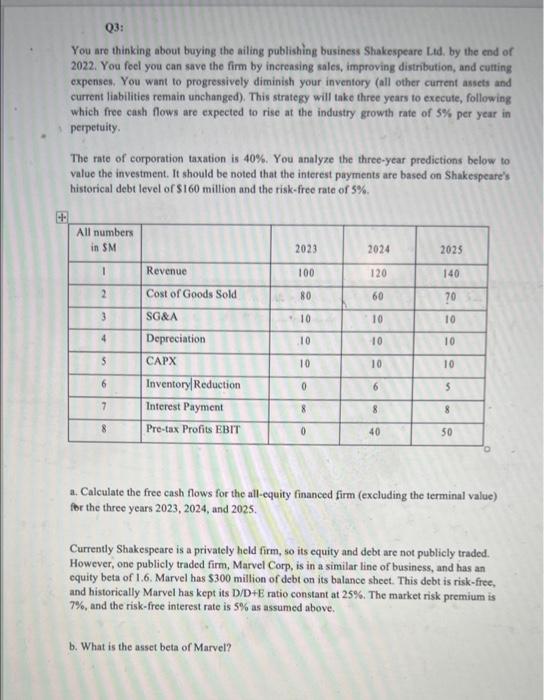

Q3: You are thinking about buying the ailing publishing business Shakespeare Ltd. by the end of 2022. You feel you can save the firm by increasing sales, improving distribution, and cutting expenses. You want to progressively diminish your inventory (all other current assets and current liabilities remain unchanged). This strategy will take three years to execute, following which free cash flows are expected to rise at the industry growth rate of 5% per year in perpetuity. The rate of corporation taxation is 40%. You analyze the three-year predictions below to value the investment. It should be noted that the interest payments are based on Shakespeare's historical debt level of $160 million and the risk-free rate of 5%. + All numbers. in SM 2023 2024 2025 1 Revenue 100 120 140 2 Cost of Goods Sold 80 60 70 3 SG&A -10 10 10 4 Depreciation 10 10 10 CAPX 10 10 10 Inventory Reduction 0 6 5 7 Interest Payment 8 8 8 8 Pre-tax Profits EBIT 0 40 50 a. Calculate the free cash flows for the all-equity financed firm (excluding the terminal value) for the three years 2023, 2024, and 2025. Currently Shakespeare is a privately held firm, so its equity and debt are not publicly traded. However, one publicly traded firm, Marvel Corp, is in a similar line of business, and has an equity beta of 1.6. Marvel has $300 million of debt on its balance sheet. This debt is risk-free, and historically Marvel has kept its D/D+E ratio constant at 25%. The market risk premium is 7%, and the risk-free interest rate is 5% as assumed above. b. What is the asset beta of Marvel? 5 6 Shakespeare currently has $160 million of long-term risk-free debt on its balance sheet and it has maintained this amount historically. However, after the acquisition, you plan to change the capital structure to maintain a constant debt to value ratio, D/(D+E), of 1/3. The debt you issue is risk-free. c. What is the appropriate WACC rate for Shakespeare? d. Using the WACC rate calculated above, what is the enterprise value of Shakespeare? Q3: You are thinking about buying the ailing publishing business Shakespeare Ltd. by the end of 2022. You feel you can save the firm by increasing sales, improving distribution, and cutting expenses. You want to progressively diminish your inventory (all other current assets and current liabilities remain unchanged). This strategy will take three years to execute, following which free cash flows are expected to rise at the industry growth rate of 5% per year in perpetuity. The rate of corporation taxation is 40%. You analyze the three-year predictions below to value the investment. It should be noted that the interest payments are based on Shakespeare's historical debt level of $160 million and the risk-free rate of 5%. + All numbers. in SM 2023 2024 2025 1 Revenue 100 120 140 2 Cost of Goods Sold 80 60 70 3 SG&A -10 10 10 4 Depreciation 10 10 10 CAPX 10 10 10 Inventory Reduction 0 6 5 7 Interest Payment 8 8 8 8 Pre-tax Profits EBIT 0 40 50 a. Calculate the free cash flows for the all-equity financed firm (excluding the terminal value) for the three years 2023, 2024, and 2025. Currently Shakespeare is a privately held firm, so its equity and debt are not publicly traded. However, one publicly traded firm, Marvel Corp, is in a similar line of business, and has an equity beta of 1.6. Marvel has $300 million of debt on its balance sheet. This debt is risk-free, and historically Marvel has kept its D/D+E ratio constant at 25%. The market risk premium is 7%, and the risk-free interest rate is 5% as assumed above. b. What is the asset beta of Marvel? 5 6 Shakespeare currently has $160 million of long-term risk-free debt on its balance sheet and it has maintained this amount historically. However, after the acquisition, you plan to change the capital structure to maintain a constant debt to value ratio, D/(D+E), of 1/3. The debt you issue is risk-free. c. What is the appropriate WACC rate for Shakespeare? d. Using the WACC rate calculated above, what is the enterprise value of Shakespeare