Question

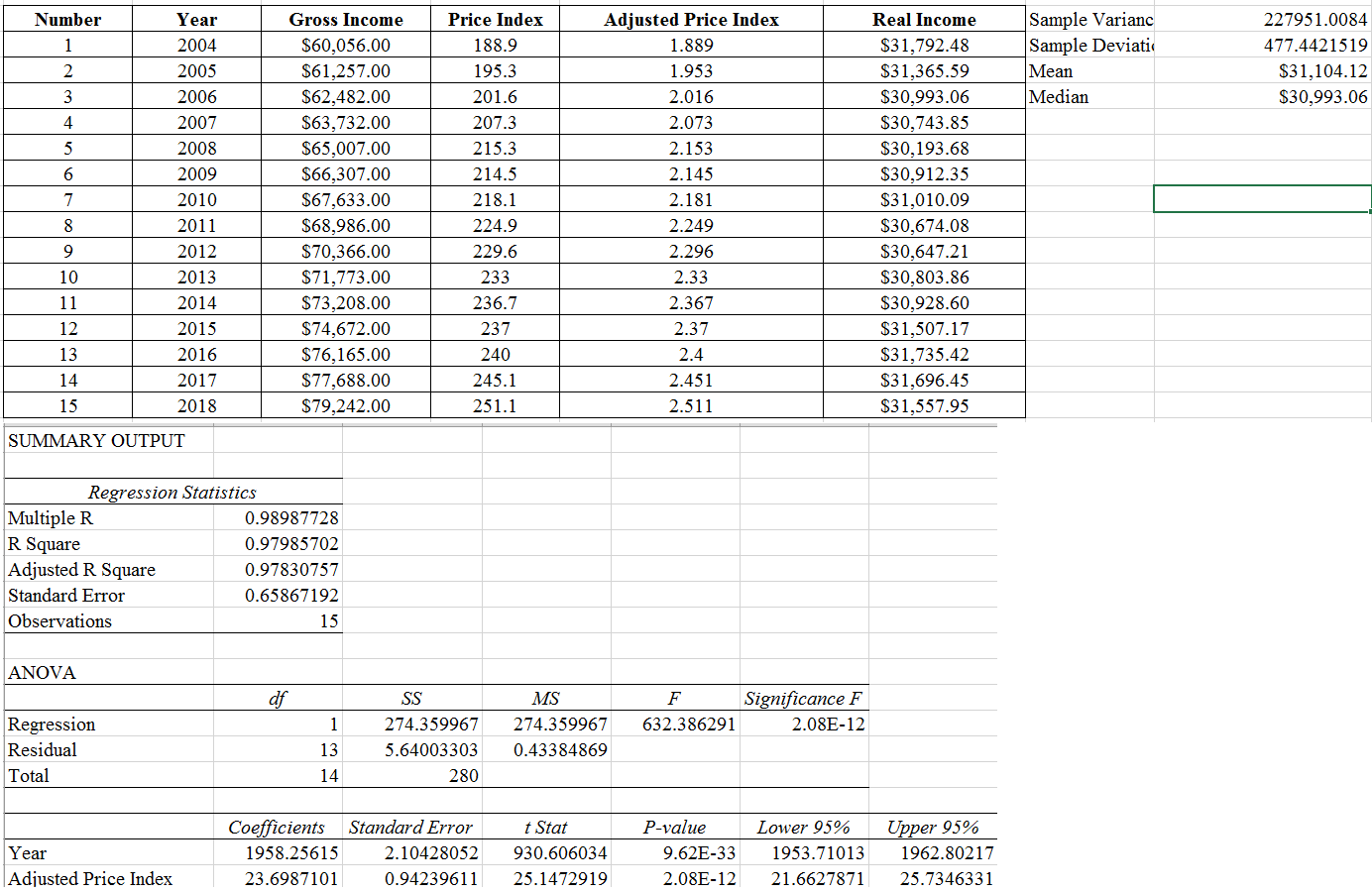

Q3. Assume that Mrs. Cooks real income will not change over the next ten years. Use the mean real income from question 1 to determine

Q3. Assume that Mrs. Cooks real income will not change over the next ten years. Use the mean real income from question 1 to determine projected real income for the future ten years of Mrs. Cooks work expectancy. Use the regression equation from question 2 to project adjusted price indices for the next ten years. Assume that Mrs. Cook pays 20% of her actual income in taxes and that Green will not provide significant state assistance. Use the projected real income and adjusted price indices to estimate Mrs. Cooks net actual income for the next ten years. What would be the likely amount of an award to Mrs. Cook based on a present value rate of 8%? Discuss the factors that could cause Mrs. Cooks future income to differ from your estimate.

Do your calculations for question 3 in the following order:

1. Use mean real income from question 1 to determine projected real income for 2019 - 2028.

(Mean = 31, 104.12 from Q1)

2. Use regression equation from question 2 to determine projected adjusted price indices.

( y=23.699x + 1958.3 from Q2)

R^2+0.9799

3. Use projected real income, adjusted price indices, and tax to estimate Mrs. Cook's net actual income for 2019 - 2028.

4. Determine the present value of the future net cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started