Answered step by step

Verified Expert Solution

Question

1 Approved Answer

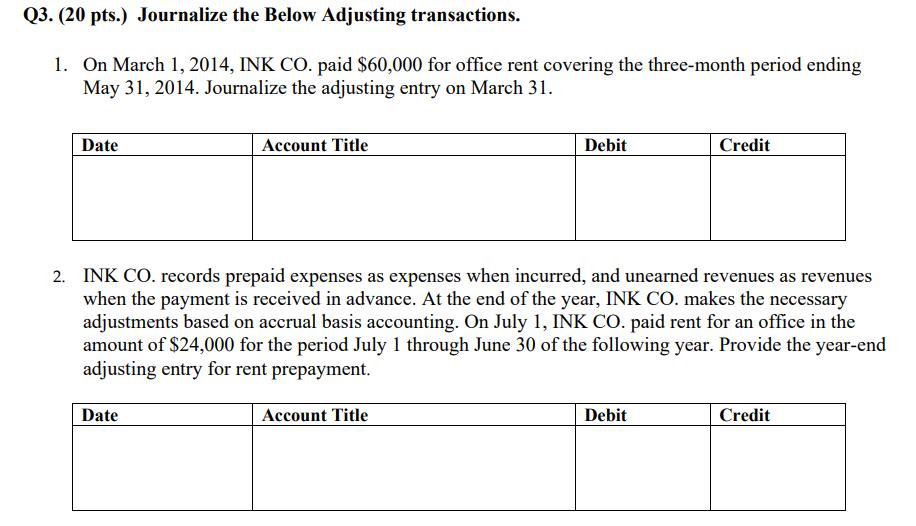

Q3. (20 pts.) Journalize the Below Adjusting transactions. 1. On March 1, 2014, INK CO. paid $60,000 for office rent covering the three-month period

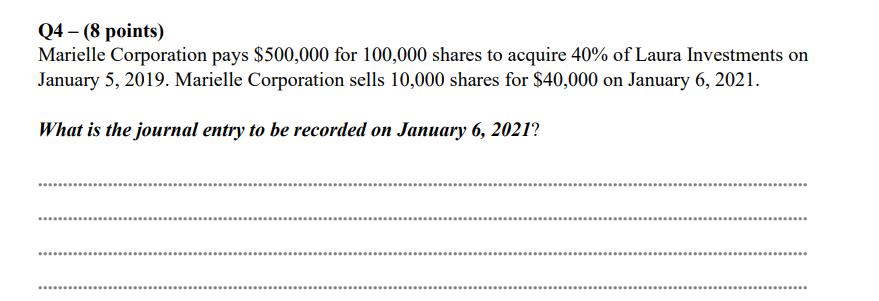

Q3. (20 pts.) Journalize the Below Adjusting transactions. 1. On March 1, 2014, INK CO. paid $60,000 for office rent covering the three-month period ending May 31, 2014. Journalize the adjusting entry on March 31. Date Account Title Date Debit 2. INK CO. records prepaid expenses as expenses when incurred, and unearned revenues as revenues when the payment is received in advance. At the end of the year, INK CO. makes the necessary adjustments based on accrual basis accounting. On July 1, INK CO. paid rent for an office in the amount of $24,000 for the period July 1 through June 30 of the following year. Provide the year-end adjusting entry for rent prepayment. Account Title Credit Debit Credit Q4 - (8 points) Marielle Corporation pays $500,000 for 100,000 shares to acquire 40% of Laura Investments on January 5, 2019. Marielle Corporation sells 10,000 shares for $40,000 on January 6, 2021. What is the journal entry to be recorded on January 6, 2021? ****** ******* ***********

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journalize the below adjustments 01 On March 01 2014 INK CO paid 60000 for office rent covering the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started