Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q-3: A Sales Tax Registered Person is using its input for making both taxable as well as exempt supplies and paid Sales Tax at those

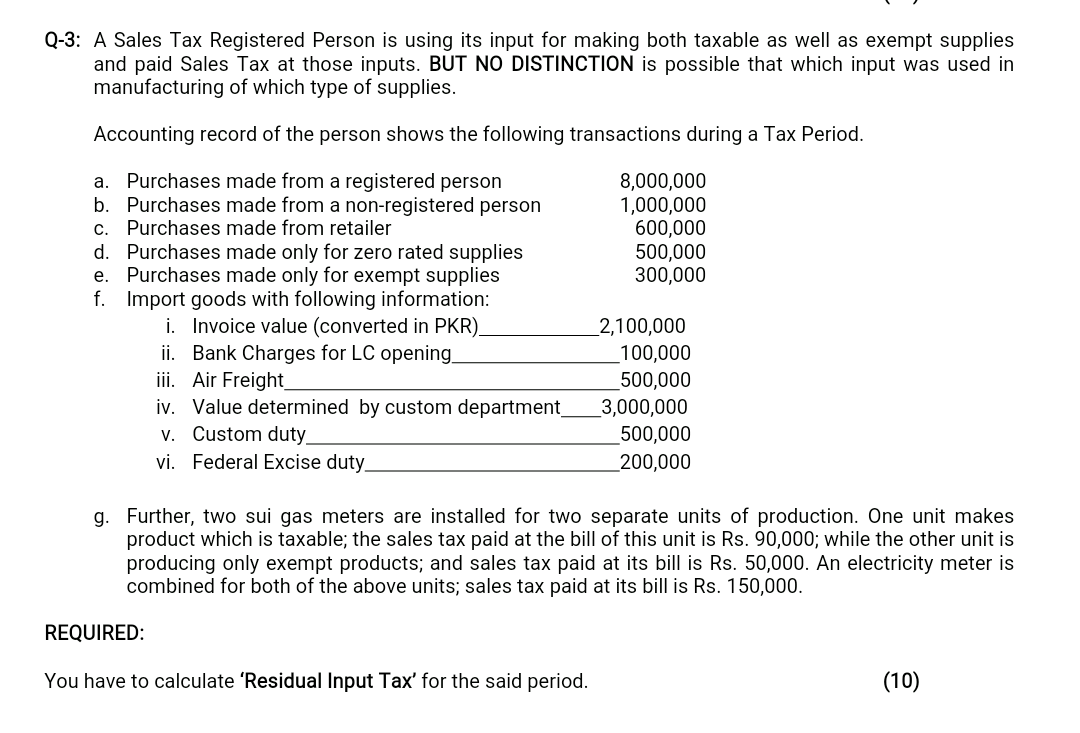

Q-3: A Sales Tax Registered Person is using its input for making both taxable as well as exempt supplies and paid Sales Tax at those inputs. BUT NO DISTINCTION is possible that which input was used in manufacturing of which type of supplies. Accounting record of the person shows the following transactions during a Tax Period. 8,000,000 1,000,000 600,000 500,000 300,000 a. Purchases made from a registered person b. Purchases made from a non-registered person c. Purchases made from retailer d. Purchases made only for zero rated supplies e. Purchases made only for exempt supplies f. Import goods with following information: i. Invoice value (converted in PKR). ii. Bank Charges for LC opening iii. Air Freight iv. Value determined by custom department V. Custom duty vi. Federal Excise duty. 2,100,000 100,000 500,000 3,000,000 500,000 200,000 g. Further, two sui gas meters are installed for two separate units of production. One unit makes product which is taxable; the sales tax paid at the bill of this unit is Rs. 90,000; while the other unit is producing only exempt products; and sales tax paid at its bill is Rs. 50,000. An electricity meter is combined for both of the above units; sales tax paid at its bill is Rs. 150,000. REQUIRED: You have to calculate 'Residual Input Tax' for the said period. (10) Q-3: A Sales Tax Registered Person is using its input for making both taxable as well as exempt supplies and paid Sales Tax at those inputs. BUT NO DISTINCTION is possible that which input was used in manufacturing of which type of supplies. Accounting record of the person shows the following transactions during a Tax Period. 8,000,000 1,000,000 600,000 500,000 300,000 a. Purchases made from a registered person b. Purchases made from a non-registered person c. Purchases made from retailer d. Purchases made only for zero rated supplies e. Purchases made only for exempt supplies f. Import goods with following information: i. Invoice value (converted in PKR). ii. Bank Charges for LC opening iii. Air Freight iv. Value determined by custom department V. Custom duty vi. Federal Excise duty. 2,100,000 100,000 500,000 3,000,000 500,000 200,000 g. Further, two sui gas meters are installed for two separate units of production. One unit makes product which is taxable; the sales tax paid at the bill of this unit is Rs. 90,000; while the other unit is producing only exempt products; and sales tax paid at its bill is Rs. 50,000. An electricity meter is combined for both of the above units; sales tax paid at its bill is Rs. 150,000. REQUIRED: You have to calculate 'Residual Input Tax' for the said period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started