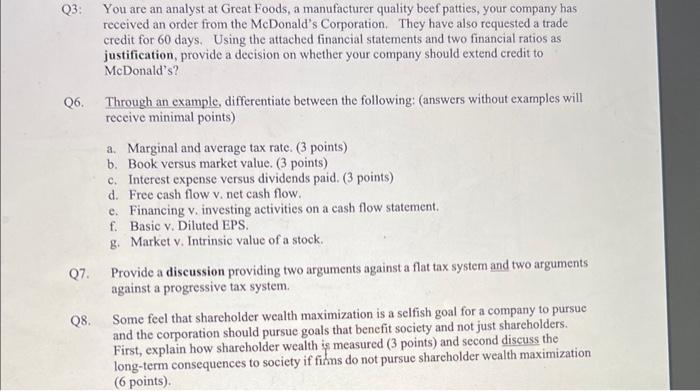

Q3: You are an analyst at Great Foods, a manufacturer quality beef patties, your company has received an order from the McDonald's Corporation. They have also requested a trade credit for 60 days. Using the attached financial statements and two financial ratios as justification, provide a decision on whether your company should extend credit to McDonald's? Q6. Through an example, differentiate between the following: (answers without examples will reccive minimal points) a. Marginal and average tax rate. ( 3 points) b. Book versus market value. ( 3 points) c. Interest expense versus dividends paid. ( 3 points) d. Free cash flow v. net cash flow. e. Financing v, investing activities on a cash flow statement. f. Basic v. Diluted EPS. g. Market v. Intrinsic value of a stock. Q7. Provide a discussion providing two arguments against a flat tax system and two arguments against a progressive tax system. Q8. Some feel that shareholder wealth maximization is a selfish goal for a company to pursue and the corporation should pursue goals that benefit society and not just shareholders. First, explain how shareholder wealth is measured ( 3 points) and second discuss the long-term consequences to society if finns do not pursue shareholder wealth maximization (6 points). Q3: You are an analyst at Great Foods, a manufacturer quality beef patties, your company has received an order from the McDonald's Corporation. They have also requested a trade credit for 60 days. Using the attached financial statements and two financial ratios as justification, provide a decision on whether your company should extend credit to McDonald's? Q6. Through an example, differentiate between the following: (answers without examples will reccive minimal points) a. Marginal and average tax rate. ( 3 points) b. Book versus market value. ( 3 points) c. Interest expense versus dividends paid. ( 3 points) d. Free cash flow v. net cash flow. e. Financing v, investing activities on a cash flow statement. f. Basic v. Diluted EPS. g. Market v. Intrinsic value of a stock. Q7. Provide a discussion providing two arguments against a flat tax system and two arguments against a progressive tax system. Q8. Some feel that shareholder wealth maximization is a selfish goal for a company to pursue and the corporation should pursue goals that benefit society and not just shareholders. First, explain how shareholder wealth is measured ( 3 points) and second discuss the long-term consequences to society if finns do not pursue shareholder wealth maximization (6 points)