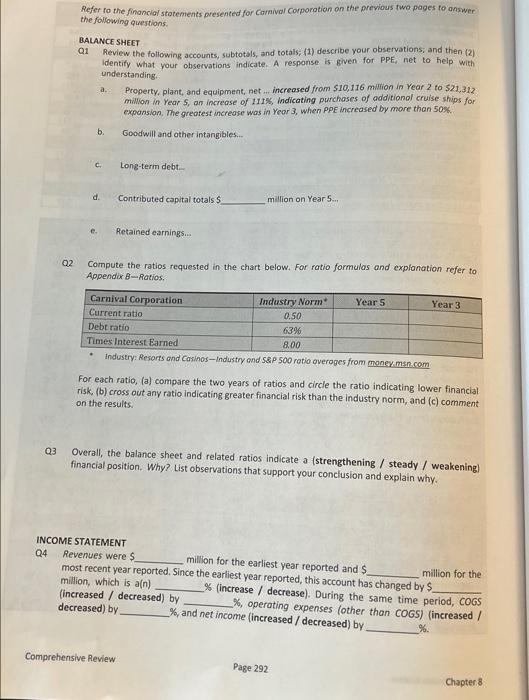

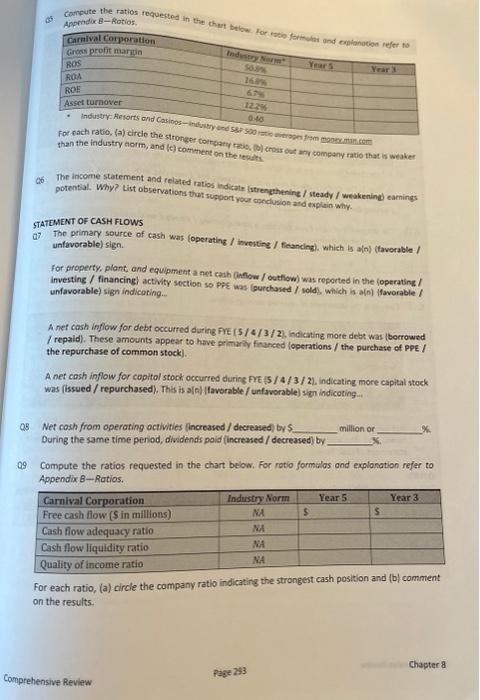

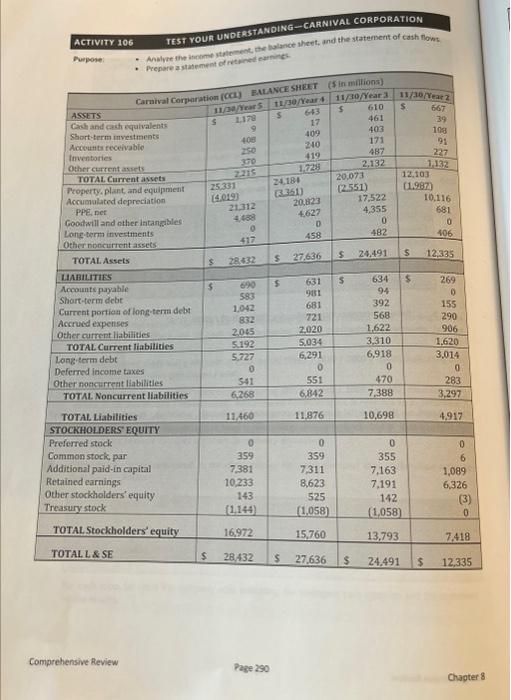

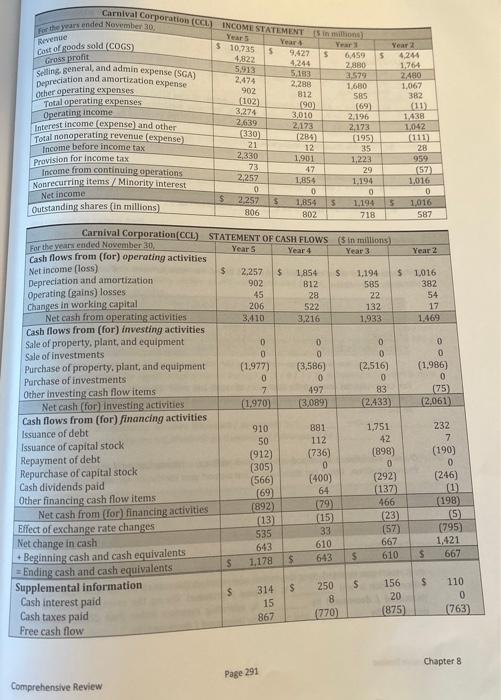

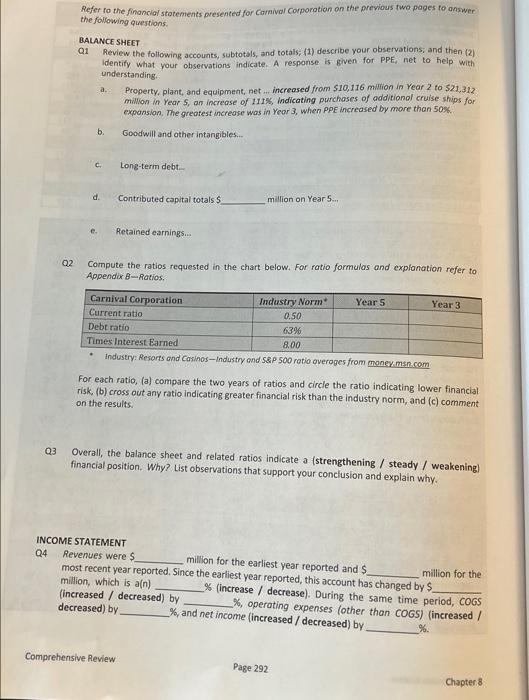

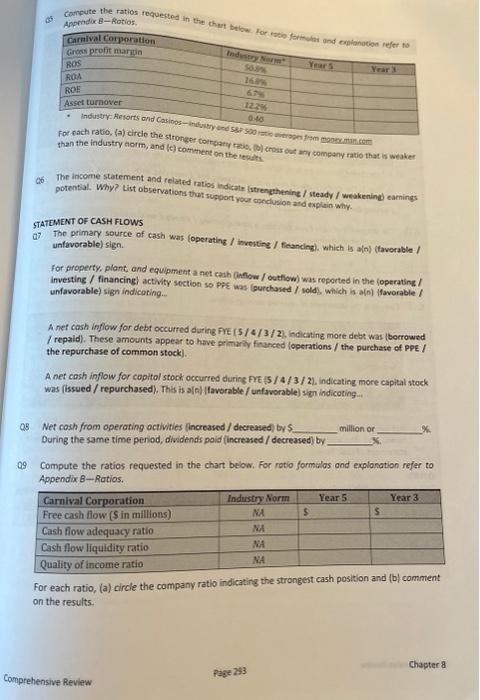

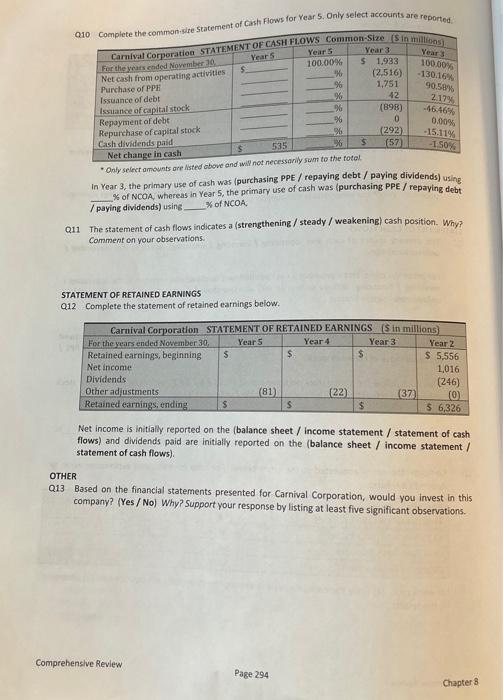

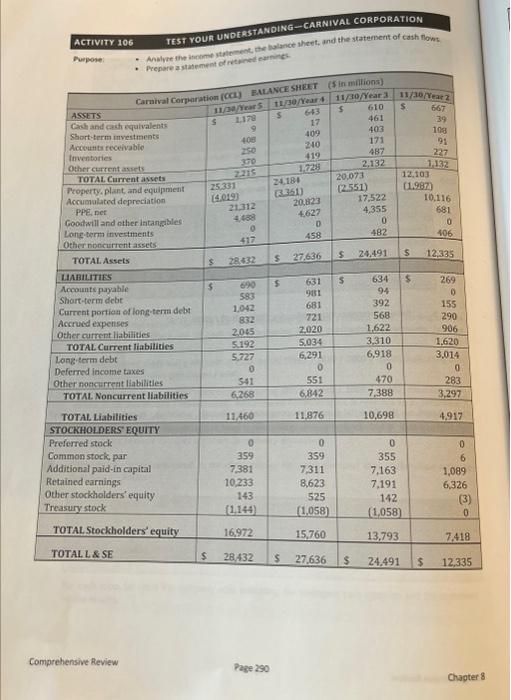

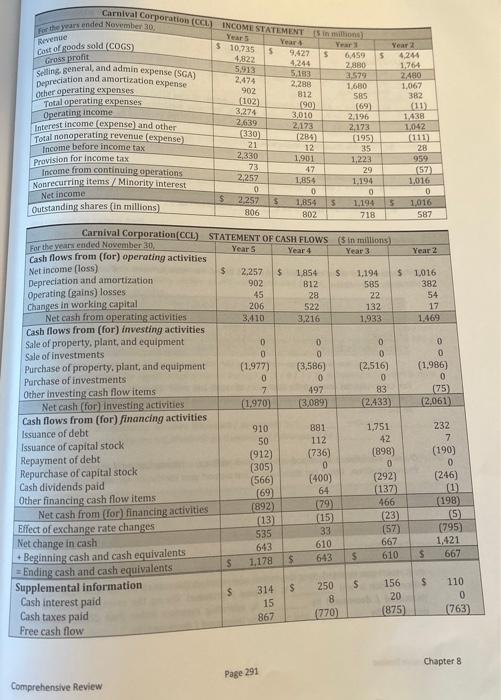

Q3 Q2 Refer to the financial statements presented for Carnival Corporation on the previous two pages to answer the following questions. BALANCE SHEET Q1 Review the following accounts, subtotals, and totals; (1) describe your observations; and then (2) identify what your observations indicate. A response is given for PPE, net to help with understanding. d. e. a. b. C. * Property, plant, and equipment, net ... increased from $10,116 million in Year 2 to $21,312 million in Year 5, an increase of 111%, indicating purchases of additional cruise ships for expansion. The greatest increase was in Year 3, when PPE increased by more than 50%. Goodwill and other intangibles... Long-term debt... Contributed capital totals $ Retained earnings... Compute the ratios requested in the chart below. For ratio formulas and explanation refer to Appendix B-Ratios. Carnival Corporation Current ratio million on Year 5... Comprehensive Review 0.50 Debt ratio 63% Times Interest Earned 8.00 Industry: Resorts and Casinos-Industry and S&P 500 ratio averages from money.msn.com Industry Norm* INCOME STATEMENT Q4 Year 5 For each ratio, (a) compare the two years of ratios and circle the ratio indicating lower financial risk, (b) cross out any ratio indicating greater financial risk than the industry norm, and (c) comment on the results. Overall, the balance sheet and related ratios indicate a (strengthening / steady / weakening) financial position. Why? List observations that support your conclusion and explain why. Year 3 million for the earliest year reported and $ Revenues were $_ most recent year reported. Since the earliest year reported, this account has changed by $ million, which is a(n) (increased / decreased) by decreased) by Page 292 million for the % (increase / decrease). During the same time period, COGS %, operating expenses (other than COGS) (increased / %, and net income (increased / decreased) by %. Chapter 8

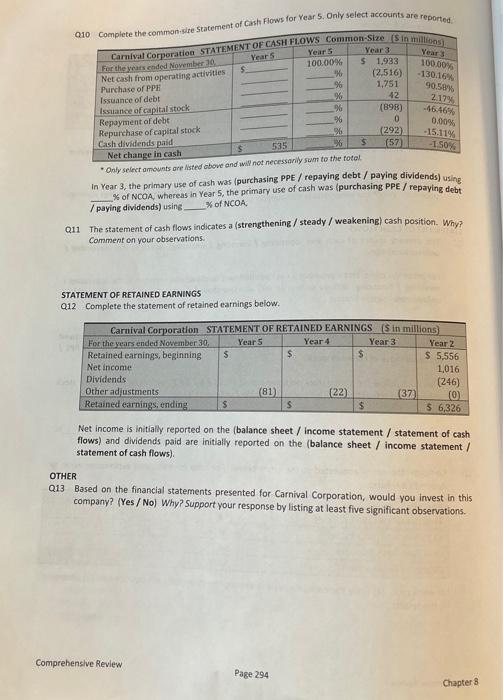

Refer ro the financial stotements presented for Cornival Corporotion on the previous two pages to answer the following questions. BALANCE SHEET Q1 Review the following accounts, subtotals, and totals; (1) describe vour observations; and then (2) identify what your observations indicate. A response is given for PPE, net to help with understanding. a. Property, plant, and equipment, net ... increased from $10,116 mimion in Year 2 to $21,312 million in Year S, an increase of 111%, indicating purchases of additionol cruise ships for expansion. The greatest increase was in Yeor 3, when PPE increased by more than 50%. b. Goodwill and ather intangibles... c. Long-term debt. d. Contributed capital totals S million on Year 5 ... e. Retained earnings... Q2 Compute the ratios requested in the chart below. For ratio formulas and explonation refer to Appendix B-rotios. Inoustry: Kesorts and Cashos-Industry and S\&P 500 rotio overoges from monex msincom For each ratio, (a) compare the two years of ratios and circle the ratio indicating lower financial risk, (b) cross out any ratio indicating greater financial risk than the industry norm, and (c) comment on the results. Q3 Overall, the balance sheet and related ratios indicate a (strengthening / steady / weakening) financial position. Why? List observations that support your conclusion and explain why. INCOME STATEMENT Q4 Revenues were \$ most recent year reported, $ million for the earliest year reported and $ million, which is a(n) (increased / decreased) by decreased) by \% million for the * (increase / decrease). During the same time \% operiod, COGS %, operating expenses (other than COGS) (increased / %. c5: Compute the ratios requested in the Q6. The income statement and related ratios indicate latrencehenine / stesdy / weokening earnings potential. Why? List observations that support your epenclusion and explain why. STATEMENT OF CASH FLOWS d7 The primary source of cash was (operating / investine / feancling). which is a (n) (tavorable / unfavorable) sign. for property, plant and equipment a net cash (inflow / outflow) was reported in the (operating I investing / financingl activity sectibn so phe was (surchased / sold, which is aln) (favorable I unfavorable) sign indicoting... A net cash inflow for debt occurred during Fre ( 5/4/3/2, indicating more debt was (borrowed / repaid). These amounts appear to have primariy finunced (operations / the purchase of ppe / the repurchase of common stock). A net cosh inflow for copitol stock occurred during FrE (5/4/3/2) indicating more capital vtock was (issued / repurchased). This is alp]/ tavorable/ untavorable) sign indicoting m... QS Net cash from operoting octivities (increased / decreased) by 5 million or \%. During the same time period, dividends poid (increased / decreased) by S. Q9 Compute the ratios requested in the chart below, For rotio formulos and explanation refer to Appendix B-Ratios. For each ratio, (a) circle the company ratio indicating the strongest cash position and (b) comment on the results. Q11 - Only select amounts are Nsted cbove and wa not necessurny In Year 3, the primary use of cash was (purchasing PPE / repaying debt / paying dividends) using. \% of NCOA whereas in Year 5, the primary use of cash was (purchasing PPE / repaying debt / paying dividends) using E of NCOA. Q11 The statement of cash flows indicates a (strengthening / steady / weakening) cash position. Why? comment on your observations. STATEMENT OF RETAINED EARNINGS Q12 Complete the statement of retained earnings below. Net income is initially reported on the (balance sheet / income statement / statement of cash flows) and dividends paid are initially reported on the (balance sheet / income statement statement of cash flows). OTHER Q13 Based on the financial statements presented for Carnival Corporation, would you invest in this company? (Yes/No) Why? Support your response by listing at least five significant observations. ACTIVITY 106 TEST YOUR UNDERSTANDING - CARNIVAL CORPORATION Comprehensive Review Page 290 Chagter 8 Page 291 Chapter 8 Comprehensive Review