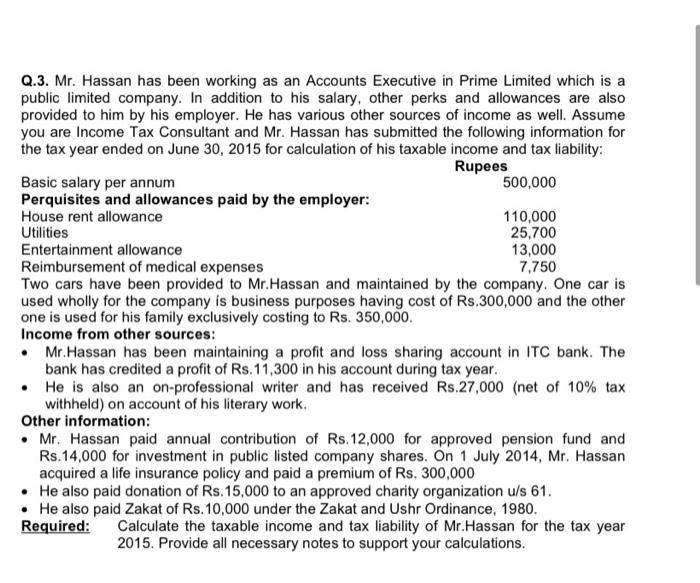

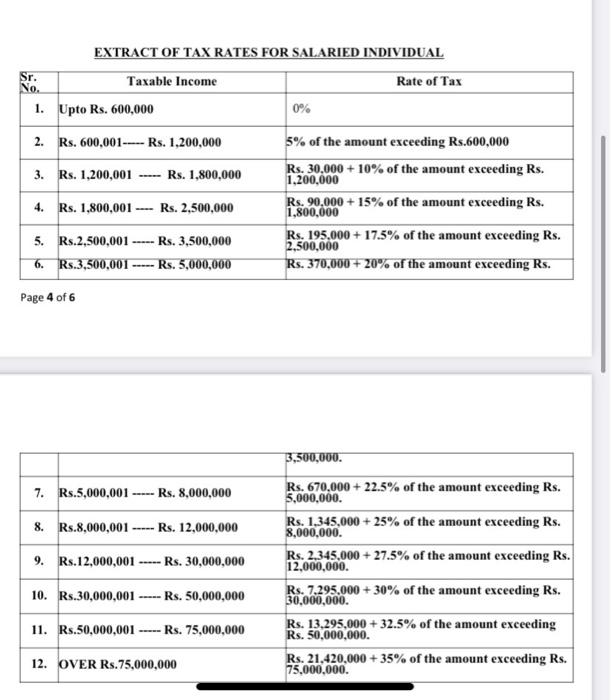

Q.3. Mr. Hassan has been working as an Accounts Executive in Prime Limited which is a public limited company. In addition to his salary, other perks and allowances are also provided to him by his employer. He has various other sources of income as well. Assume you are Income Tax Consultant and Mr. Hassan has submitted the following information for the tax year ended on June 30, 2015 for calculation of his taxable income and tax liability: Rupees Basic salary per annum 500,000 Perquisites and allowances paid by the employer: House rent allowance 110,000 Utilities 25,700 Entertainment allowance 13,000 Reimbursement of medical expenses 7,750 Two cars have been provided to Mr.Hassan and maintained by the company. One car is used wholly for the company is business purposes having cost of Rs.300,000 and the other one is used for his family exclusively costing to Rs. 350,000. Income from other sources: Mr.Hassan has been maintaining a profit and loss sharing account in ITC bank. The bank has credited a profit of Rs.11,300 in his account during tax year. . He is also an on-professional writer and has received Rs.27,000 (net of 10% tax withheld) on account of his literary work. Other information: Mr. Hassan paid annual contribution of Rs.12,000 for approved pension fund and Rs.14,000 for investment in public listed company shares. On 1 July 2014, Mr. Hassan acquired a life insurance policy and paid a premium of Rs. 300,000 He also paid donation of Rs. 15,000 to an approved charity organization u/s 61. He also paid Zakat of Rs. 10,000 under the Zakat and Ushr Ordinance, 1980. Required: Calculate the taxable income and tax liability of Mr.Hassan for the tax year 2015. Provide all necessary notes to support your calculations. EXTRACT OF TAX RATES FOR SALARIED INDIVIDUAL Taxable Income Rate of Tax 1. Upto Rs. 600,000 0% 2. Rs. 600,001- Rs. 1,200,000 5% of the amount exceeding Rs.600,000 3. Rs. 1,200,001 Rs. 1,800,000 Rs. 30.000 + 10% of the amount exceeding Rs. 1,200,000 4. Rs. 1,800,001 Rs. 2,500,000 Rs. 90,000+ 15% of the amount exceeding Rs. 1,800,000 5. Rs.2,500,001 -----Rs. 3,500,000 Rs. 195.000+ 17.5% of the amount exceeding Rs. 2,500,000 Rs. 370,000+ 20% of the amount exceeding Rs. 6. Rs.3,500,001 ----- Rs. 5,000,000 Page 4 of 6 3,500,000. 7. Rs.5,000,001- ----- Rs. 8,000,000 Rs. 670,000+22.5% of the amount exceeding Rs. 5,000,000. 8. Rs.8,000,001 Rs. 12,000,000 Rs. 1,345,000+ 25% of the amount exceeding Rs. 8,000,000. 9. Rs.12,000,001----- Rs. 30,000,000 Rs. 2,345,000+27.5% of the amount exceeding Rs. 12,000,000. 10. Rs.30,000,001- -Rs. 50,000,000 Rs. 7,295.000 + 30% of the amount exceeding Rs. 30,000,000. 11. Rs.50,000,001 - Rs. 75,000,000 Rs. 13,295,000+32.5% of the amount exceeding Rs. 50,000,000. 12. OVER Rs.75,000,000 Rs. 21,420,000+ 35% of the amount exceeding Rs. 75,000,000. Sr. No. Q.3. Mr. Hassan has been working as an Accounts Executive in Prime Limited which is a public limited company. In addition to his salary, other perks and allowances are also provided to him by his employer. He has various other sources of income as well. Assume you are Income Tax Consultant and Mr. Hassan has submitted the following information for the tax year ended on June 30, 2015 for calculation of his taxable income and tax liability: Rupees Basic salary per annum 500,000 Perquisites and allowances paid by the employer: House rent allowance 110,000 Utilities 25,700 Entertainment allowance 13,000 Reimbursement of medical expenses 7,750 Two cars have been provided to Mr.Hassan and maintained by the company. One car is used wholly for the company is business purposes having cost of Rs.300,000 and the other one is used for his family exclusively costing to Rs. 350,000. Income from other sources: Mr.Hassan has been maintaining a profit and loss sharing account in ITC bank. The bank has credited a profit of Rs.11,300 in his account during tax year. . He is also an on-professional writer and has received Rs.27,000 (net of 10% tax withheld) on account of his literary work. Other information: Mr. Hassan paid annual contribution of Rs.12,000 for approved pension fund and Rs.14,000 for investment in public listed company shares. On 1 July 2014, Mr. Hassan acquired a life insurance policy and paid a premium of Rs. 300,000 He also paid donation of Rs. 15,000 to an approved charity organization u/s 61. He also paid Zakat of Rs. 10,000 under the Zakat and Ushr Ordinance, 1980. Required: Calculate the taxable income and tax liability of Mr.Hassan for the tax year 2015. Provide all necessary notes to support your calculations. EXTRACT OF TAX RATES FOR SALARIED INDIVIDUAL Taxable Income Rate of Tax 1. Upto Rs. 600,000 0% 2. Rs. 600,001- Rs. 1,200,000 5% of the amount exceeding Rs.600,000 3. Rs. 1,200,001 Rs. 1,800,000 Rs. 30.000 + 10% of the amount exceeding Rs. 1,200,000 4. Rs. 1,800,001 Rs. 2,500,000 Rs. 90,000+ 15% of the amount exceeding Rs. 1,800,000 5. Rs.2,500,001 -----Rs. 3,500,000 Rs. 195.000+ 17.5% of the amount exceeding Rs. 2,500,000 Rs. 370,000+ 20% of the amount exceeding Rs. 6. Rs.3,500,001 ----- Rs. 5,000,000 Page 4 of 6 3,500,000. 7. Rs.5,000,001- ----- Rs. 8,000,000 Rs. 670,000+22.5% of the amount exceeding Rs. 5,000,000. 8. Rs.8,000,001 Rs. 12,000,000 Rs. 1,345,000+ 25% of the amount exceeding Rs. 8,000,000. 9. Rs.12,000,001----- Rs. 30,000,000 Rs. 2,345,000+27.5% of the amount exceeding Rs. 12,000,000. 10. Rs.30,000,001- -Rs. 50,000,000 Rs. 7,295.000 + 30% of the amount exceeding Rs. 30,000,000. 11. Rs.50,000,001 - Rs. 75,000,000 Rs. 13,295,000+32.5% of the amount exceeding Rs. 50,000,000. 12. OVER Rs.75,000,000 Rs. 21,420,000+ 35% of the amount exceeding Rs. 75,000,000. Sr. No