Answered step by step

Verified Expert Solution

Question

1 Approved Answer

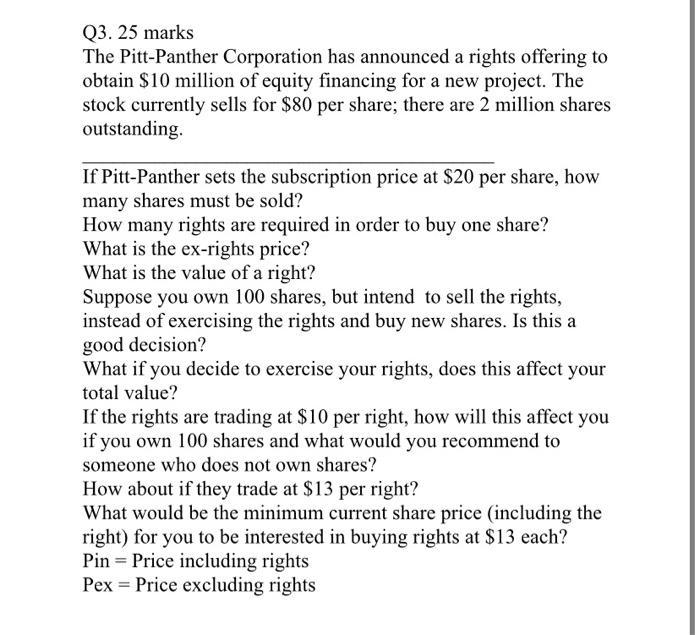

Q3. 25 marks The Pitt-Panther Corporation has announced a rights offering to obtain $10 million of equity financing for a new project. The stock

Q3. 25 marks The Pitt-Panther Corporation has announced a rights offering to obtain $10 million of equity financing for a new project. The stock currently sells for $80 per share; there are 2 million shares outstanding. If Pitt-Panther sets the subscription price at $20 per share, how many shares must be sold? How many rights are required in order to buy one share? What is the ex-rights price? What is the value of a right? Suppose you own 100 shares, but intend to sell the rights, instead of exercising the rights and buy new shares. Is this a good decision? What if you decide to exercise your rights, does this affect your total value? If the rights are trading at $10 per right, how will this affect you if you own 100 shares and what would you recommend to someone who does not own shares? How about if they trade at $13 per right? What would be the minimum current share price (including the right) for you to be interested in buying rights at $13 each? Pin Price including rights Pex Price excluding rights =

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 1 Total financing required 10000000 If subscription price is 20 Number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started