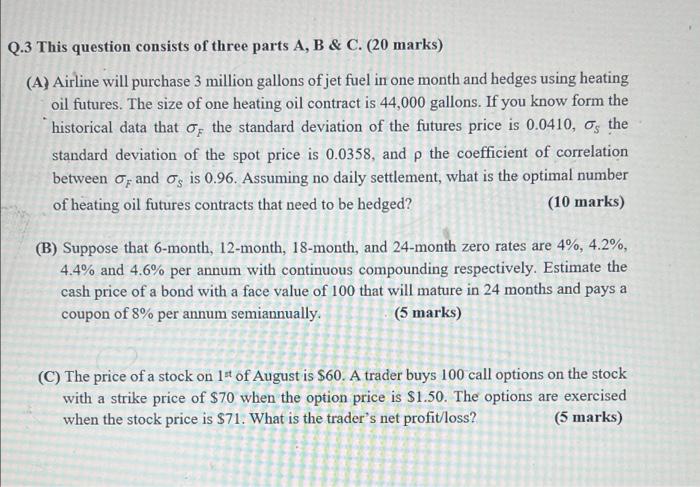

Q.3 This question consists of three parts A, B & C. (20 marks) (A) Airline will purchase 3 million gallons of jet fuel in one month and hedges using heating oil futures. The size of one heating oil contract is 44,000 gallons. If you know form the historical data that of the standard deviation of the futures price is 0.0410, the standard deviation of the spot price is 0.0358, and p the coefficient of correlation between of and os is 0.96. Assuming no daily settlement, what is the optimal number of heating oil futures contracts that need to be hedged? (10 marks) (B) Suppose that 6-month, 12-month, 18-month, and 24-month zero rates are 4%, 4.2%, 4.4% and 4.6% per annum with continuous compounding respectively. Estimate the cash price of a bond with a face value of 100 that will mature in 24 months and pays a coupon of 8% per annum semiannually. (5 marks) (C) The price of a stock on 1st of August is $60. A trader buys 100 call options on the stock with a strike price of $70 when the option price is $1.50. The options are exercised when the stock price is $71. What is the trader's net profit/loss? (5 marks) Q.3 This question consists of three parts A, B & C. (20 marks) (A) Airline will purchase 3 million gallons of jet fuel in one month and hedges using heating oil futures. The size of one heating oil contract is 44,000 gallons. If you know form the historical data that of the standard deviation of the futures price is 0.0410, the standard deviation of the spot price is 0.0358, and p the coefficient of correlation between of and os is 0.96. Assuming no daily settlement, what is the optimal number of heating oil futures contracts that need to be hedged? (10 marks) (B) Suppose that 6-month, 12-month, 18-month, and 24-month zero rates are 4%, 4.2%, 4.4% and 4.6% per annum with continuous compounding respectively. Estimate the cash price of a bond with a face value of 100 that will mature in 24 months and pays a coupon of 8% per annum semiannually. (5 marks) (C) The price of a stock on 1st of August is $60. A trader buys 100 call options on the stock with a strike price of $70 when the option price is $1.50. The options are exercised when the stock price is $71. What is the trader's net profit/loss