000 IMPORTANT: - For cash outflows, please don't include the -(minus) sign in front of the amounts and also don't put the amounts in parentheses. For any amounts, please don't include the dollar sign ($) or any thousands separator - i.e. $12,000 should be written as 12000 1. Cash received from customers (1 mark) 2. Purchases (1 mark) 3. Cash paid to suppliers (1 mark) 4. Cash paid for rent (1 mark) 5. Cash paid for other operating expenses (2 marks) 6. Cash paid for interest (0.5 marks) 7. Cash received for interest (0.5 marks) 8. Cash paid for income tax (1 mark) 9. Cash received from land sales (1 mark) 10. Cash paid for land purchases (1 mark) 11. Accumulated depreciation of building sold (2 marks) 12. Cash received from buildings sold (1 mark) 13. Cash paid for equipment purchases (1 mark) 14. Cash paid for building purchases (1 mark) 15. Cash paid for loan (0.5 marks) 14. Cash paid for building purchases (1 mark) 15. Cash paid for loan (0.5 marks) 16. Cash received from loan (1 mark) 17. Cash paid for share buyback (0.5 marks) 18. Cash received for share issues (1 mark) 19. Cash paid as dividends (2 marks) (b) Calculate the net operating cash flows for the financial period ended 30 June 2019 either based on the cash flows calculated above or using the indirect method. (2 marks). IMPORTANT: - If the amount is negative, please include the (minus) sign in front of the amount and don't put it in parentheses. - Please don't include the dollar sign ($) or any thousands separator - i.e. $12,000 should be written as 12000. Net cash flows from operating activities (2 marks)