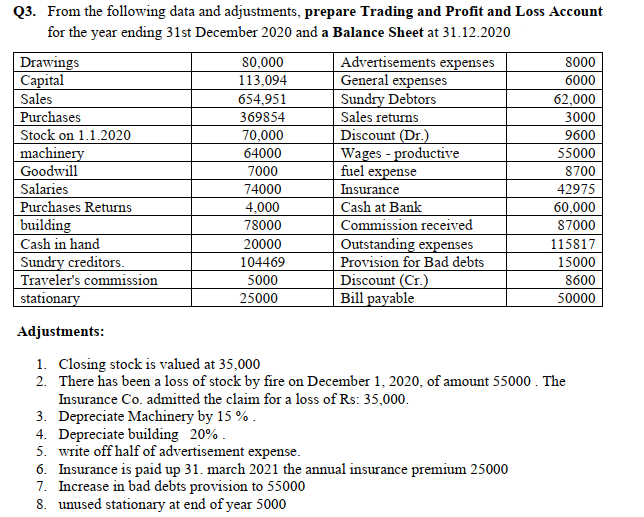

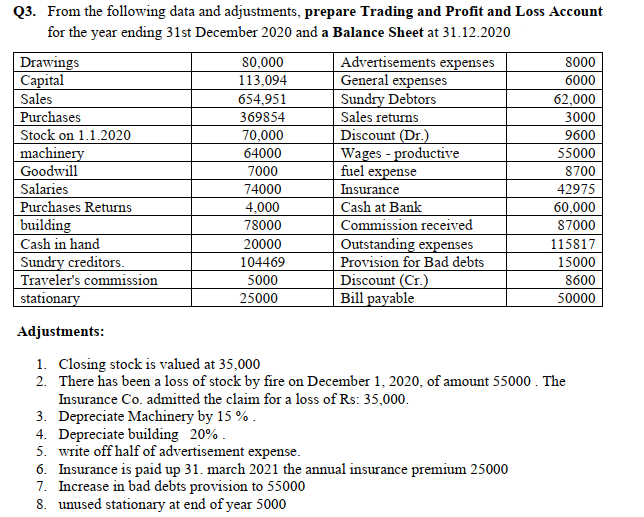

Q3. From the following data and adjustments, prepare Trading and Profit and Loss Account for the year ending 31st December 2020 and a Balance Sheet at 31.12.2020 Drawings 80,000 Advertisements expenses 8000 Capital 113,094 General expenses 6000 Sales 654,951 Sundry Debtors 62,000 Purchases 369854 Sales returns 3000 Stock on 1.1.2020 70,000 Discount (Dr.) 9600 machinery 64000 Wages - productive 55000 Goodwill 7000 fuel expense 8700 Salaries 74000 Insurance 42975 Purchases Returns 4,000 Cash at Bank 60,000 building 78000 Commission received 87000 Cash in hand 20000 Outstanding expenses 115817 Sundry creditors. 104469 Provision for Bad debts 15000 Traveler's commission 5000 Discount (Cr.) 8600 stationary 25000 Bill payable 50000 Adjustments: 1. Closing stock is valued at 35,000 2. There has been a loss of stock by fire on December 1, 2020, of amount 55000. The Insurance Co. admitted the claim for a loss of Rs: 35,000. 3. Depreciate Machinery by 15%. 4. Depreciate building 20%. 5. write off half of advertisement expense. 6. Insurance is paid up 31. march 2021 the annual insurance premium 25000 7. Increase in bad debts provision to 55000 8. unused stationary at end of year 5000 Q3. From the following data and adjustments, prepare Trading and Profit and Loss Account for the year ending 31st December 2020 and a Balance Sheet at 31.12.2020 Drawings 80,000 Advertisements expenses 8000 Capital 113,094 General expenses 6000 Sales 654,951 Sundry Debtors 62,000 Purchases 369854 Sales returns 3000 Stock on 1.1.2020 70,000 Discount (Dr.) 9600 machinery 64000 Wages - productive 55000 Goodwill 7000 fuel expense 8700 Salaries 74000 Insurance 42975 Purchases Returns 4,000 Cash at Bank 60,000 building 78000 Commission received 87000 Cash in hand 20000 Outstanding expenses 115817 Sundry creditors. 104469 Provision for Bad debts 15000 Traveler's commission 5000 Discount (Cr.) 8600 stationary 25000 Bill payable 50000 Adjustments: 1. Closing stock is valued at 35,000 2. There has been a loss of stock by fire on December 1, 2020, of amount 55000. The Insurance Co. admitted the claim for a loss of Rs: 35,000. 3. Depreciate Machinery by 15%. 4. Depreciate building 20%. 5. write off half of advertisement expense. 6. Insurance is paid up 31. march 2021 the annual insurance premium 25000 7. Increase in bad debts provision to 55000 8. unused stationary at end of year 5000