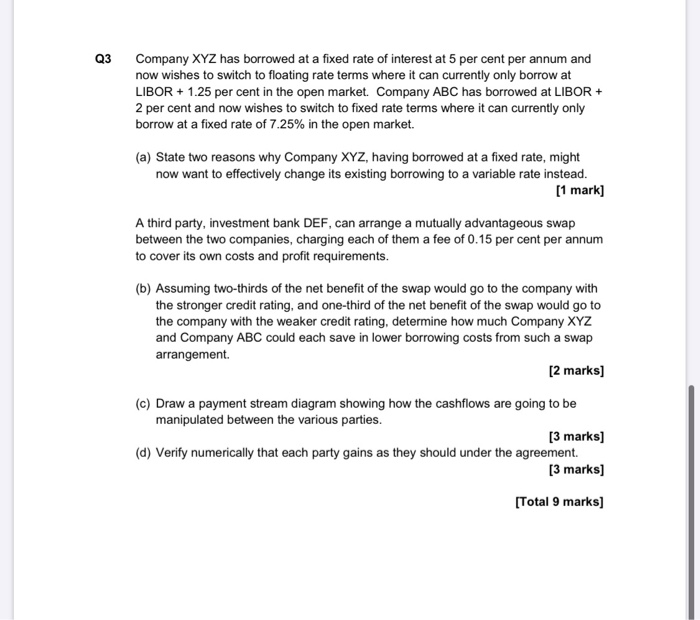

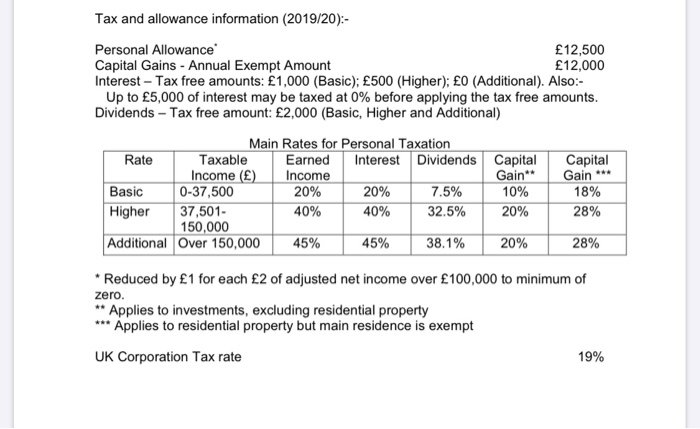

Q3 Company XYZ has borrowed at a fixed rate of interest at 5 per cent per annum and now wishes to switch to floating rate terms where it can currently only borrow at LIBOR + 1.25 per cent in the open market. Company ABC has borrowed at LIBOR + 2 per cent and now wishes to switch to fixed rate terms where it can currently only borrow at a fixed rate of 7.25% in the open market. (a) State two reasons why Company XYZ, having borrowed at a fixed rate, might now want to effectively change its existing borrowing to a variable rate instead. [1 mark] A third party, investment bank DEF, can arrange a mutually advantageous swap between the two companies, charging each of them a fee of 0.15 per cent per annum to cover its own costs and profit requirements. (b) Assuming two-thirds of the net benefit of the swap would go to the company with the stronger credit rating, and one-third of the net benefit of the swap would go to the company with the weaker credit rating, determine how much Company XYZ and Company ABC could each save in lower borrowing costs from such a swap arrangement. [2 marks] (c) Draw a payment stream diagram showing how the cashflows are going to be manipulated between the various parties. [3 marks] (d) Verify numerically that each party gains as they should under the agreement. [3 marks] [Total 9 marks] Tax and allowance information (2019/20):- Personal Allowance 12,500 Capital Gains - Annual Exempt Amount 12,000 Interest - Tax free amounts: 1,000 (Basic); 500 (Higher); O (Additional). Also:- Up to 5,000 of interest may be taxed at 0% before applying the tax free amounts. Dividends - Tax free amount: 2,000 (Basic, Higher and Additional) Capital Gain *** Main Rates for Personal Taxation Rate Taxable Earned Interest Dividends Income () Income Basic 0-37,500 20% 20% 7.5% Higher 37,501- 40% 40% 32.5% 150,000 Additional Over 150,000 45% 45% 38.1% Capital Gain** 10% 20% 18% 28% 20% 28% * Reduced by 1 for each 2 of adjusted net income over 100,000 to minimum of zero. ** Applies to investments, excluding residential property *** Applies to residential property but main residence is exempt UK Corporation Tax rate 19%