Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3 Telbel Ltd. is considering undertaking a major expansion an immediate cash outlay of $ 150 crore. The Board of Director of company are expecting

Q3

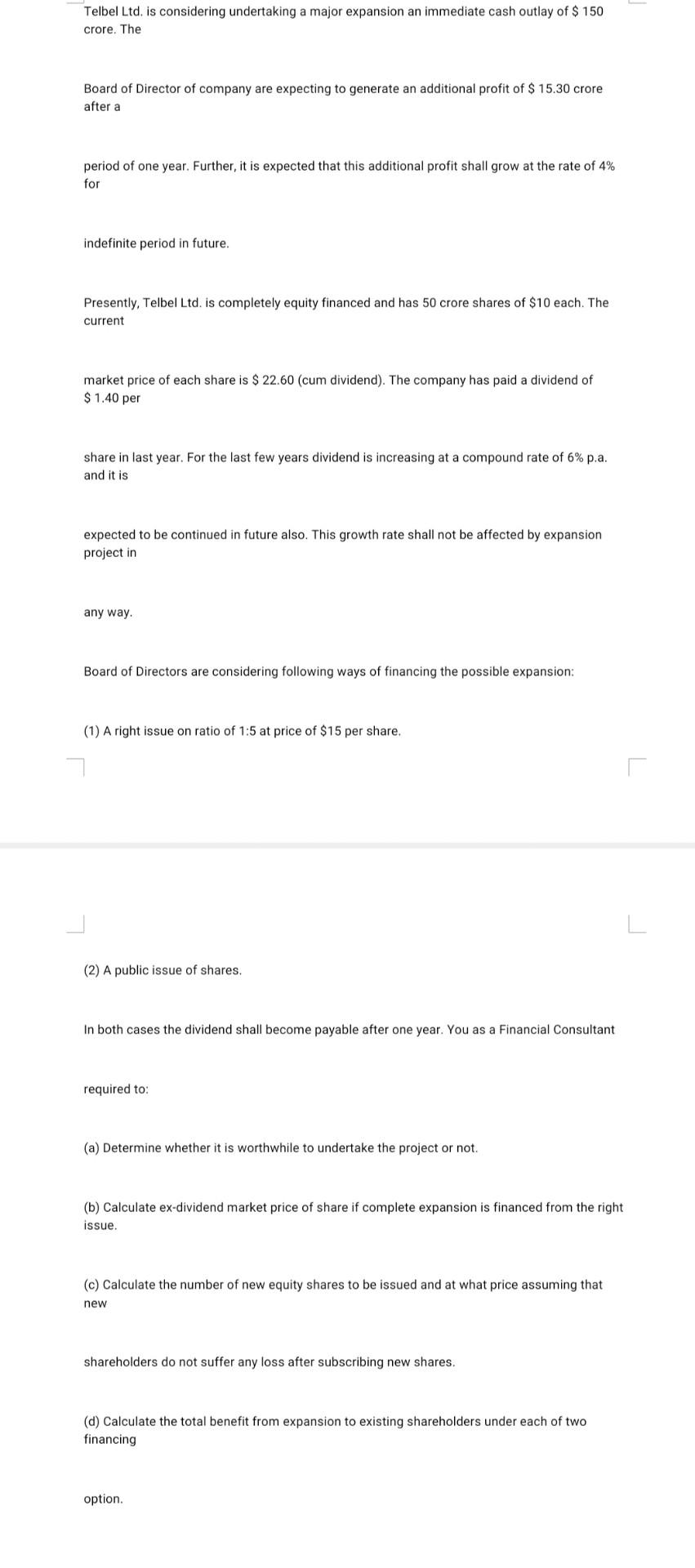

Telbel Ltd. is considering undertaking a major expansion an immediate cash outlay of $ 150 crore. The Board of Director of company are expecting to generate an additional profit of $ 15.30 crore after a period of one year. Further, it is expected that this additional profit shall grow at the rate of 4% for indefinite period in future. Presently, Telbel Ltd. is completely equity financed and has 50 crore shares of $10 each. The current market price of each share is $ 22.60 (cum dividend). The company has paid a dividend of $ 1.40 per share in last year. For the last few years dividend is increasing at a compound rate of 6% p.a. and it is expected to be continued in future also. This growth rate shall not be affected by expansion project in any way. Board of Directors are considering following ways of financing the possible expansion: (1) A right issue on ratio of 1:5 at price of $15 per share, L (2) A public issue of shares. In both cases the dividend shall become payable after one year. You as a Financial Consultant required to: (a) Determine whether it is worthwhile to undertake the project or not. (b) Calculate ex-dividend market price of share if complete expansion is financed from the right issue. (c) Calculate the number of new equity shares to be issued and at what price assuming that new shareholders do not suffer any loss after subscribing new shares. (d) Calculate the total benefit from expansion to existing shareholders under each of two financing option. Telbel Ltd. is considering undertaking a major expansion an immediate cash outlay of $ 150 crore. The Board of Director of company are expecting to generate an additional profit of $ 15.30 crore after a period of one year. Further, it is expected that this additional profit shall grow at the rate of 4% for indefinite period in future. Presently, Telbel Ltd. is completely equity financed and has 50 crore shares of $10 each. The current market price of each share is $ 22.60 (cum dividend). The company has paid a dividend of $ 1.40 per share in last year. For the last few years dividend is increasing at a compound rate of 6% p.a. and it is expected to be continued in future also. This growth rate shall not be affected by expansion project in any way. Board of Directors are considering following ways of financing the possible expansion: (1) A right issue on ratio of 1:5 at price of $15 per share, L (2) A public issue of shares. In both cases the dividend shall become payable after one year. You as a Financial Consultant required to: (a) Determine whether it is worthwhile to undertake the project or not. (b) Calculate ex-dividend market price of share if complete expansion is financed from the right issue. (c) Calculate the number of new equity shares to be issued and at what price assuming that new shareholders do not suffer any loss after subscribing new shares. (d) Calculate the total benefit from expansion to existing shareholders under each of two financing optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started