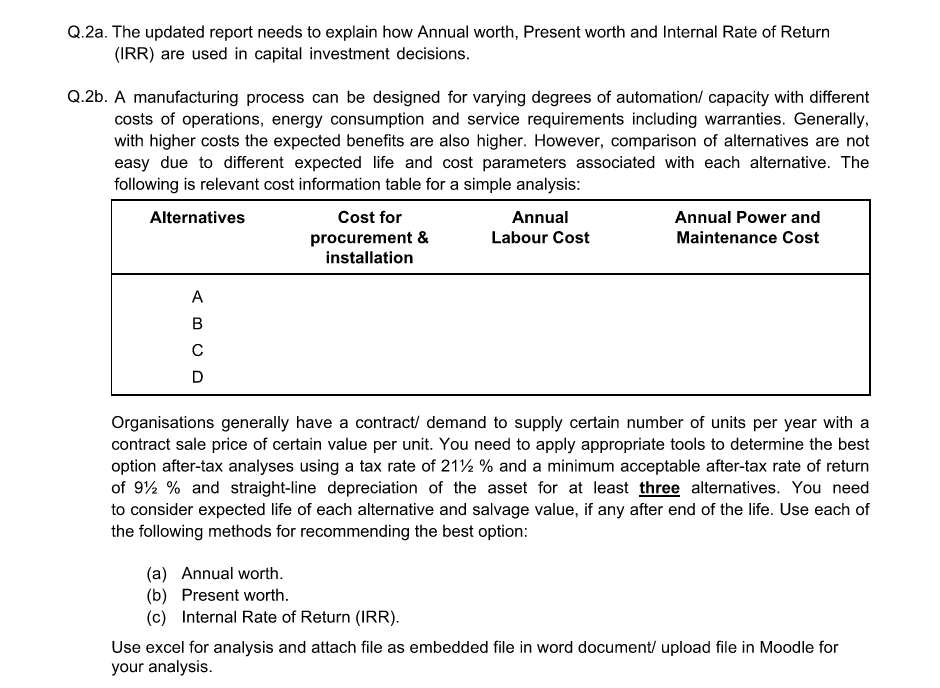

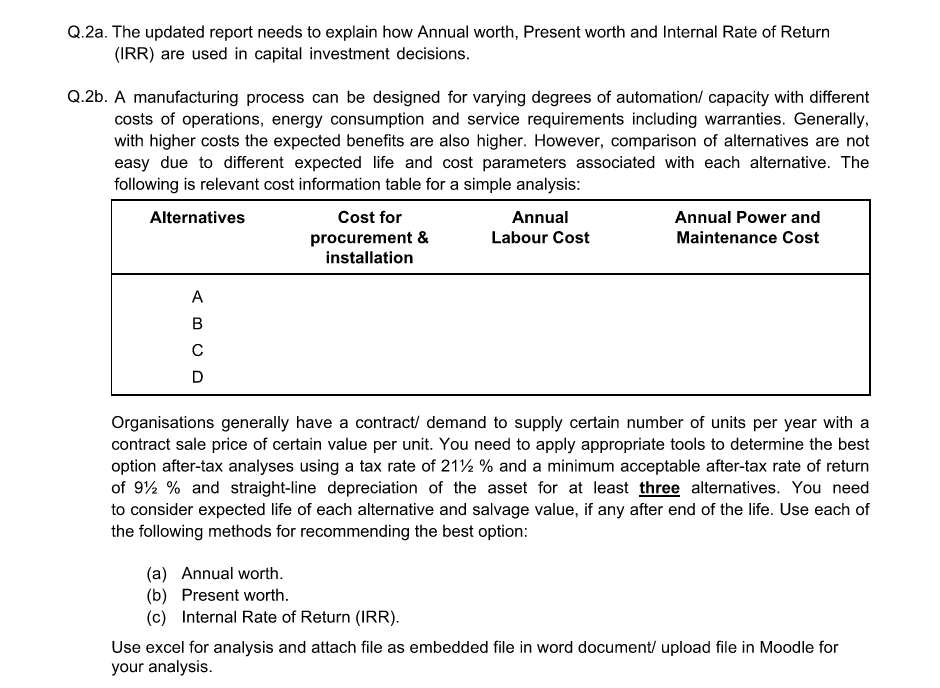

Q.2a. The updated report needs to explain how Annual worth, Present worth and Internal Rate of Return (IRR) are used in capital investment decisions. Q.2b. A manufacturing process can be designed for varying degrees of automation/ capacity with different costs of operations, energy consumption and service requirements including warranties. Generally, with higher costs the expected benefits are also higher. However, comparison of alternatives are not easy due to different expected life and cost parameters associated with each alternative. The following is relevant cost information table for a simple analysis: Organisations generally have a contract/ demand to supply certain number of units per year with a contract sale price of certain value per unit. You need to apply appropriate tools to determine the best option after-tax analyses using a tax rate of 211/2% and a minimum acceptable after-tax rate of return of 91/2% and straight-line depreciation of the asset for at least three alternatives. You need to consider expected life of each alternative and salvage value, if any after end of the life. Use each of the following methods for recommending the best option: (a) Annual worth. (b) Present worth. (c) Internal Rate of Return (IRR). Use excel for analysis and attach file as embedded file in word document/ upload file in Moodle for your analysis. Q.2a. The updated report needs to explain how Annual worth, Present worth and Internal Rate of Return (IRR) are used in capital investment decisions. Q.2b. A manufacturing process can be designed for varying degrees of automation/ capacity with different costs of operations, energy consumption and service requirements including warranties. Generally, with higher costs the expected benefits are also higher. However, comparison of alternatives are not easy due to different expected life and cost parameters associated with each alternative. The following is relevant cost information table for a simple analysis: Organisations generally have a contract/ demand to supply certain number of units per year with a contract sale price of certain value per unit. You need to apply appropriate tools to determine the best option after-tax analyses using a tax rate of 211/2% and a minimum acceptable after-tax rate of return of 91/2% and straight-line depreciation of the asset for at least three alternatives. You need to consider expected life of each alternative and salvage value, if any after end of the life. Use each of the following methods for recommending the best option: (a) Annual worth. (b) Present worth. (c) Internal Rate of Return (IRR). Use excel for analysis and attach file as embedded file in word document/ upload file in Moodle for your analysis