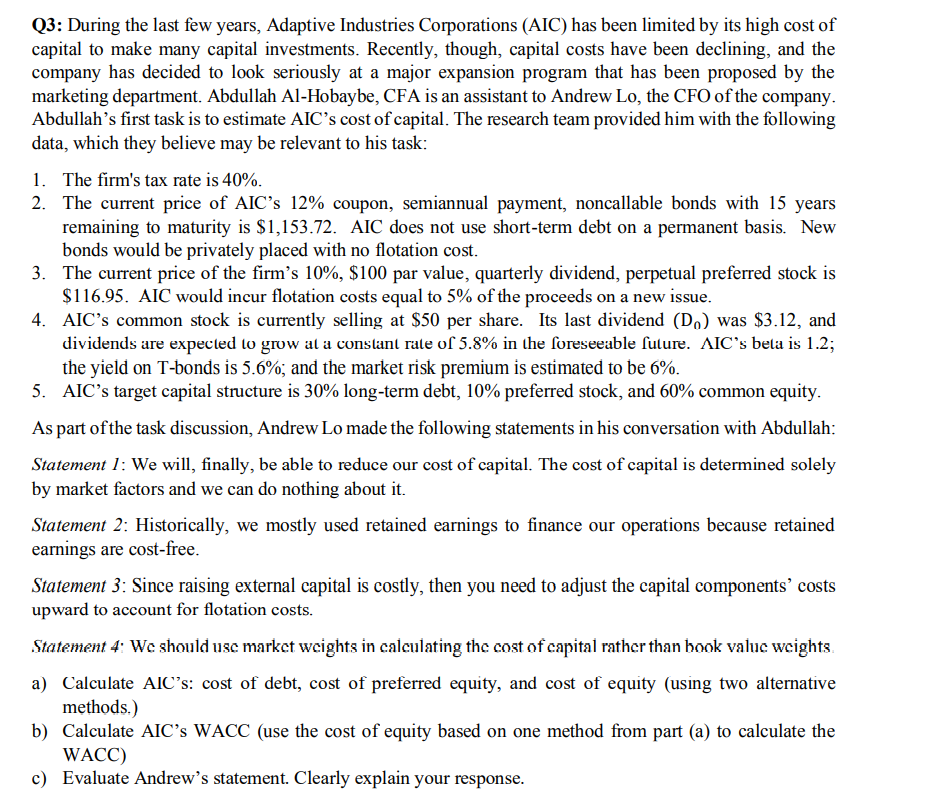

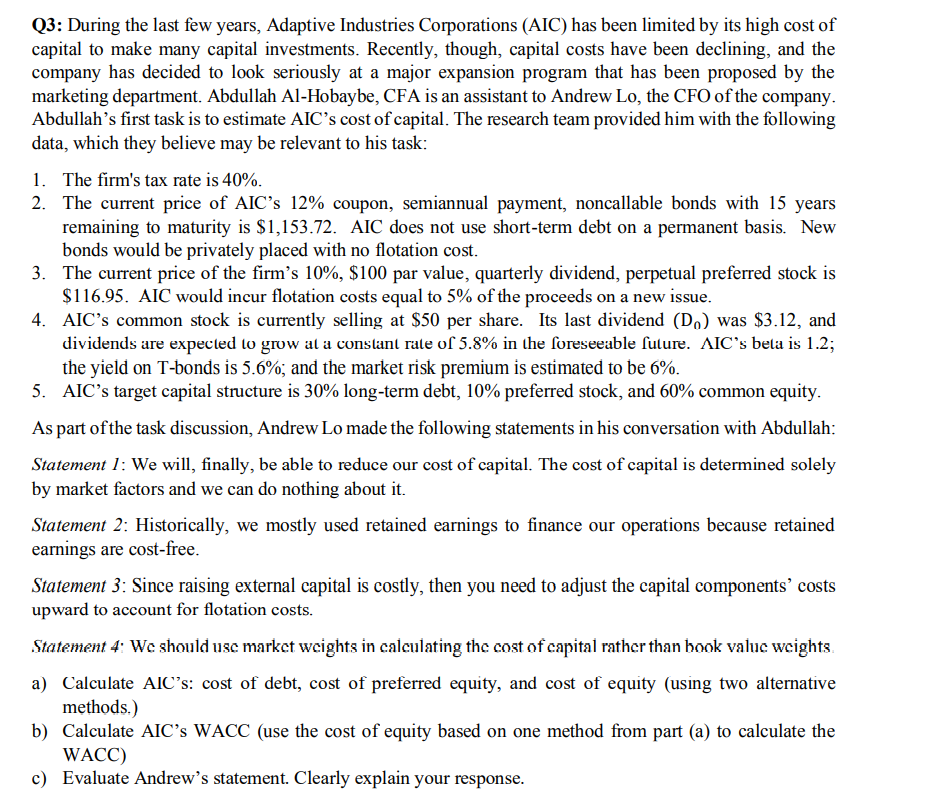

Q3: During the last few years, Adaptive Industries Corporations (AIC) has been limited by its high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program that has been proposed by the marketing department. Abdullah Al-Hobaybe, CFA is an assistant to Andrew Lo, the CFO of the company. Abdullah's first task is to estimate AIC's cost of capital. The research team provided him with the following data, which they believe may be relevant to his task: 1. The firm's tax rate is 40%. 2. The current price of AIC's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. AIC does not use short-term debt on a permanent basis. New bonds would be privately placed with no flotation cost. 3. The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. AIC would incur flotation costs equal to 5% of the proceeds on a new issue. 4. AIC's common stock is currently selling at $50 per share. Its last dividend (D.) was $3.12, and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. AIC's bela is 1.2; the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. 5. AIC's target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity. As part of the task discussion, Andrew Lo made the following statements in his conversation with Abdullah: Statement 1: We will, finally, be able to reduce our cost of capital. The cost of capital is determined solely by market factors and we can do nothing about it. Statement 2: Historically, we mostly used retained earnings to finance our operations because retained earnings are cost-free. Statement 3: Since raising external capital is costly, then you need to adjust the capital components' costs upward to account for flotation costs. Statement 4: We should use market weights in calculating the cost of capital rather than book value weights, a) Calculate AIC's: cost of debt, cost of preferred equity, and cost of equity (using two alternative methods.) b) Calculate AIC's WACC (use the cost of equity based on one method from part (a) to calculate the WACC) c) Evaluate Andrew's statement. Clearly explain your response. Q3: During the last few years, Adaptive Industries Corporations (AIC) has been limited by its high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program that has been proposed by the marketing department. Abdullah Al-Hobaybe, CFA is an assistant to Andrew Lo, the CFO of the company. Abdullah's first task is to estimate AIC's cost of capital. The research team provided him with the following data, which they believe may be relevant to his task: 1. The firm's tax rate is 40%. 2. The current price of AIC's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. AIC does not use short-term debt on a permanent basis. New bonds would be privately placed with no flotation cost. 3. The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. AIC would incur flotation costs equal to 5% of the proceeds on a new issue. 4. AIC's common stock is currently selling at $50 per share. Its last dividend (D.) was $3.12, and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. AIC's bela is 1.2; the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. 5. AIC's target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity. As part of the task discussion, Andrew Lo made the following statements in his conversation with Abdullah: Statement 1: We will, finally, be able to reduce our cost of capital. The cost of capital is determined solely by market factors and we can do nothing about it. Statement 2: Historically, we mostly used retained earnings to finance our operations because retained earnings are cost-free. Statement 3: Since raising external capital is costly, then you need to adjust the capital components' costs upward to account for flotation costs. Statement 4: We should use market weights in calculating the cost of capital rather than book value weights, a) Calculate AIC's: cost of debt, cost of preferred equity, and cost of equity (using two alternative methods.) b) Calculate AIC's WACC (use the cost of equity based on one method from part (a) to calculate the WACC) c) Evaluate Andrew's statement. Clearly explain your response