Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3 b) is unanswered and difficult to find any solution for it Campbell (1991) decomposes the variation in stock returns into revisions in expectations of

Q3 b) is unanswered and difficult to find any solution for it

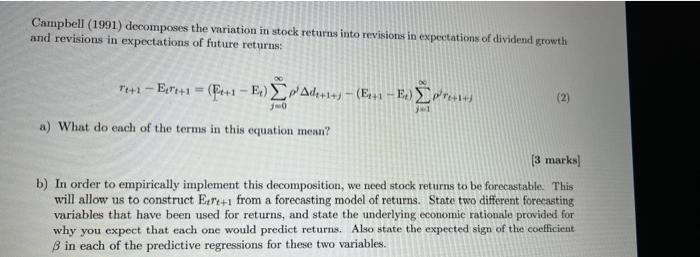

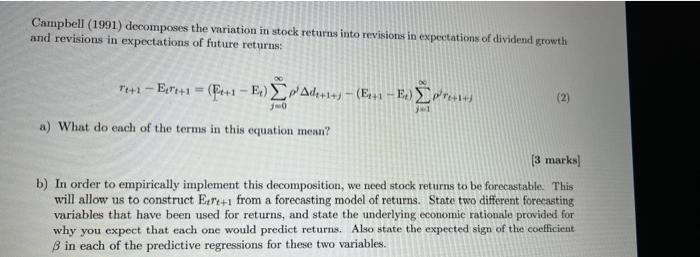

Campbell (1991) decomposes the variation in stock returns into revisions in expectations of dividend growth and revisions in expectations of future returns: **+1 - Ex +1 = (Fre+1 - E) Ade+1+) - (Ex1 - E.) +1-3 (2) JO 1 a) What do each of the terms in this equation mean? [3 marks) b) In order to empirically implement this decomposition, we need stock returns to be forecastable. This will allow us to construct Exte+1 from a forecasting model of returns. State two different forecasting variables that have been used for returns, and state the underlying economie rationale provided for why you expect that each one would predict returns. Also state the expected sign of the coefficient B in each of the predictive regressions for these two variables

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started