Answered step by step

Verified Expert Solution

Question

1 Approved Answer

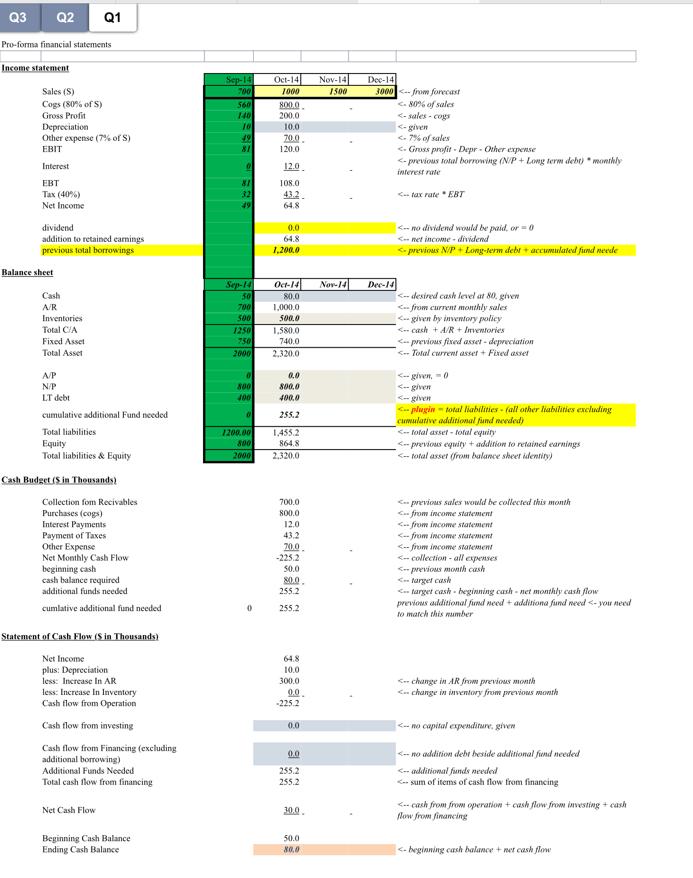

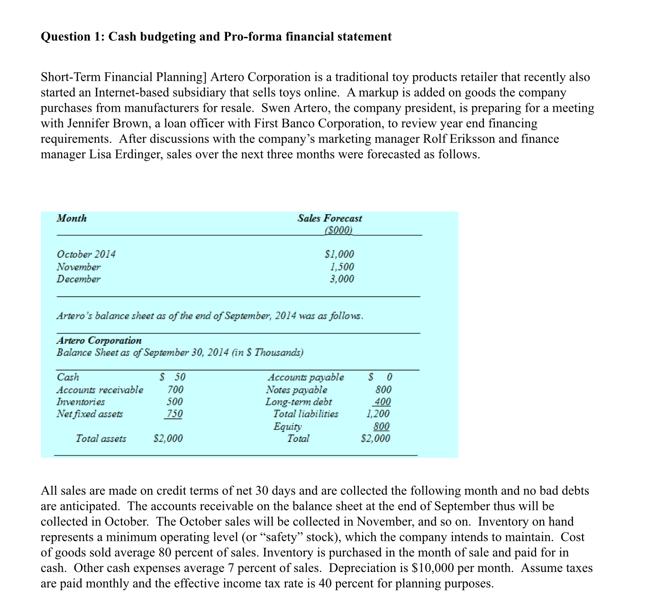

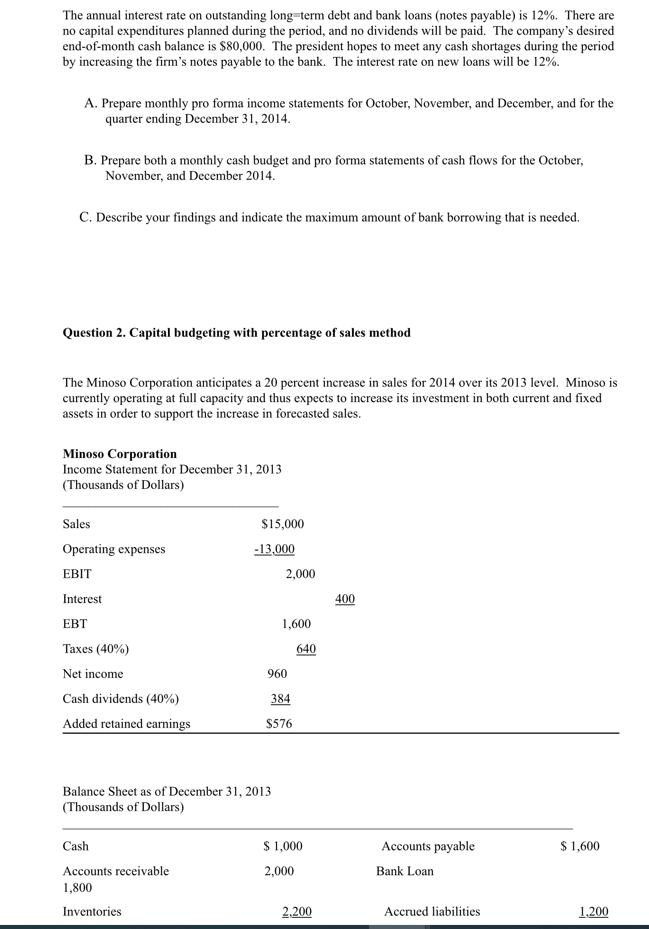

Q3 Q2 Pro-forma financial statements Income statement Sales (S) Cogs (80% of 5) Gross Profit Depreciation Other expense (7% of S) EBIT Interest EBT

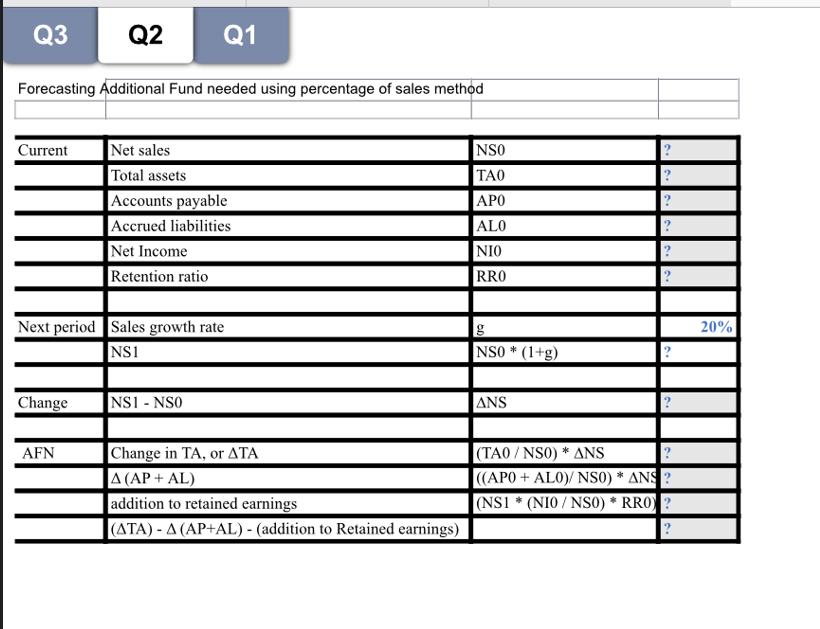

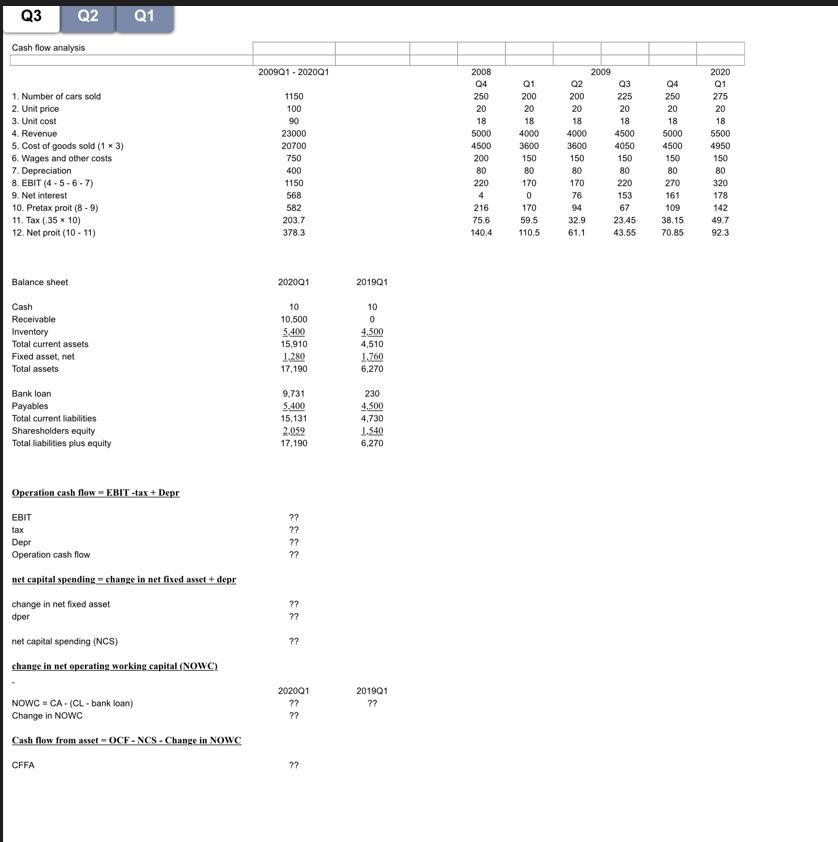

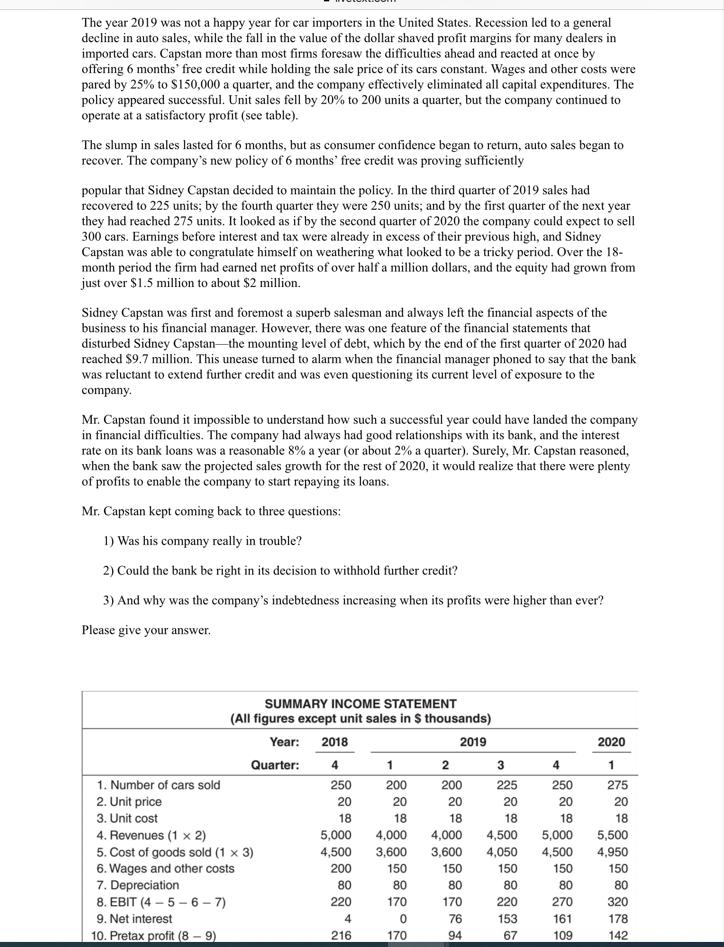

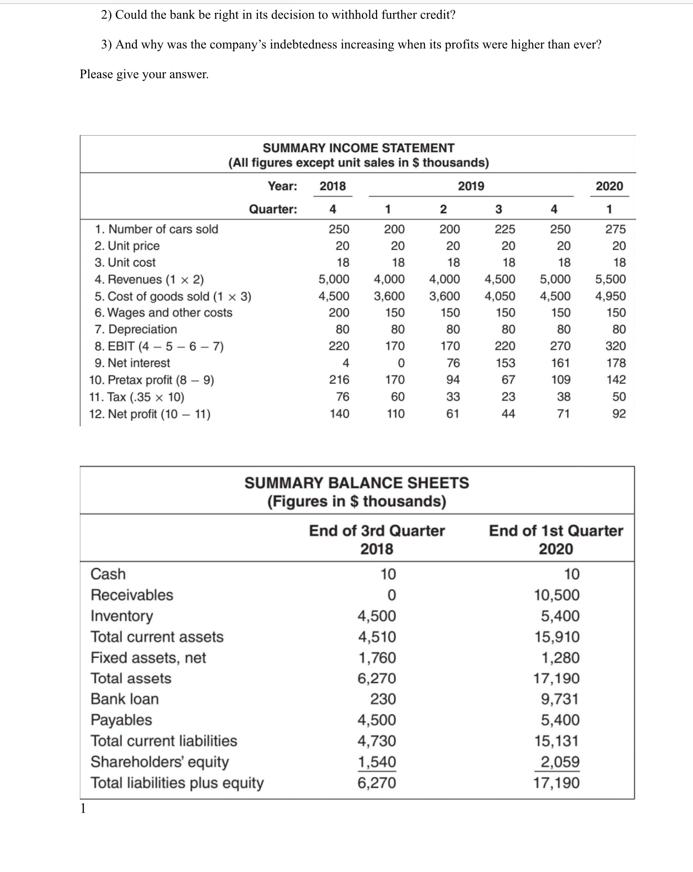

Q3 Q2 Pro-forma financial statements Income statement Sales (S) Cogs (80% of 5) Gross Profit Depreciation Other expense (7% of S) EBIT Interest EBT Tax (40%) Net Income dividend addition to retained earnings previous total borrowings Balance sheet Q1 Cash A/R Inventories Total C/A Fixed Asset Total Asset A/P N/P LT debt cumulative additional Fund needed Total liabilities Equity Total liabilities & Equity Cash Budget (S in Thousands) Collection fom Recivables Purchases (cogs) Interest Payments Payment of Taxes Other Expense Net Monthly Cash Flow beginning cash cash balance required additional funds needed cumlative additional fund needed Statement of Cash Flow (S in Thousands) Net Income plus: Depreciation less: Increase In AR less: Increase In Inventory Cash flow from Operation Cash flow from investing Cash flow from Financing (excluding additional borrowing) Additional Funds Needed Total cash flow from financing Net Cash Flow Beginning Cash Balance - Ending Cash Balance Sep-14 Oct-14 700 1000 560 140 10 49 81 138 Sep-14 50 700 500 1250 750 2000 0 800 400 0 1200.00 800 2000 0 800.0 200.0 10.0 70.0 120.0 12.0 108.0 43.2 64.8 0.0 64.8 1,200.0 Oct-14 80.0 1,000.0 500.0 1,580.0 740.0 2,320.0 0.0 800.0 400.0 255.2 1,455.2 864.8 2,320.0 700.0 800.0 12.0 43.2 70.0 -225.2 50.0 80.0 255.2 255.2 64.8 10.0 300.0 0.0 -225.2 0.0 0.0 255.2 255.2 30.0. 50.0 80,0 Nov-14 1500 Nov-14 Dec-14 3000 from forecast

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

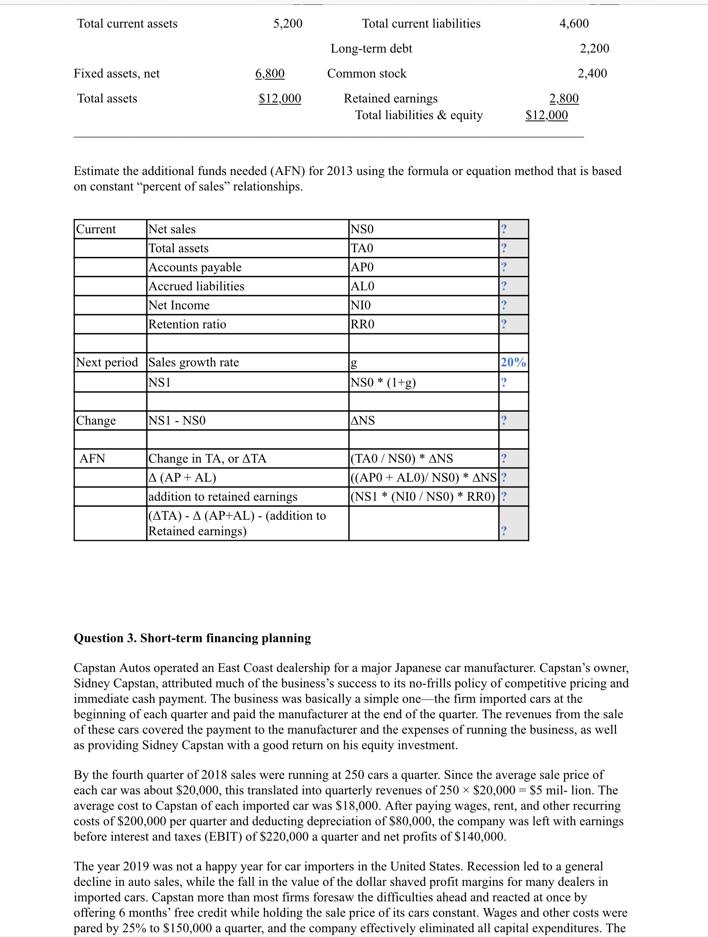

Question 1 Cash Budgeting and Proforma Financial Statement A Proforma Income Statements Month October 2014 November 2014 December 2014 Quarter Ending December 31 2014 Sales 1000 1500 3000 5500 COGS 80...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started