Answered step by step

Verified Expert Solution

Question

1 Approved Answer

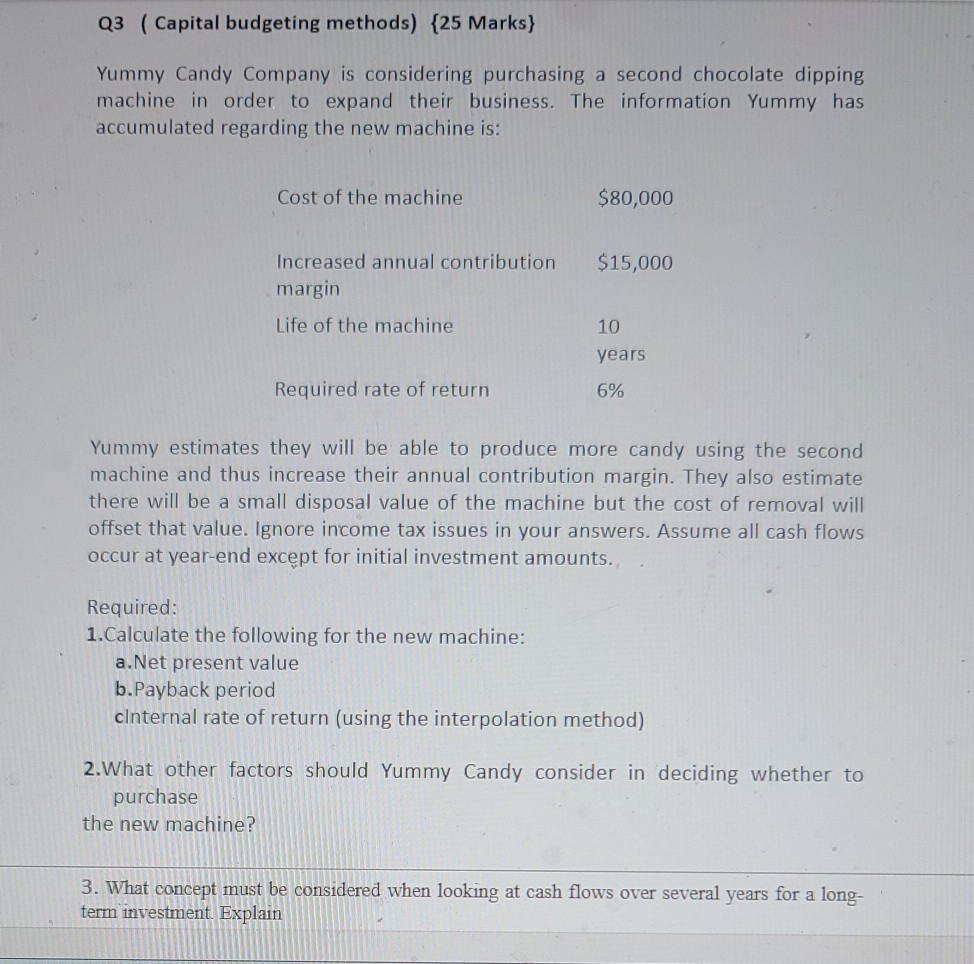

Q3 ( Capital budgeting methods) {25 Marks) Yummy Candy Company is considering purchasing a second chocolate dipping machine in order to expand their business. The

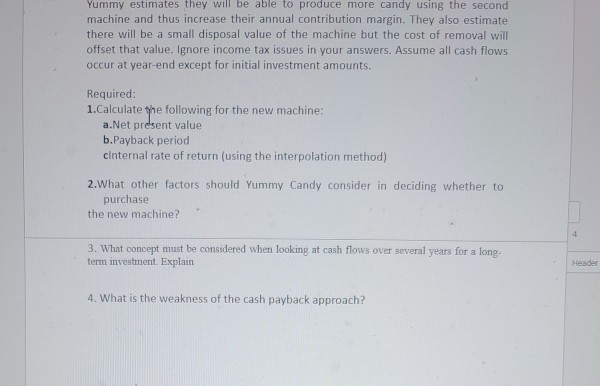

Q3 ( Capital budgeting methods) {25 Marks) Yummy Candy Company is considering purchasing a second chocolate dipping machine in order to expand their business. The information Yummy has accumulated regarding the new machine is: Cost of the machine $80,000 $15,000 Increased annual contribution margin Life of the machine 10 years Required rate of return 6% Yummy estimates they will be able to produce more candy using the second machine and thus increase their annual contribution margin. They also estimate there will be a small disposal value of the machine but the cost of removal will offset that value. Ignore income tax issues in your answers. Assume all cash flows occur at year-end except for initial investment amounts. Required: 1.Calculate the following for the new machine: a.Net present value b.Payback period cinternal rate of return (using the interpolation method) 2.What other factors should Yummy Candy consider in deciding whether to purchase the new machine? 3. What concept must be considered when looking at cash flows over several years for a long- term investment. Explain Yummy estimates they will be able to produce more candy using the second machine and thus increase their annual contribution margin. They also estimate there will be a small disposal value of the machine but the cost of removal will offset that value. Ignore income tax issues in your answers. Assume all cash flows occur at year-end except for initial investment amounts. Required: 1.Calculate the following for the new machine: a.Net present value b.Payback period cinternal rate of return (using the interpolation method) 2.What other factors should Yummy Candy consider in deciding whether to purchase the new machine? 4 3. What concept must be considered when looking at cash flows over several years for a long- term investment. Explain Header 4. What is the weakness of the cash payback approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started