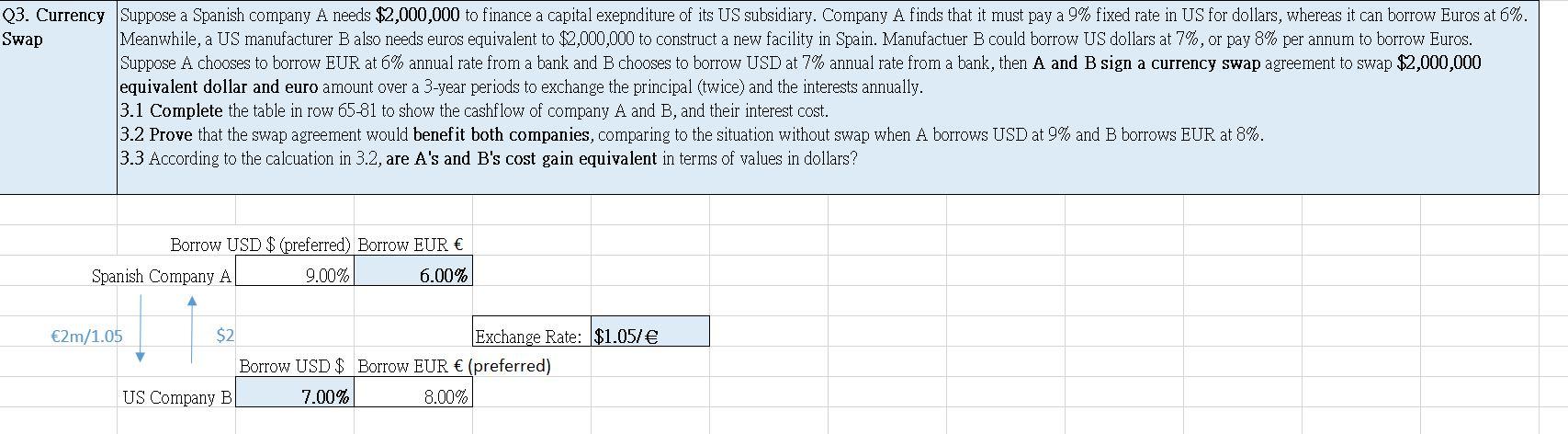

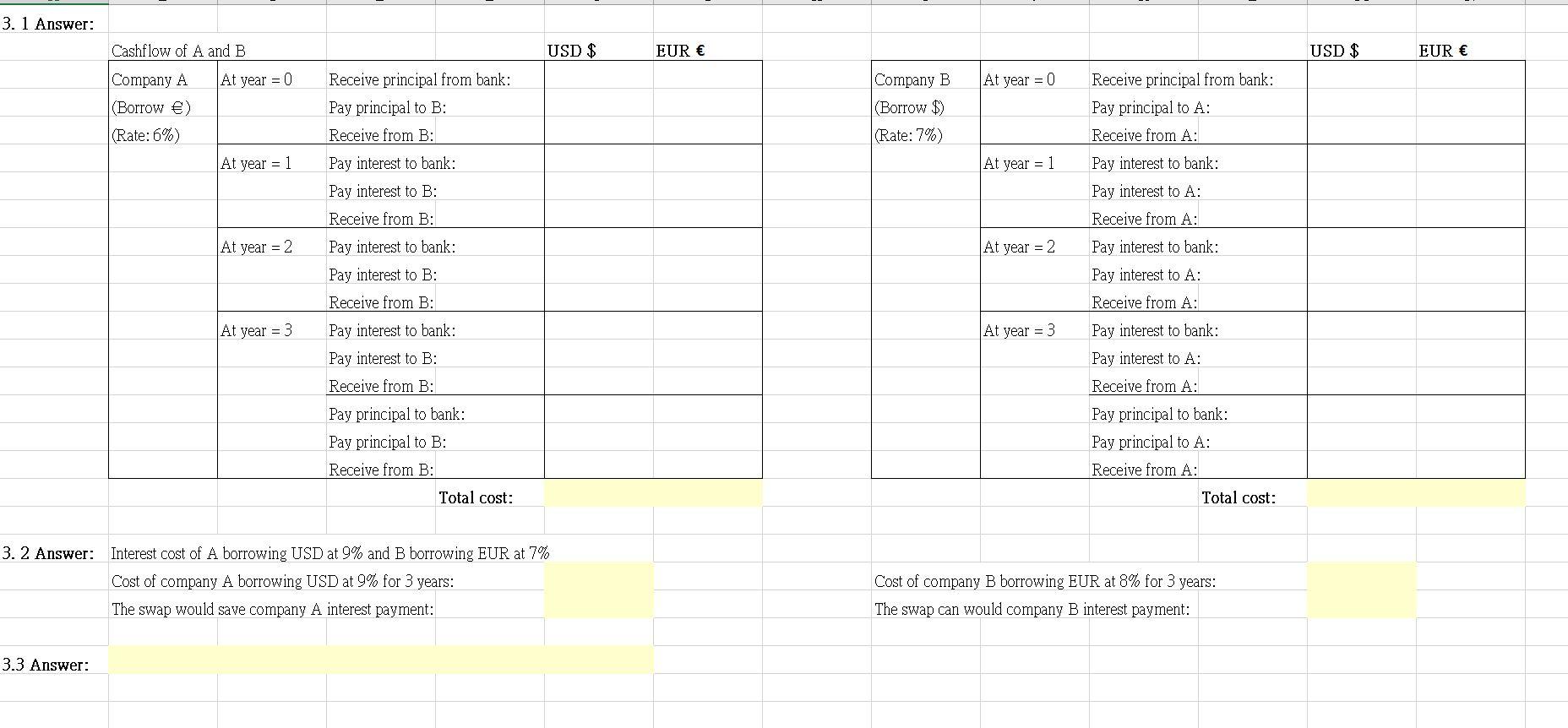

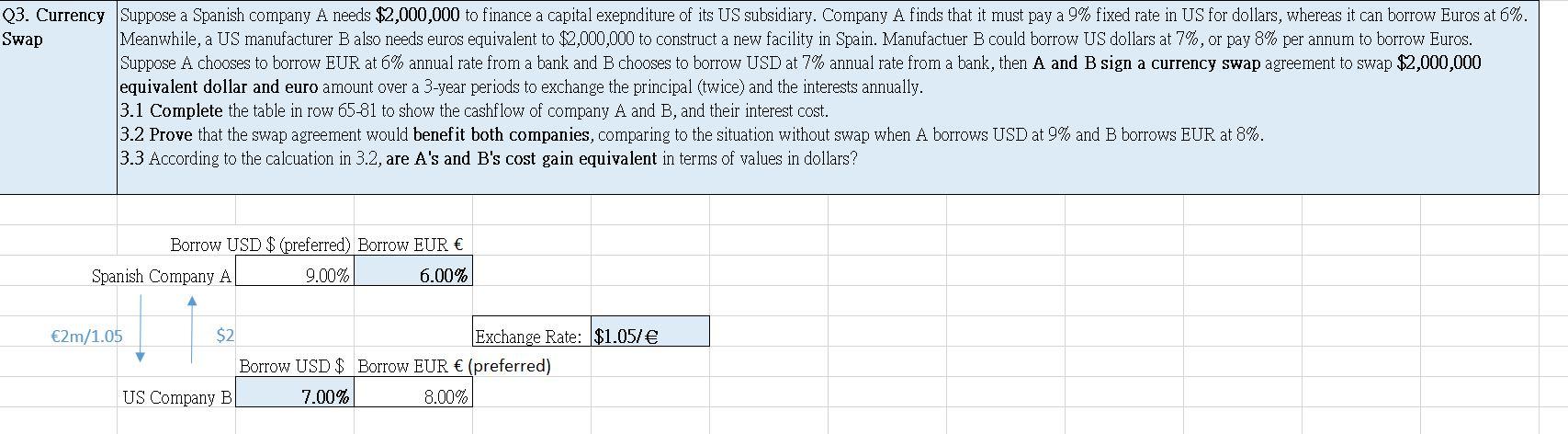

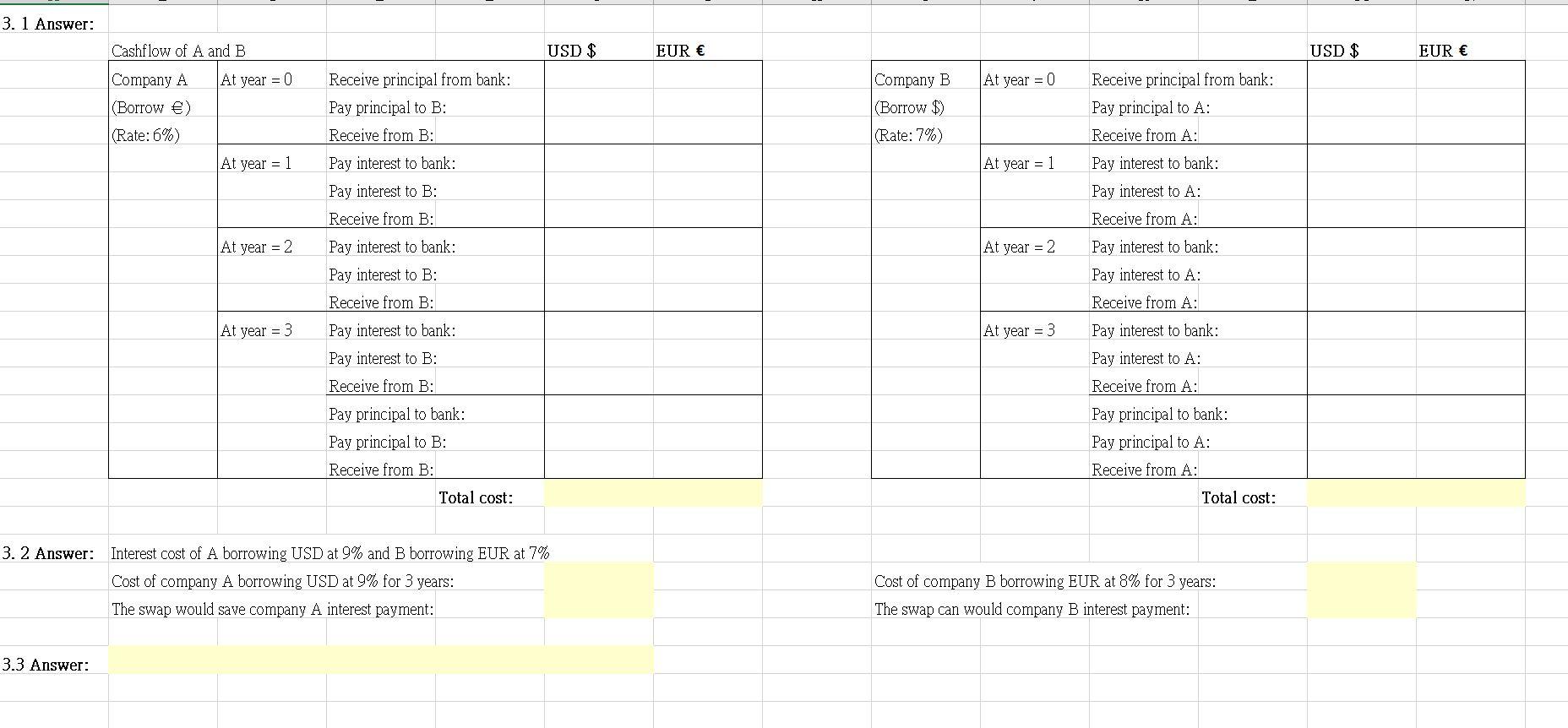

Q3. Currency Suppose a Spanish company A needs $2,000,000 to finance a capital exepnditure of its US subsidiary. Company A finds that it must pay a 9% fixed rate in US for dollars, whereas it can borrow Euros at 6%. Swap Meanwhile, a US manufacturer B also needs euros equivalent to $2,000,000 to construct a new facility in Spain. Manufactuer B could borrow US dollars at 7%, or pay 8% per annum to borrow Euros. Suppose A chooses to borrow EUR at 6% annual rate from a bank and B chooses to borrow USD at 7% annual rate from a bank, then A and B sign a currency swap agreement to swap $2,000,000 equivalent dollar and euro amount over a 3-year periods to exchange the principal (twice) and the interests annually. 3.1 Complete the table in row 65-81 to show the cashflow of company A and B, and their interest cost. 3.2 Prove that the swap agreement would benefit both companies, comparing to the situation without swap when A borrows USD at 9% and B borrows EUR at 8%. 3.3 According to the calcuation in 3.2, are A's and B's cost gain equivalent in terms of values in dollars? Borrow USD $ (preferred) Borrow EUR Spanish Company A 9.00% 6.00% 2m/1.05 $2 Exchange Rate: $1.057 Borrow USD $ Borrow EUR (preferred) US Company B 7.00% 8.00% 3. 1 Answer: Cashflow of A and B USD $ EUR USD $ EUR At year = 0 At year = 0 Company A (Borrow ) (Rate: 6%) Receive principal from bank: Pay principal to B: Receive from B: Pay interest to bank: Company B (Borrow $) (Rate:7%) At year = 1 At year = 1 Pay interest to B: At year = 2 At year = 2 Receive principal from bank: Pay principal to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay principal to bank: Pay principal to A: Receive from A: Total cost: At year = 3 Receive from B: Pay interest to bank: Pay interest to B: Receive from B: Pay interest to bank: Pay interest to B: Receive from B: Pay principal to bank: Pay principal to B: Receive from B: At year = 3 Total cost: 3.2 Answer: Interest cost of A borrowing USD at 9% and B borrowing EUR at 7% Cost of company A borrowing USD at 9% for 3 years: The swap would save company A interest payment: Cost of company B borrowing EUR at 8% for 3 years: The swap can would company B interest payment: 3.3 Answer: Q3. Currency Suppose a Spanish company A needs $2,000,000 to finance a capital exepnditure of its US subsidiary. Company A finds that it must pay a 9% fixed rate in US for dollars, whereas it can borrow Euros at 6%. Swap Meanwhile, a US manufacturer B also needs euros equivalent to $2,000,000 to construct a new facility in Spain. Manufactuer B could borrow US dollars at 7%, or pay 8% per annum to borrow Euros. Suppose A chooses to borrow EUR at 6% annual rate from a bank and B chooses to borrow USD at 7% annual rate from a bank, then A and B sign a currency swap agreement to swap $2,000,000 equivalent dollar and euro amount over a 3-year periods to exchange the principal (twice) and the interests annually. 3.1 Complete the table in row 65-81 to show the cashflow of company A and B, and their interest cost. 3.2 Prove that the swap agreement would benefit both companies, comparing to the situation without swap when A borrows USD at 9% and B borrows EUR at 8%. 3.3 According to the calcuation in 3.2, are A's and B's cost gain equivalent in terms of values in dollars? Borrow USD $ (preferred) Borrow EUR Spanish Company A 9.00% 6.00% 2m/1.05 $2 Exchange Rate: $1.057 Borrow USD $ Borrow EUR (preferred) US Company B 7.00% 8.00% 3. 1 Answer: Cashflow of A and B USD $ EUR USD $ EUR At year = 0 At year = 0 Company A (Borrow ) (Rate: 6%) Receive principal from bank: Pay principal to B: Receive from B: Pay interest to bank: Company B (Borrow $) (Rate:7%) At year = 1 At year = 1 Pay interest to B: At year = 2 At year = 2 Receive principal from bank: Pay principal to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay interest to bank: Pay interest to A: Receive from A: Pay principal to bank: Pay principal to A: Receive from A: Total cost: At year = 3 Receive from B: Pay interest to bank: Pay interest to B: Receive from B: Pay interest to bank: Pay interest to B: Receive from B: Pay principal to bank: Pay principal to B: Receive from B: At year = 3 Total cost: 3.2 Answer: Interest cost of A borrowing USD at 9% and B borrowing EUR at 7% Cost of company A borrowing USD at 9% for 3 years: The swap would save company A interest payment: Cost of company B borrowing EUR at 8% for 3 years: The swap can would company B interest payment: 3.3