Q29

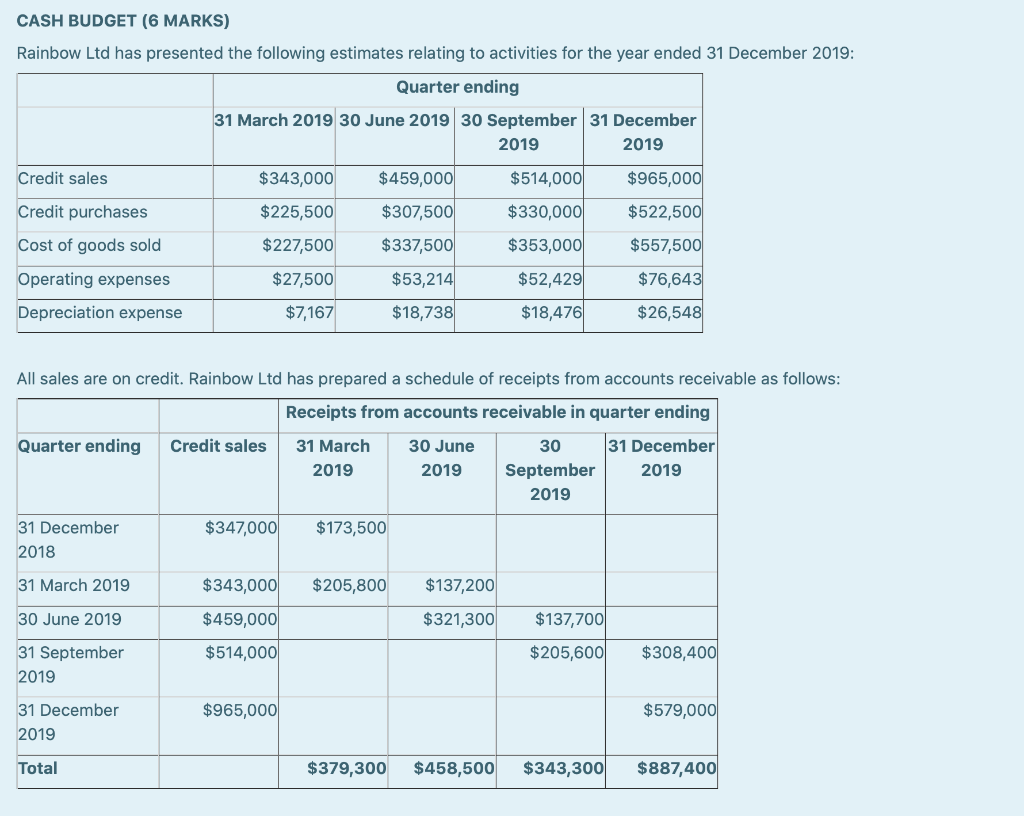

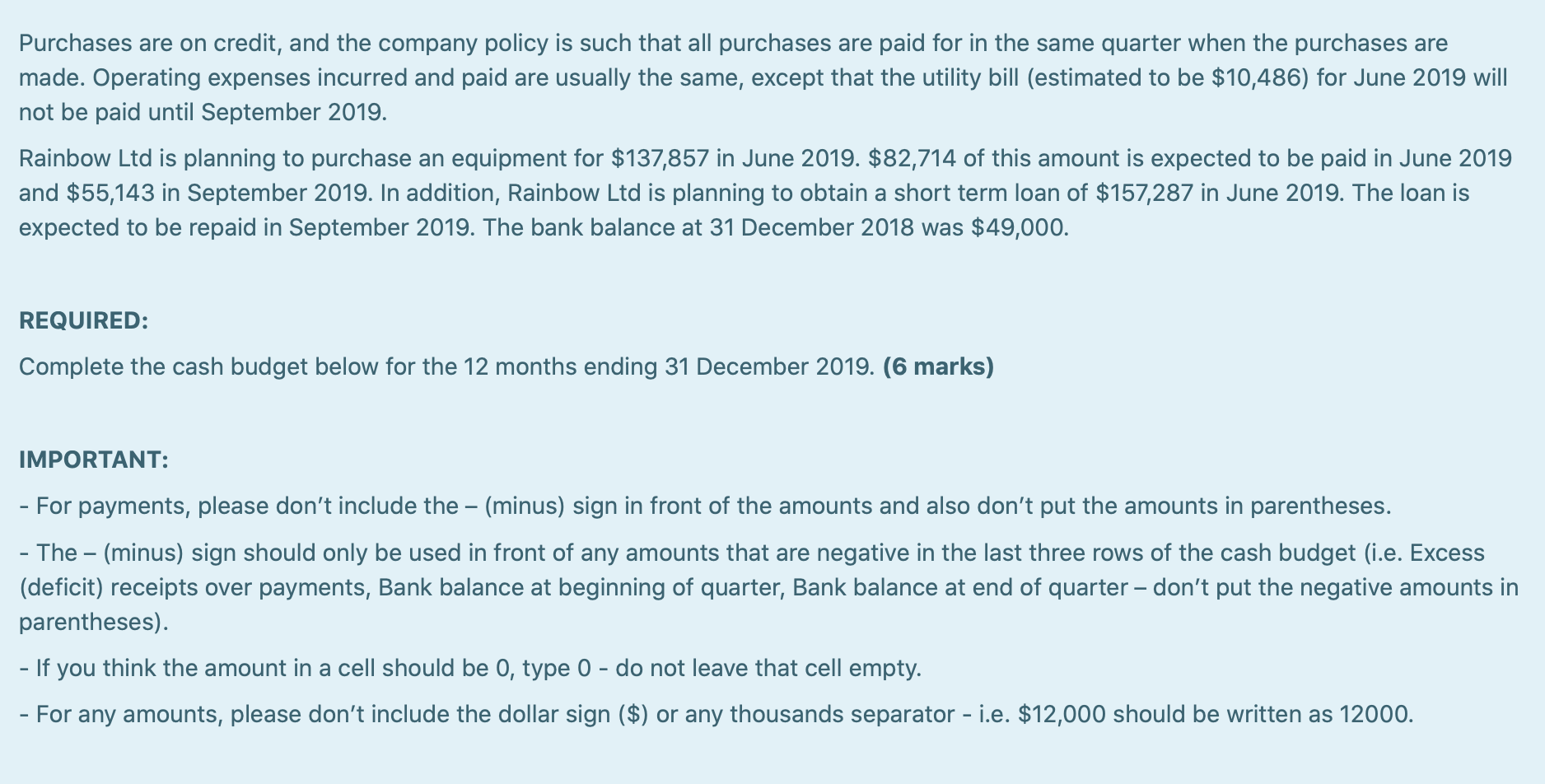

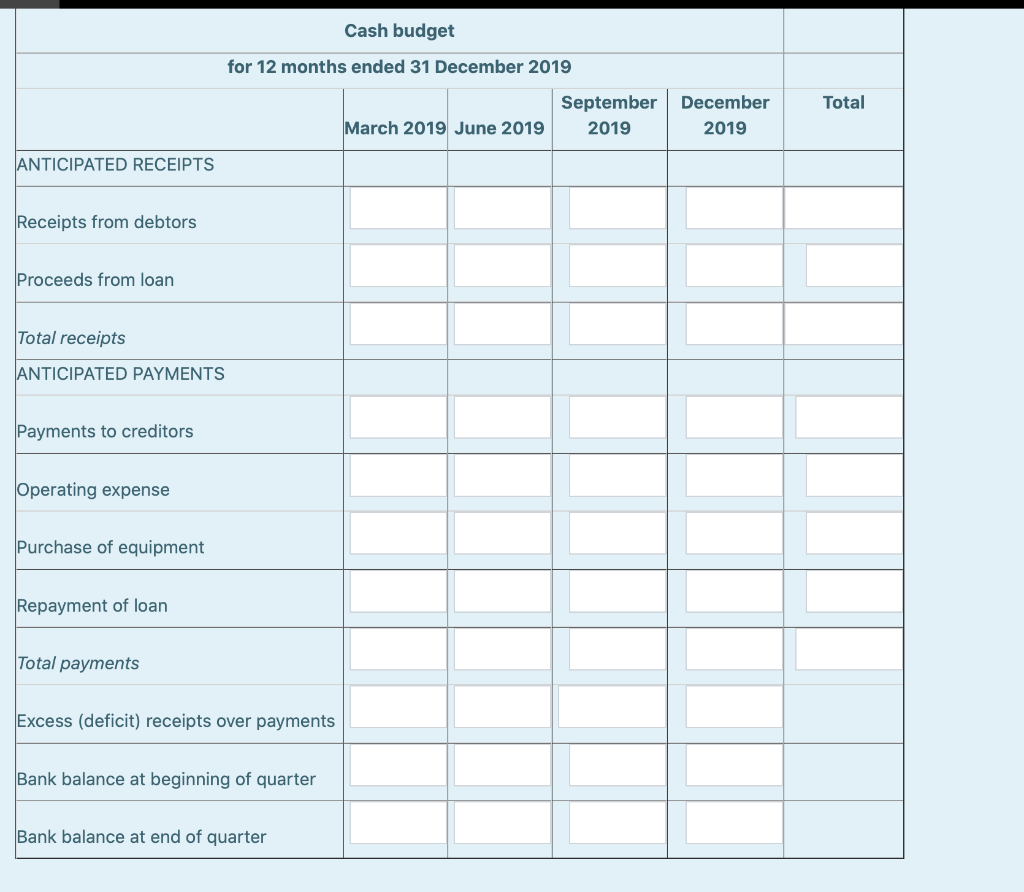

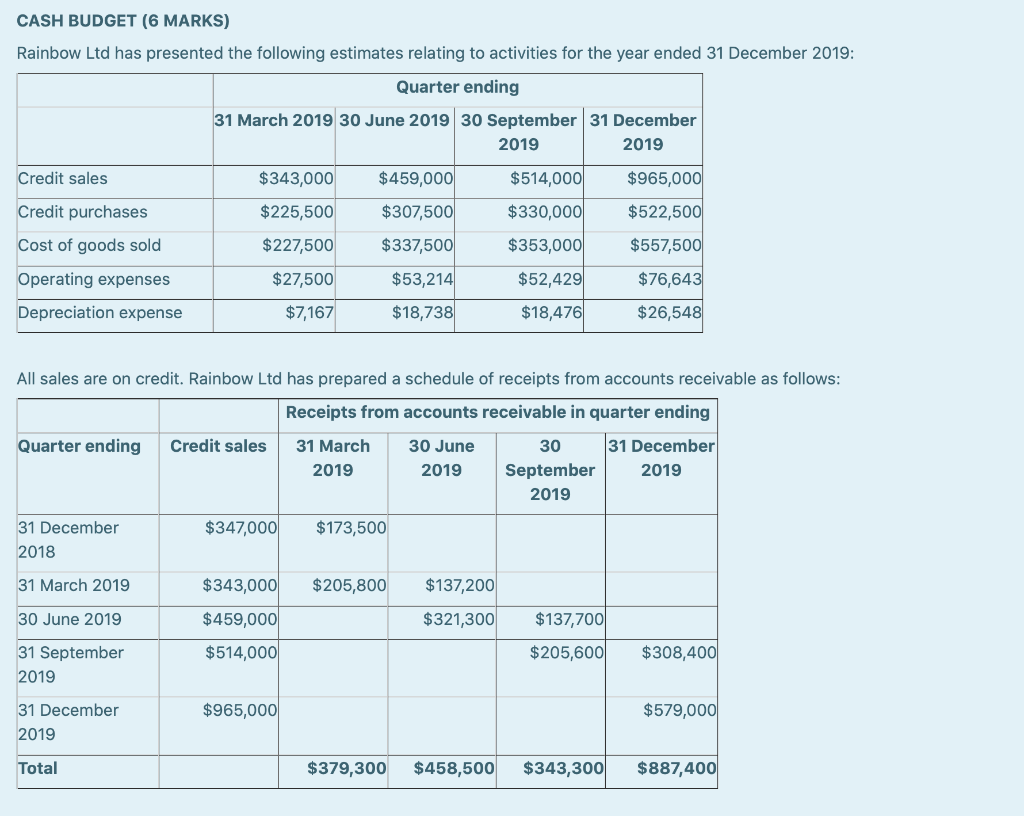

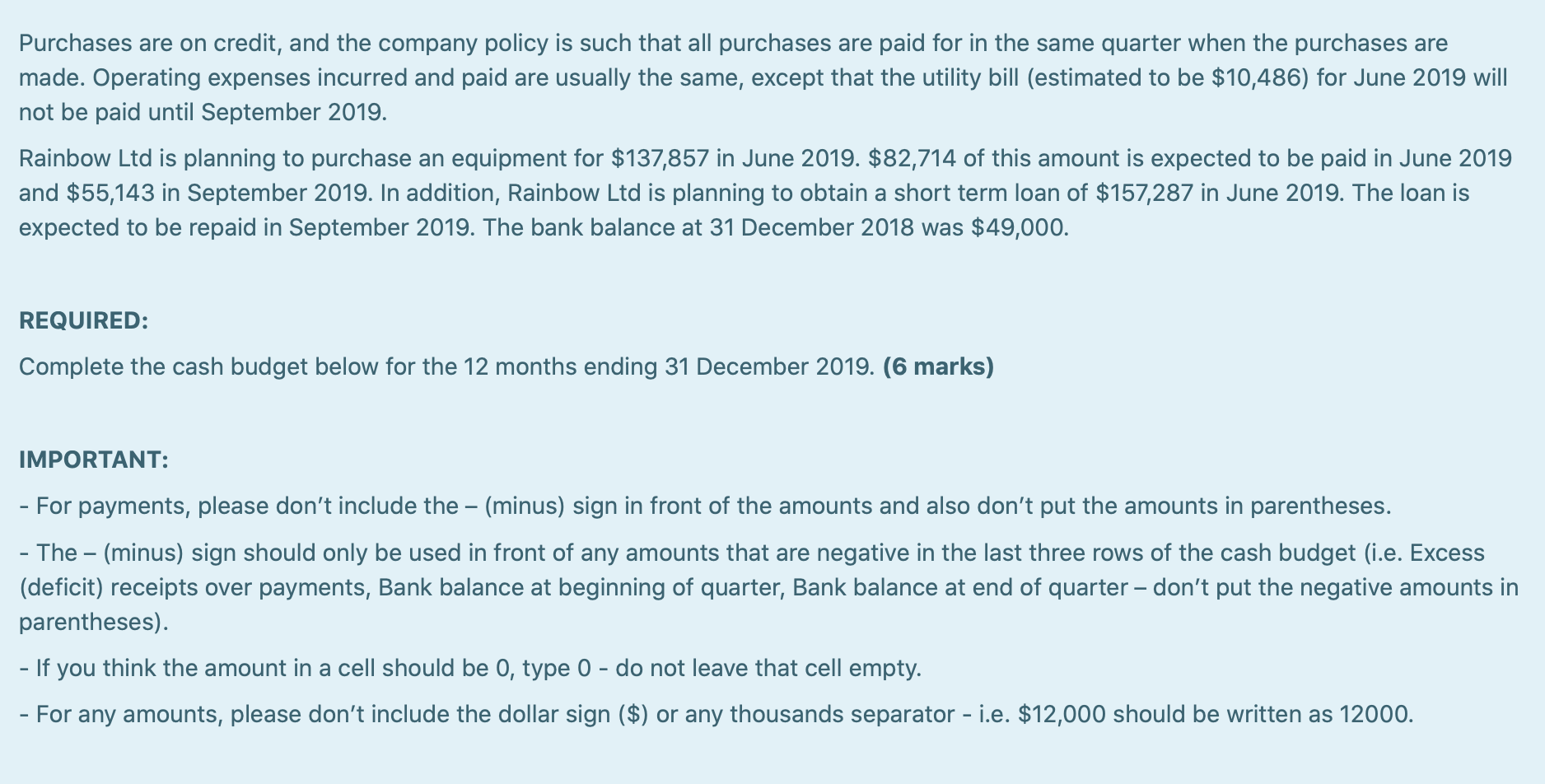

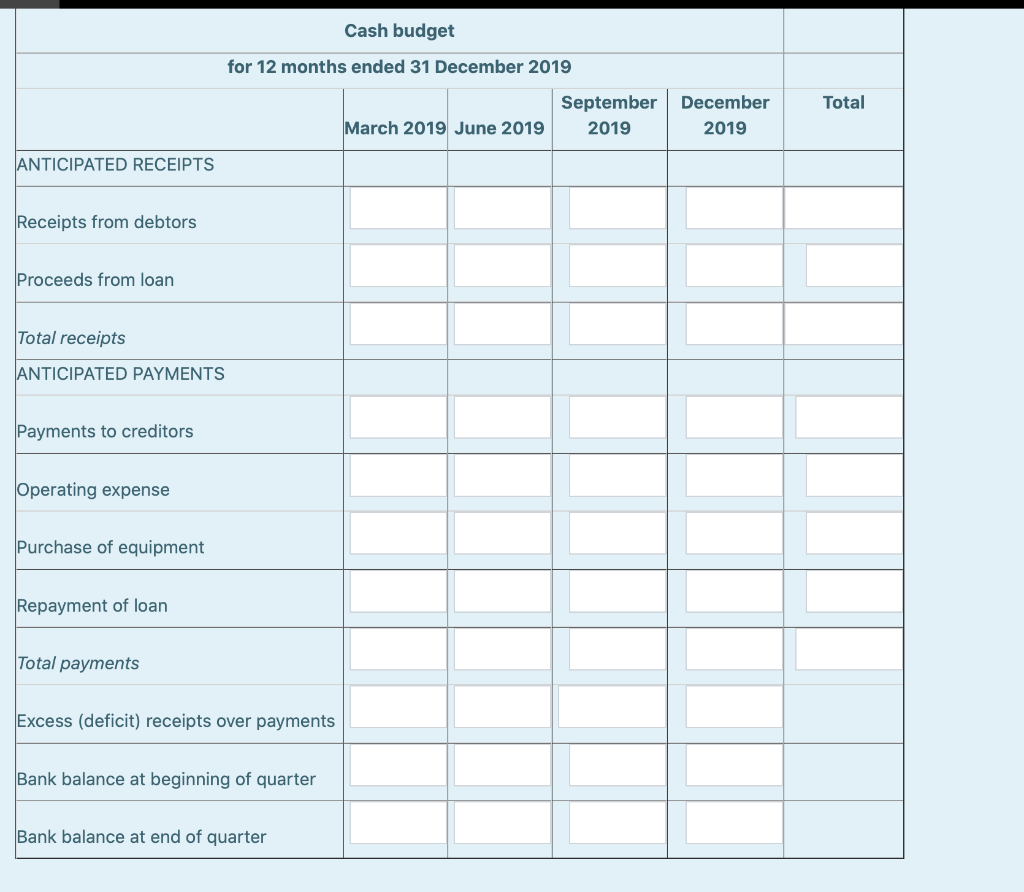

CASH BUDGET (6 MARKS) Rainbow Ltd has presented the following estimates relating to activities for the year ended 31 December 2019: Quarter ending 31 March 2019 30 June 2019 30 September 31 December 2019 2019 Credit sales $343,000 $459,000 $514,000 $965,000 $307,500 $330,000 $522,500 Credit purchases Cost of goods sold $225,500 $227,500 $337,500 $557,500 Operating expenses Depreciation expense $27,500 $7,167 $53,214 $18,738 $353,000 $52,429 $18,476 $76,643 $26,548 All sales are on credit. Rainbow Ltd has prepared a schedule of receipts from accounts receivable as follows: Receipts from accounts receivable in quarter ending Quarter ending Credit sales 31 March 2019 30 June 2019 30 September 2019 31 December 2019 $347,000 $173,500 31 December 2018 31 March 2019 $343,000 $ 205,800 $137,200 30 June 2019 $459,000 $321,300 $137,700 $205,600 $514,000 $308,400 31 September 2019 $965,000 $579,000 31 December 2019 Total $379,300 $458,500 $343,300 $887,400 Purchases are on credit, and the company policy is such that all purchases are paid for in the same quarter when the purchases are made. Operating expenses incurred and paid are usually the same, except that the utility bill (estimated to be $10,486) for June 2019 will not be paid until September 2019. Rainbow Ltd is planning to purchase an equipment for $137,857 in June 2019. $82,714 of this amount is expected to be paid in June 2019 and $55,143 in September 2019. In addition, Rainbow Ltd is planning to obtain a short term loan of $157,287 in June 2019. The loan is expected to be repaid in September 2019. The bank balance at 31 December 2018 was $49,000. REQUIRED: Complete the cash budget below for the 12 months ending 31 December 2019. (6 marks) IMPORTANT: For payments, please don't include the (minus) sign in front of the amounts and also don't put the amounts in parentheses. - The (minus) sign should only be used in front of any amounts that are negative in the last three rows of the cash budget (i.e. Excess (deficit) receipts over payments, Bank balance at beginning of quarter, Bank balance at end of quarter don't put the negative amounts in parentheses). If you think the amount in a cell should be 0, type 0 - do not leave that cell empty. For any amounts, please don't include the dollar sign ($) or any thousands separator - i.e. $12,000 should be written as 12000. Cash budget for 12 months ended 31 December 2019 Total September 2019 December 2019 March 2019 June 2019 ANTICIPATED RECEIPTS Receipts from debtors Proceeds from loan Total receipts ANTICIPATED PAYMENTS Payments to creditors Operating expense Purchase of equipment Repayment of loan Total payments Excess (deficit) receipts over payments Bank balance at beginning of quarter Bank balance at end of quarter