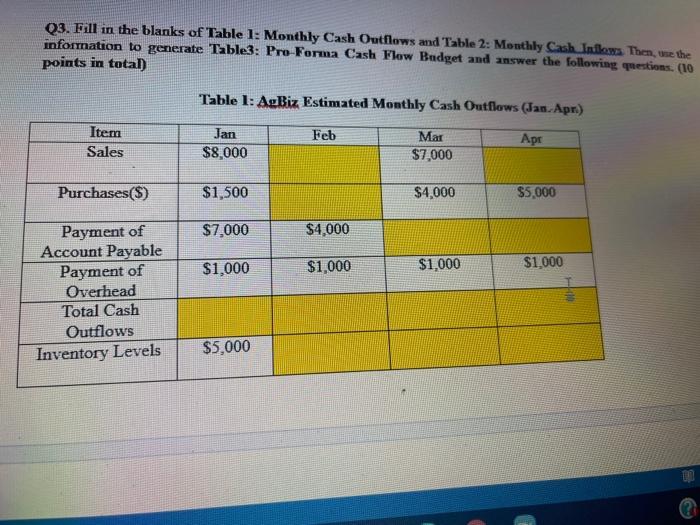

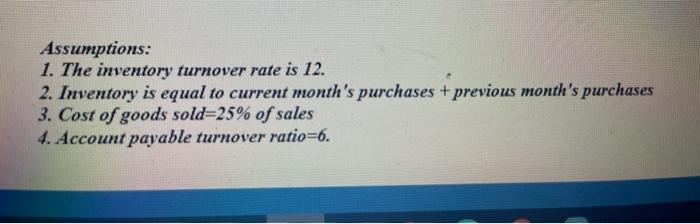

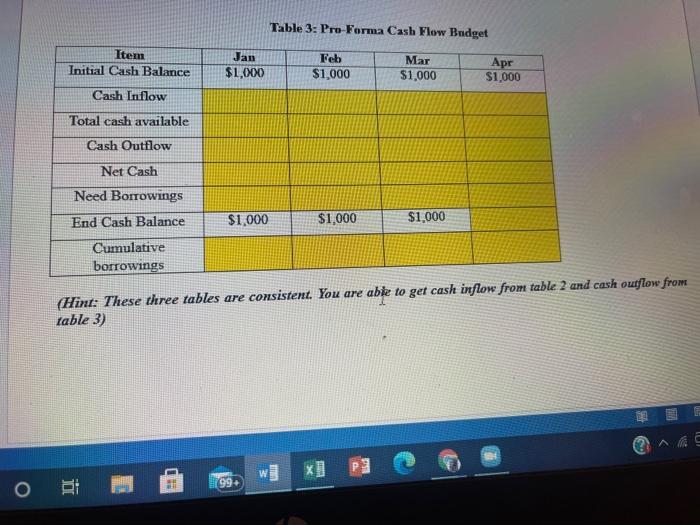

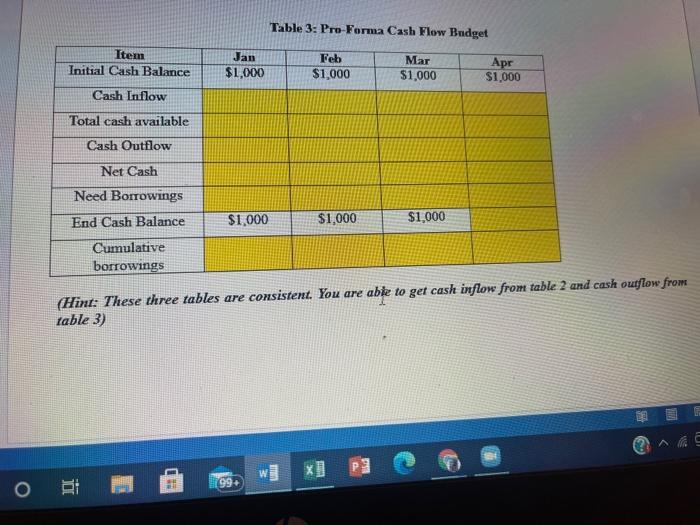

Q3. Fill in the blanks of Table 1: Monthly Cash Outflows and Table 2: Monthly Cash Indlowa Then, we the information to generate Table3: Pro-Forma Cash Flow Badget and answer the following questions. (10 points in total) Table 1: AgBiz Estimated Monthly Cash Outflows (Jan. Apr.) Feb Item Sales Jan $8,000 Mar $7,000 Apr Purchases($) $1,500 $4,000 $5,000 $7,000 $4,000 $1,000 $1,000 $1,000 $1,000 Payment of Account Payable Payment of Overhead Total Cash Outflows Inventory Levels $5,000 Assumptions: 1. The inventory turnover rate is 12. 2. Inventory is equal to current month's purchases + previous month's purchases 3. Cost of goods sold=25% of sales 4. Account payable turnover ratio=6. Table 3: Pro-Forma Cash Flow Budget Item Initial Cash Balance Jan $1,000 Feb $1,000 Mar $1,000 Apr $1,000 Cash Inflow Total cash available Cash Outflow Net Cash Need Borrowings End Cash Balance $1,000 $1,000 $1,000 Cumulative borrowings (Hint: These three tables are consistent. You are able to get cash inflow from table 2 and cash outflow from table 3) ? pl . 99 o RI Table 3: Pro-Forma Cash Flow Budget Item Initial Cash Balance Jan $1,000 Feb $1,000 Mar $1,000 Apr $1,000 Cash Inflow Total cash available Cash Outflow Net Cash Need Borrowings End Cash Balance $1,000 $1,000 $1,000 Cumulative borrowings (Hint: These three tables are consistent. You are able to get cash inflow from table 2 and cash outflow from table 3) ? pl . 99 o RI I Based on the above Pro-Forma Cash Flow Budget, answer the following two questions: (1) Does the business need to borrow money? If yes, how much money needs to be borrowed? 199+ Q3. Fill in the blanks of Table 1: Monthly Cash Outflows and Table 2: Monthly Cash Indlowa Then, we the information to generate Table3: Pro-Forma Cash Flow Badget and answer the following questions. (10 points in total) Table 1: AgBiz Estimated Monthly Cash Outflows (Jan. Apr.) Feb Item Sales Jan $8,000 Mar $7,000 Apr Purchases($) $1,500 $4,000 $5,000 $7,000 $4,000 $1,000 $1,000 $1,000 $1,000 Payment of Account Payable Payment of Overhead Total Cash Outflows Inventory Levels $5,000 Assumptions: 1. The inventory turnover rate is 12. 2. Inventory is equal to current month's purchases + previous month's purchases 3. Cost of goods sold=25% of sales 4. Account payable turnover ratio=6. Table 3: Pro-Forma Cash Flow Budget Item Initial Cash Balance Jan $1,000 Feb $1,000 Mar $1,000 Apr $1,000 Cash Inflow Total cash available Cash Outflow Net Cash Need Borrowings End Cash Balance $1,000 $1,000 $1,000 Cumulative borrowings (Hint: These three tables are consistent. You are able to get cash inflow from table 2 and cash outflow from table 3) ? pl . 99 o RI Table 3: Pro-Forma Cash Flow Budget Item Initial Cash Balance Jan $1,000 Feb $1,000 Mar $1,000 Apr $1,000 Cash Inflow Total cash available Cash Outflow Net Cash Need Borrowings End Cash Balance $1,000 $1,000 $1,000 Cumulative borrowings (Hint: These three tables are consistent. You are able to get cash inflow from table 2 and cash outflow from table 3) ? pl . 99 o RI I Based on the above Pro-Forma Cash Flow Budget, answer the following two questions: (1) Does the business need to borrow money? If yes, how much money needs to be borrowed? 199+