Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3 - Please show the details of the answers 3. The EF partnership is owned 50% each by Erica and Frieda. All items of income

Q3 - Please show the details of the answers

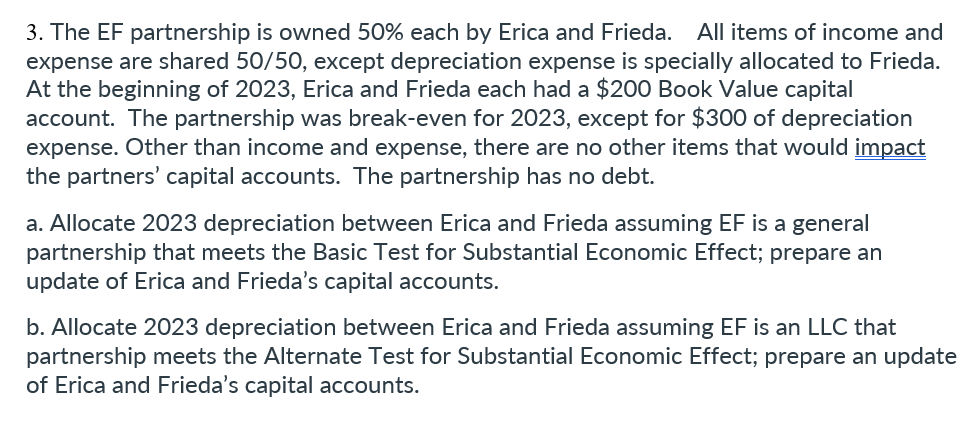

3. The EF partnership is owned 50% each by Erica and Frieda. All items of income and expense are shared 50/50, except depreciation expense is specially allocated to Frieda. At the beginning of 2023 , Erica and Frieda each had a $200 Book Value capital account. The partnership was break-even for 2023 , except for $300 of depreciation expense. Other than income and expense, there are no other items that would impact the partners' capital accounts. The partnership has no debt. a. Allocate 2023 depreciation between Erica and Frieda assuming EF is a general partnership that meets the Basic Test for Substantial Economic Effect; prepare an update of Erica and Frieda's capital accounts. b. Allocate 2023 depreciation between Erica and Frieda assuming EF is an LLC that partnership meets the Alternate Test for Substantial Economic Effect; prepare an update of Erica and Frieda's capital accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started