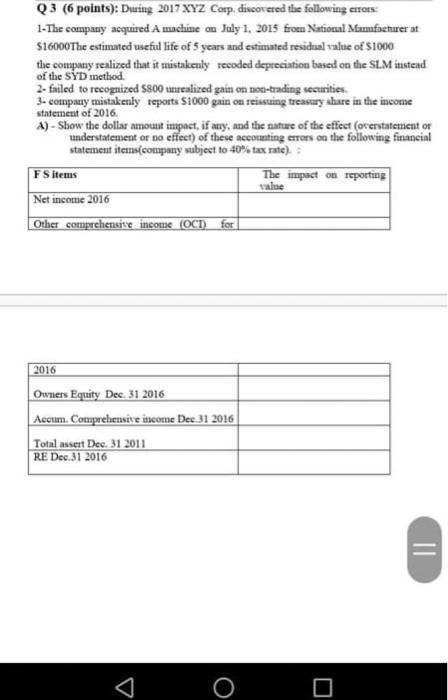

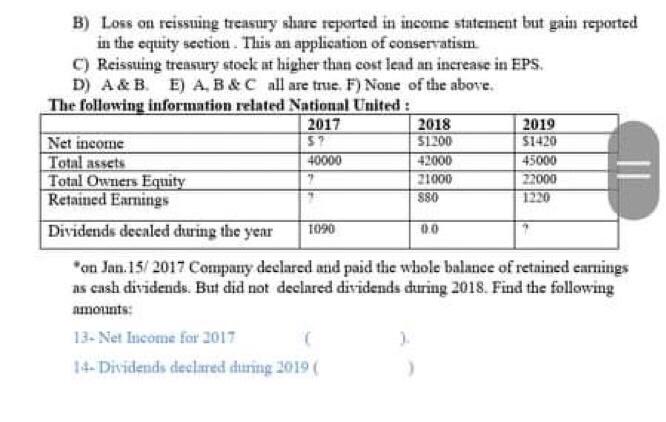

Q3 (6 points): During 2017 XYZ Corp. discovered the following errors 1-The company acquired A machine on July 1, 2015 from National Mamfacturer at S16000The estimated useful life of 5 years and estimated residual value of S1000 the company realized that it mistakenly recoded depreciation based on the SL.M instead of the SYD method 2-failed to recognized $800 twrealized gain on non-trading securities 3-company mistakenly reports $1000 gain on reissuing treasury share in the income statement of 2016 A) - Show the dollar amount impact, if any, and the natwe of the effect (overytatement or understatement or no effect) of these accounting errors on the following fancial statement itens company subject to 40% tax rate) FSitems The impact on reporting Net income 2016 Other comprehensive income (OCT) for 2016 Owners Equity Dec. 31 2016 Aecum. Comprehensive income Dec.31 2016 Totul assert Des 31 2011 RE Dec.31 2016 = B) Loss on reissuing treasury share reported in income statement but gain reported in the equity section. This an application of conservatism C) Reissuing treasury stock at higher than cost lead an increase in EPS D) A&B. E) A. B&C all are true. F) None of the above. The following information related National United : 2017 2018 2019 Net income 57 51200 $1420 Total assets 40000 42000 45000 Total Owners Equity 21000 22000 Retained Earnings 880 1220 Dividends decaled during the year 1090 0.0 ? *on Jan. 15/2017 Company declared and paid the whole balance of retnined earnings as cash dividends. But did not declared dividends during 2018. Find the following amounts: 13- Net Income for 2017 14- Dividends declared during 2019 ( Q3 (6 points): During 2017 XYZ Corp. discovered the following errors 1-The company acquired A machine on July 1, 2015 from National Mamfacturer at S16000The estimated useful life of 5 years and estimated residual value of S1000 the company realized that it mistakenly recoded depreciation based on the SL.M instead of the SYD method 2-failed to recognized $800 twrealized gain on non-trading securities 3-company mistakenly reports $1000 gain on reissuing treasury share in the income statement of 2016 A) - Show the dollar amount impact, if any, and the natwe of the effect (overytatement or understatement or no effect) of these accounting errors on the following fancial statement itens company subject to 40% tax rate) FSitems The impact on reporting Net income 2016 Other comprehensive income (OCT) for 2016 Owners Equity Dec. 31 2016 Aecum. Comprehensive income Dec.31 2016 Totul assert Des 31 2011 RE Dec.31 2016 = B) Loss on reissuing treasury share reported in income statement but gain reported in the equity section. This an application of conservatism C) Reissuing treasury stock at higher than cost lead an increase in EPS D) A&B. E) A. B&C all are true. F) None of the above. The following information related National United : 2017 2018 2019 Net income 57 51200 $1420 Total assets 40000 42000 45000 Total Owners Equity 21000 22000 Retained Earnings 880 1220 Dividends decaled during the year 1090 0.0 ? *on Jan. 15/2017 Company declared and paid the whole balance of retnined earnings as cash dividends. But did not declared dividends during 2018. Find the following amounts: 13- Net Income for 2017 14- Dividends declared during 2019 (